Want unlimited access to top ideas and insights?

A handful of credit unions are leading the way in changing how the industry does its philanthropic giving.

Colorado-based Canvas Credit Union and Elevations CU both recently announced new programs utilizing “round-up” functionalities with the difference from each transaction being put toward a particular philanthropic effort. If a member enrolls in the program and spends $20.25, for example, the purchase would be rounded up to $21 in the member’s account, with the extra 75 cents being put toward the credit union’s charity of choice.

While round-up functionalities aren’t new – Bank of America’s Keep the Change program has existed for well over a decade –

For Lone Tree-based Canvas Credit Union, the program came directly from feedback from members through the $2.5 billion-asset institution’s relationship with Colorado State University. Tansley Stearns, chief people and strategy officer, explained that students asked the credit union for easier, more automated ways to save, and the credit union elected to take measures one step further, adding the option of rounding up to save or give back.

“For a lot of people, and especially this next generation, it’s important to them to work with organizations that do right by the world and help then give,” said Stearns.

While Level Up for Savings launched in 2018 and has a few thousand participants, the Level Up for Charity program is newer and has only a handful of users. Stearns said management hasn’t set a fundraising target for the year. All funds Canvas garners will be donated to Children’s Hospital Colorado.

Malcolm Johnson, the credit union’s director of public relations and community involvement, noted that Canvas donated $50,000 to the hospital last year as part of a two-year commitment for a $50,000 contribution each year. The credit union’s overall charitable giving last year was $150,000 and a similar number has been earmarked for 2019.

Johnson and Stearns said whatever funds come from Level Up will be on top of the $150,000 already set aside.

At the $2.1 billion-asset Elevations CU in Boulder, the new Local Change program aims to boost member contributions to the Elevations Foundation, a nonprofit that provides college scholarships, community grants, disaster relief and more.

“Our members trust us with their finances, why wouldn’t they trust us with their philanthropy?” Dennis Paul, vice president of community affairs, said of the Local Change program.

Paul admitted, however, that it may not be an easy sell. For one thing, while consumers may not know exactly what the United Way, for example, does with a given donation, they’re still familiar with the organization – a benefit the Elevations Foundation and other credit union nonprofits can’t boast.

“Awareness is always a challenge,” said Paul. “We can’t assume our membership is in lockstep with the foundation. We’re very deliberate about highlighting our initiatives and getting out in front with our membership, but even that is no guarantee.”

Elevations management is planning to increase its messaging surrounding the foundation’s work as part of the Local Change roll out.

It’s tough to predict how much money the program might raise in the first year since participants can donate between 1 cent to 99 cents per transaction, Paul said. But the credit union is hoping to raise $44,000, which would be about a 0.5% adoption rate, with ambitions to reach up to a 1% adoption rate.

Canvas and Elevations aren't the only ones offering these features. Tarrant County's CU in Texas also ran a similar program but is phasing it out as it prepares for a core conversion.

Making choices about giving back

Credit unions

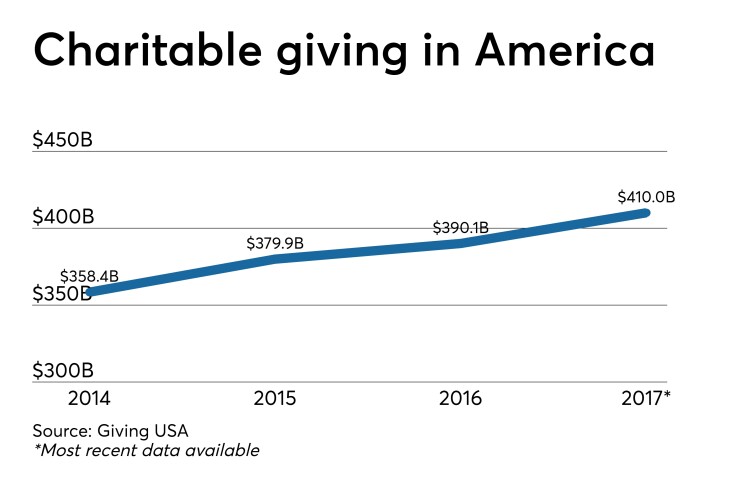

Overall global philanthropy, however, continues to trend upward, said Marian Z. Stern, principal at the consultancy Projects in Philanthropy. While some individuals and organizations cut back on giving in the wake of the financial crisis, the recession has essentially been in the rear-view mirror since at least 2015.

On top of that, she added, the last few years have seen an increase in mission-driven philanthropy, with many people donating to politically active groups like the American Civil Liberties Union or the Anti-Defamation league.

Despite that dip around the recession, Stern predicted any economic slowdown in the coming years likely wouldn’t result in a significant drop in donations from credit unions and others, in part because the last recession was such an anomaly.

And while she acknowledged that round-up philanthropy could allow CUs to continue giving at the same overall rate during leaner times without cutting into the institution’s bottom line, she said cutting back on a commitment to the community sends the wrong message to members.

“Cutting back on philanthropy is not the natural fallback position in financial institutions,” Stern explained. “It would seem like an easy thing to lop off – members of our credit union are giving their own money anyway, we cannot do it [and] and won’t make an appreciable difference in the community. But organizations that make philanthropy a part of their culture don’t want to cut back, and they might find other places to cut before they would cut back on philanthropy.”

Credit unions are also often keen to showcase their charitable initiatives. This work usually extends far beyond what could be listed in a line item on a call report or a white paper, since CUs donate not just money but volunteer hours in their communities, said Gigi Hyland, executive director of the National Credit Union Foundation.

She noted that some reports from the Credit Union National Association and state leagues in places like Michigan, Wisconsin and

“Showing dollars contributed to philanthropy is incredibly important, and it’s also important that credit unions show the impact they're having on members and their communities in terms of financial health,” she said. “That impact needs to be a measurable impact around [factors such as] taking a member from a 630 credit score to a 720 score or from not having any emergency savings to having emergency savings.”