Marriott Employees Federal Credit Union is facing a class action lawsuit alleging that it is violating the Truth in Lending Act.

The Bethesda, Md.-based institution drew notice throughout the credit union industry earlier this month when it was the focus of a New York Times article that

The complaint, filed recently in the U.S. District Court for the Eastern District of Pennsylvania, alleges the $188 million-asset credit union is violating TILA by not disclosing the true costs of the “

According to the suit, members must be in good standing with the credit union to be eligible to apply for mini-loans, and in order for the loan to be disbursed must agree to have a minimum of $33 per week deducted from their wages and deposited into an account at the credit union. Members also are required to authorize the CU conduct payroll deductions, including an additional $10 weekly deduction which plaintiffs claim amounts to a weekly cash security for the loan.

The plaintiffs further allege that MEFCU charges a $35 application for each mini-loan despite not running credit checks on applicants. That fee is required even if a borrower has previously applied for or paid off a mini-loan.

While the National Credit Union Administration caps interest rates on loans at 18 percent, the suit claims MEFCU is skirting that rule through its application fees. The plaintiffs allege that when application fees are included as part of the overall finance charge, each mini-loan carries an effective APR of 46 percent.

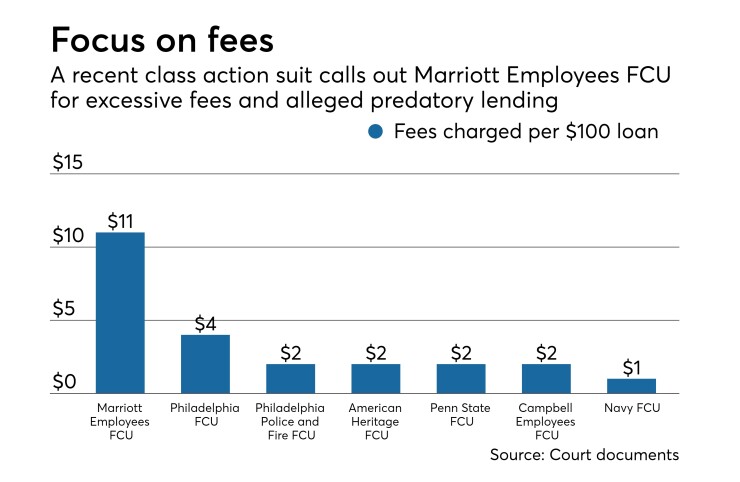

According to the suit, MEFCU earns $11 in fee income for every $100 in loans, an amount plaintiffs claim is “excessively high.” Additionally, court papers say the credit union markets mini-loans to its most vulnerable members, including those who have low incomes and live paycheck to paycheck.

Court papers say Marriott employees who have used mini-loans repeatedly turn to the product throughout their course of employment at the hotel chain in order to afford basic living expenses.

More than 100 people have joined the suit’s class, and lead plaintiffs Katherine Payne and Arthur Coates – both long-time members and employees of Philadelphia Marriott Downtown – have taken out mini-loans in the past.

Neither the hotel chain nor its Philadelphia location specifically are named as a party in the lawsuit, though court papers claim Marriott International controls MEFCU’s operations because company executives serve as the controlling members of MEFCU’s board.

Plaintiffs in the case want MEFCU stopped “from imposing and collecting unreasonable fees and providing incorrect disclosures,” and are seeking a jury trial to award both monetary and statutory damages.

Representatives from Marriott Employees FCU did not respond to Credit Union Journal’s request for comment.