American Banker's 2026 Predictions Report

American Banker’s 2026 Predictions report was fielded online during October and November of 2025 among 174 banking professionals who work across a variety of executive roles at banks, credit unions, neobanks and payments companies.

A closer look at national banking leaders’ responses reveals what large bank leaders care about most. Top findings from the report- National bankers were the most trusting in the Fed board’s credibility.

- AI is a big technology spending area for national bankers in the coming months.

- Real-time payments pose the most worrisome fraud threat to national bankers.

Results from the report are highlighted below using interactive charts. Mouse over each section for more detail, click on the chart labels to show or hide sections and use the arrows to cycle between chart views.

This item focuses on results from national bankers. To view findings broken down by respondent category, click the links below.

- Community banks:

Community bankers distrust the Fed, fear nonbank competitors - Midsize/regional banks:

Regional bank execs love mobile apps, fear wire transfer fraud - Credit unions: Coming soon

To view the overall research, click the links below.

- Part one:

Bankers forecast 2026 upheaval in cybersecurity, regulation - Part two:

Bankers fear economic struggle in 2026 - Part three:

Fraud will remain a top problem for banks in 2026, but AI could help - Part four:

Cybersecurity, fraud attacks may cause systemic risk in 2026 - Part five:

Bankers wary of nonbank payment rivals in 2026

In the Federal Reserve, we trust

Conversations around

National bankers were the group that recorded the largest growth of confidence in the credibility of the Federal Reserve Board of Directors, with 8% saying they have a lot more trust now and 22% saying a moderate amount more. Credit unions (19%) were tied with midsize/regional banks (19%) for trust growth, while community banks were last (10%).

While Powell's term as Fed chair is

During his

"We've seen these cost overruns. The … independence of the Fed is based on its trust with the American people, and the Federal Reserve lost the trust of the American people when it … allowed the greatest inflation of 49 years to ravage, ravage working people in this country," Bessent said.

Key takeaway: National bankers were the most trusting in the Fed board's credibility.

National bankers' eyes are on AI and machine learning

Trump's executive order,

More than half of national bankers (68%) said investing in AI and machine learning was among the top five spending priorities for this year. Some regional bankers (54%), community bankers (44%) and credit union executives (43%) also said AI was a top spending area for the coming months.

AI has become a double-edged sword for financial institutions, promising streamlined operations and

In speaking at a January discussion hosted by Bankwell Financial Group, Joe Chambers, general counsel and chief of staff of the Connecticut Department of Banking, said transparency between banks and regulators surrounding AI deployment is key for ensuring these programs are done correctly.

"AI can increase efficiency, enhance customer service, provide a regulatory compliance backstop or replace manual processes," Chambers said. "All of those are good things, but the flip side is that using AI can introduce risks. Those risks are heightened with consumer information, data security risks."

Key takeaway: AI is a big tech spending area for national bankers in the coming months.

Real-time payments create real-time fraud challenges

The growth of real-time payments across the financial services industry has created new fraud challenges for banks and credit unions.

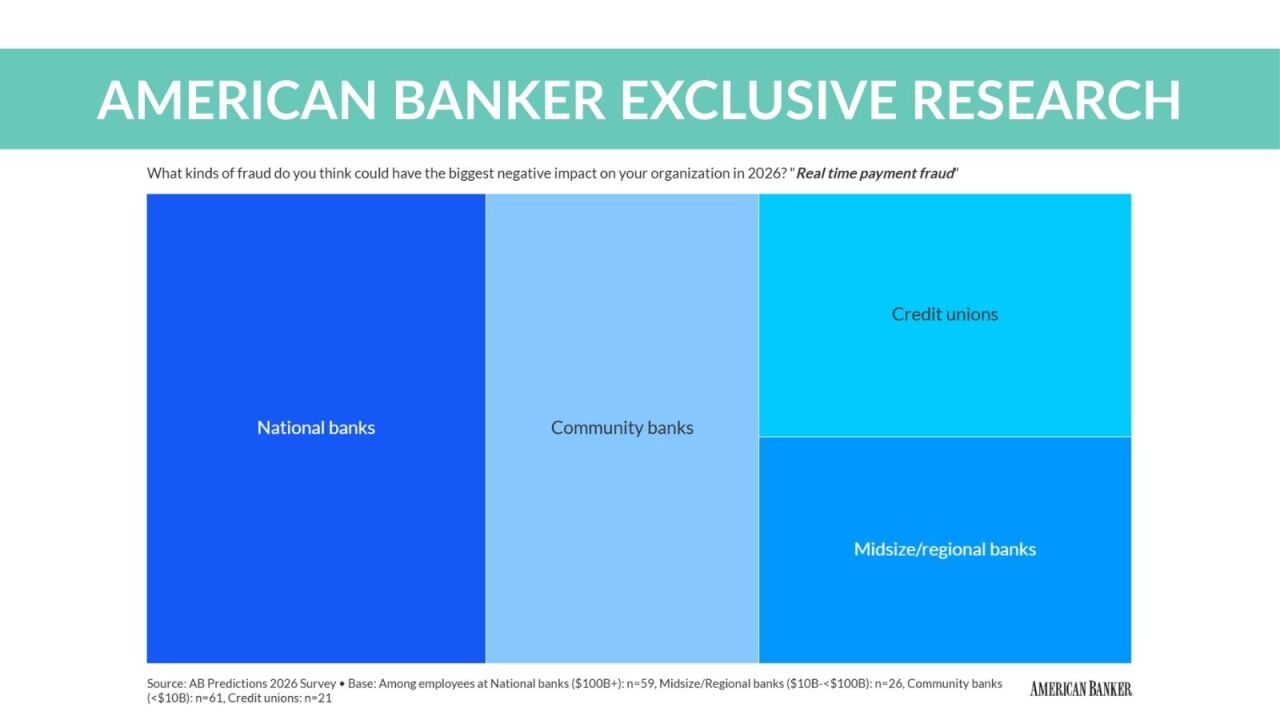

More than half (51%) of national bankers said real-time payments fraud is the top category of scheme that could have a detrimental impact to their institution. Community bankers (41%), credit union leaders (29%) and regional bankers (27%) said the same.

The near instantaneous settlement component of real-time payments makes fraudsters in this niche particularly challenging to combat, as transactions are incredibly complex to unwind once completed.

In September, the Brazilian real-time payment system Pix was the catalyst for a

These worries haven't scared off banks like The Bank of New York Mellon Corporation, which in February of last year was

"Since RTP launched in 2017, we have seen a lot of consumer-oriented uses, such as account-to-account payments, business-to-consumer transactions. The jump to $10 million opens up a lot more payments, such as vendor payment or intracompany transactions," Carl Slabicki, co-head of global payments at BNY Mellon, told American Banker. "It's a good evolution for the network."

Key takeaway: Real-time payments pose the most worrisome fraud threat to national bankers.