Want unlimited access to top ideas and insights?

Credit unions are suddenly flush with deposits but they may have limited options in how to deploy these funds.

Last year, some credit unions found

However, credit unions could struggle to find ways to turn those funds into interest-earning assets, experts said. Potential strategies could include expanding credit card portfolios, focusing on member service or undertaking different investment strategies than those they normally utilize.

“It’s very tough right now,” said Bob Doby, a partner at DJ Consulting. “Credit unions are working on getting deposit costs down so they can be marginally profitable.”

In April, credit unions posted a 4.7% rise in saving balances while loans increased by just 0.1%, according to CUNA Mutual Group’s Credit Union Trends Report for June, which includes April data.

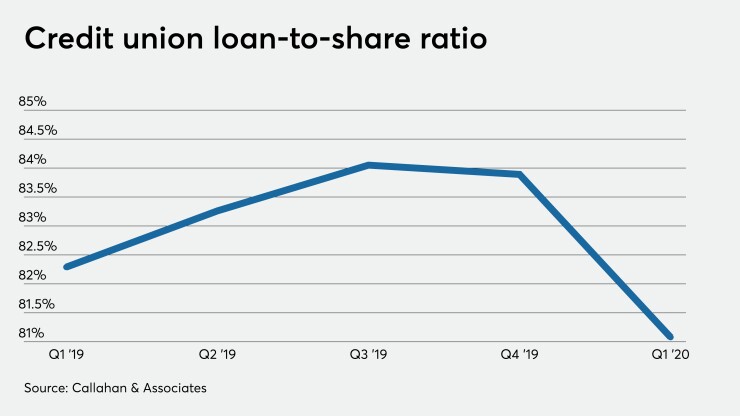

The loan-to-share ratio dropped to 81.08% in the first quarter, the lowest it’s been since the first quarter of 2018, according to data from Callahan & Associates.

“What’s interesting is the pendulum has swung back the other way,” said Ed Meier, vice president at Heber Fuger Wendin, a financial advisor to credit unions. “Credit unions went from fully lent out to being flush with liquidity once the coronavirus kicked in full force in March.”

But now institutions must find ways to earn money off of this funding while also managing for risk. That can be difficult since lending in many categories has slowed, according to CUNA Mutual data.

Still, there could be opportunities in areas smaller institutions often overlook, such as credit cards, because that field is normally dominated by he largest players, said Jeffrey Marsico, an executive vice president at the consulting firm Kafafian Group.

There has been some pressure on card balances as consumers rushed to pay off these debts once the pandemic gained steam, Marsico added. Credit union credit card outstanding balances fell by 1.2% in April from the same period a year earlier, according to CUNA Mutual data.

Still, technology makes it easier today to manage smaller card portfolios, so credit unions need less scale in the space to turn a profit, he added.

Mortgages have been one

Still, credit unions that make these loans with the intention of keeping them on their books need to think through the potential interest rate risk, Marsico added. In March, the Federal Reserve dropped rates essentially to zero to combat the economic fallout from the coronavirus.

“It is a challenge to do traditional underwriting because credit unions are unsure of how the government support programs are bolstering would-be borrowers,” Marsico said. “For the credit unions that we measure profitability, they are having success in home residential loans and even home equity lines of credit. But many are portfolio lenders and that’s a risk and a challenge to them.”

Arkansas Federal Credit Union in Jacksonville, Ark., has seen its deposits spike by about 14% year to date and 18% from one year earlier, said President and CEO Rodney Showmar. But the $1.4 billion-asset institution is still having “a banner year” in terms of lending, he added. Its loans outstanding are up 12% year to date and 21% from a year earlier, Showmar said.

Executives believe the institution laid the ground work for this success over the last few years by emphasizing that employees should consult with members rather than just push products or simply process transactions, Showmar said.

Staff also proactively called members once the pandemic hit to see if they were experiencing financial hardship and if there was anything that Arkansas FCU could do to help. So far it has issued more than 2,400 loan payment deferrals.

“We were reaching out and asking if they were okay with making payments,” Showmar added. “We were asking, ‘Have you been furloughed? How is this affecting you?’ That sends the right message.”

Specifically, Arkansas Federal has seen demand increase for indirect auto loans. Overall for the industry, new car loans declined by 1.2% in April from a year earlier while used car loans increased by 3.1% year over year, according to CUNA Mutual data.

The credit union sent employees to car dealerships to reassure them that they were still approving loans. As a result, the institution made $44 million of these credits in April, more than double its usual number. The shorter nature of auto loans should help it manage its interest rate risk.

Auto loans, especially for used cars, can be a good source of growth right now, Doby said. The price of these vehicles has dropped as dealers, who need to turn inventory quickly for the cash flow, are motivated to make sales. Still, lenders need to be careful how they underwrite these loans in case the value of the car declines faster than expected.

“There is some market risk there,” Doby added. “The key is if you underwrite it correctly and have a good member that doesn’t have a cash flow problem.”

Toronto-Dominion Bank plans to give most employees the option to return to the office this month and is aiming for workers to officially transition to their new working models by June.

The Biden administration once again extended the pause on student loan payments enacted to help borrowers during the COVID-19 pandemic, this time through the end of August.

Employees will still have some flexibility to work from home, but are strongly encouraged to collaborate with colleagues in person, according to people familiar with the matter.

Though institutions generally prefer to deploy deposits into loans because of better returns, more credit unions are also showing an interest in different products on the investment side of the balance sheet, experts said.

Corporate bonds issued by top-tier companies, such as Amazon, MetLife and John Deere, could be of interest to more credit unions, said Meier, of Herber Fuger Wendin. The difference in pricing between these bonds and U.S. Treasuries has widened considerably. Corporations turned to issuing bonds when the stock market cratered in March.

However, these investments are inherently riskier — some companies could become troubled and default on their debt — which is why the pricing is a bit better for investors. Additionally, there are regulatory restrictions on credit unions investing in corporate bonds.

There is also more interest from credit unions in charitable donation accounts and total benefits pre-funding, since these options allow the institution to make higher-yielding investments it may otherwise be prohibited from doing, said Bob Lindner, director of credit union business development at Madison Investment Advisors.

For charitable donation accounts, a credit union can invest up to 5% of its net worth in a portfolio, with 51% of the earnings from that account donated to a charity of the institution’s choice. The credit union can keep the remaining profits.

As for the total benefits pre-funding option, the credit union can invest up to 25% of its net worth to pre-fund certain expenses, such as health insurance, contributions to retirement and pension plans and deferred executive compensation.

“Deposit growth has been robust and loan growth is off,” Lindner said. “Because of that, we are seeing a huge increase in investable funds at credit unions.”