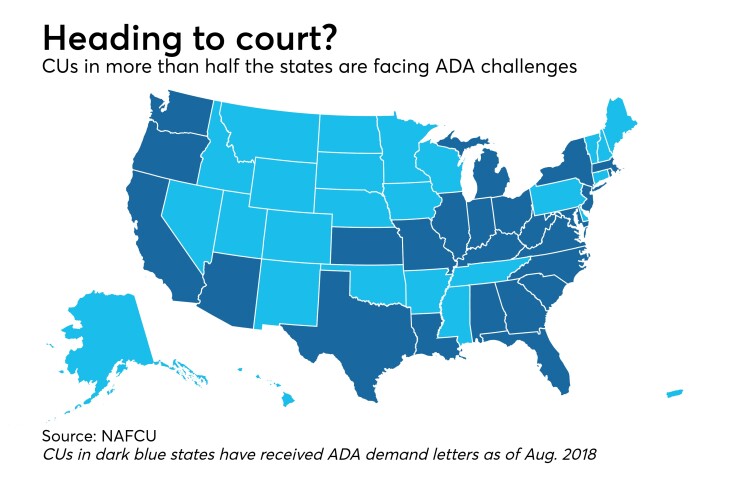

Credit unions shouldn’t be surprised if they spend a good part of 2019 in the courtroom.

Two types of lawsuits became increasingly common at CUs throughout 2018: those alleging credit union websites

According to Michael Bell, an attorney with the firm Howard & Howard in Royal Oak, Mich., “these suits aren’t going away” in 2019 – and credit unions also shouldn’t “expect a solution to be created for them,” he cautioned.

The past year was essentially split between ADA cases being more prominent in the first half of 2018 followed by overdraft-related suits in the second – including, most recently, a

“There has been a slowdown in ADA suits against credit unions over the past six months, although you still see ADA suits against banks,” observed Carrie Hunt, EVP and general counsel at the National Association of Federally-Insured Credit Unions.

While credit unions have won several cases and seen others dismissed, in some instances plaintiffs have appealed, and those decisions likely won’t come until sometime in the new year.

Overall, said Hunt, “No news is good news in litigation, but there could be an uptick. It could be credit unions are just settling and not telling us, but we don’t think so.”

One analyst also noted that recent changes at the Department of Justice could bode well for CUs.

Asked if the departure of Attorney General Jeff Sessions would have any impact on the ADA website issue, Elizabeth Eurgubian, deputy chief advocacy officer and senior counsel for CUNA, said the prospect of a new attorney general “gives an opportunity to move the ADA issue up the priority list.”

“There is staff interest at the Department of Justice,” Eurgubian said, adding ”We see the possibility of rulemaking or guidance. We are going to continue our dialog with DOJ, track any litigation and make sure credit unions are informed as to what is going on across the country. We have not seen any new tactics, but we are monitoring for anything new on the part of plaintiffs’ attorneys.”

While

But whereas CUNA representatives were bullish on how changes at Justice might impact the ADA fight, Hunt struck a more skeptical tone.

“With Sessions leaving, if there is a lack of permanent leadership, it makes the staff at DOJ less likely to move ahead,” she said. “But we did not see guidance forthcoming under Sessions. Having new leadership might be a good opportunity, and any opportunity is better than no opportunity.”

Attorney Michael Bell said it’s unfortunate an all-encompassing solution hasn’t arrived to provide clarity on ADA issues, and he added that he’s not terribly optimistic about a solution in the year ahead.

“I am not holding my breath,” he said. “There are very accomplished and successful plaintiffs’ attorneys out there and I am sure they are going to continue to evolve and explore claims in this area. Bottom line, credit unions need to pay attention and work with their internal and external counsel and compliance team to reduce risk in this area.”

Still trollin’

When it comes to overdrafts, because plaintiffs are pursuing a number of different legal claims, both trade associations said an industry-wide fix is unlikely.

While CUNA’s Eurgubian said credit unions always face the possibility of “frivolous” litigation, NAFCU’s Hunt noted that CUs have faced plenty of overdraft-related lawsuits over the years. Because the area of law pertaining to overdrafts is subtle, she added, there are questions as to how various rules and regulations are interpreted.

“Credit unions need to do an assessment of how they have complied with the rules and regulations,” she said. “They need to check with outside counsel to see if anything can be changed. NAFCU is providing our regular compliance assistance on what the rules and regulations require, and we are tracking litigation to see if credit unions need our assistance, but a lot of these cases come down to individual contract disputes, rather than a broad issue of interpretation.”

In mid-2018 CUNA pointed out the threat of law firms

And the bad news, noted Bell, is that – like ADA – a global solution hasn’t arisen yet “and I don’t expect it to,” he said. “As an example, the CFPB could take a moment and make a real difference here, but the bureau remains silent and uninvolved. Last time I looked, plaintiffs’ firms were still searching aggressively for clients and lawsuits, so I don’t expect this to change.”