Growth in credit unions’ commercial loan portfolios this year will depend on how quickly the economy rebounds from COVID-19. But even if the nation returns to full strength by the end of 2020, commercial business may not return to normal levels until 2022.

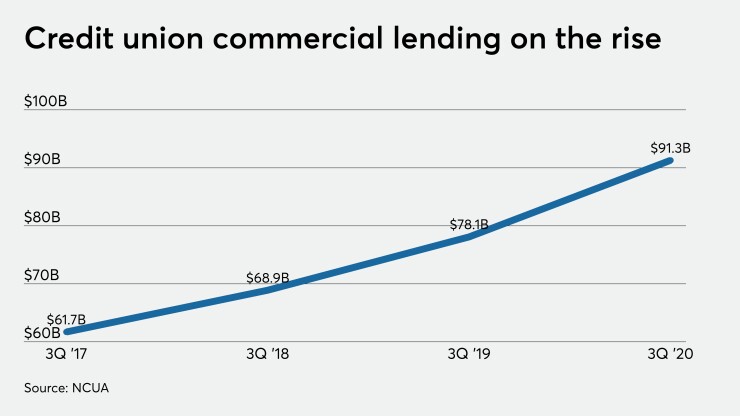

As of Sept. 30, 2020, credit unions had $91.3 billion in commercial loans on the books, a 48% increase in three years, according to data from the National Credit Union Administration. How those figures advance in 2021 may largely be out of credit unions’ hands.

“In the short term it’s going to be extremely painful, but we will eventually see a lot of pent-up demand coming back, and once vaccinations are widespread and people are psychologically ready, I think at that time [loan volumes are] going to be pretty good,” said Rohit Arora, CEO of Biz2Credit.

That firm’s analysis showed credit unions approving 20.6% of all small business loan applications in December, compared with an approval rate of nearly 40% one year prior. Arora predicted a return to those levels isn’t likely until the middle of next year. That’s similar to the financial crisis of 2008, he said, when a return to normal didn’t fully hit until 2011, since many lenders waited until 2010 to see the full recovery.

“When lenders want to do traditional lending, they look at the last two or three years of financials,” he said. “2020 is going to look like a big hole out there, so many [lenders] may wait for 2021 to close before they really step back in and get back to more lending.”

While loans made through the U.S. Small Business Administration’s Paycheck Protection Program have garnered plenty of headlines in the last year, only a small part of the credit union industry has been involved with that initiative. And with a limited amount of PPP funding available and many loans eligible for forgiveness, PPP is not expected to be a substantial part of overall commercial loan activity for the industry in 2021.

The good news for credit unions is that much of the growth in this sector in recent years can be attributed to commercial banks pulling back from smaller customers, said Steve Reider, CEO of the consulting firm Bancography. NCUA figures show a nearly 17% year-over-year increase in commercial lending at the end of the third quarter, the most recent data available.

“A lot of the commercial banks have taken their commercial operations much more upstream,” said Reider. “What that’s done is created a bit of a void. Historically, a lot of community banks jumped into that void, but of course there’s a lot fewer community banks today, which has created a really nice opening, from a credit union perspective, to step in and assume some of that business lending. As that segment revives, you’re going to see increased share gains by credit unions within the smallest business segment.”

Clackamas Community Federal Credit Union in Milwaukie, Ore., holds about $38 million in commercial loans on its books as of Sept. 30, a 23% increase from where things stood at that point in 2019. Chief Lending Officer Kimo Rosa noted that the credit union is in the process of attempting to shift from a heavy concentration on real estate to a focus on commercial and industrial lending, including services such as equipment loans and lines of credit.

CCFCU’s average loan size over the last five years has been about $500,000, said Rosa, but that could shrink as it diversifies. The lending team there is eyeing new averages of between $200,000 and $400,000, though some of those declines may be compensated for as the credit union focuses more on deepening relations with commercial clients, including bringing over deposits, business credit card lines and more.

With the economy still in recovery mode, Clackamas Community has changed its underwriting.

“In the past we may have taken interim financials or a previous year’s income and just netted it out through the current year,” explained Rosa. “Now our business teams are seeking out more current financials, so we’re definitely trying to see the effects of how COVID has affected our businesses…We were granting payment forbearances for our business loans as well, and for businesses that took that, we downgraded them as a risk rating. We did provide them that opportunity to continue to be current on their loan and advancing the due date.”

In the wake of that, he added, the credit union has increased how often it reviews its commercial clients and checks in to be sure they have appropriate levels of operating cash flow.

Most of the industry’s commercial lending gains will be made at the largest credit unions, which have the ability to provide more robust business banking offerings than their smaller counterparts, such as institutions that serve one or a few select employer groups.

“You’re certainly not going to see it in the historic, pure SEG-based credit unions that operate within a single small company or a union or church group,” said Reider.

The exception, he said, is instances in which some smaller credit unions may make loans to owner-occupied businesses run by a member who already does his or her consumer banking with the credit union.

That’s some of what Lesco Federal Credit Union in Latrobe, Pa., is counting on. The $89 million-asset institution recently began working with the credit union service organization CU Biz Loan to dip a toe into the commercial lending space.

“We were getting inundated by calls about PPP loans,” said CEO Neal Fenton. “We had to basically say ‘Look, we don’t have an avenue for PPP loans and things of that nature,’ so that put our radar up and unfortunately we had to turn them away. We got educated and found out who the local community banks were that could process those loans, and then we directed [members to those banks] just as a service for our members.”

Working with CU Biz Loan on participations will allow Lesco to recruit potential commercial clients and then refer those businesses to other credit unions in that network.

“We can offer these business opportunities to our members without getting inundated with all the back office work that needs to be done with business loans,” said Fenton. He added that the goal is to gradually expand and eventually begin to develop its own commercial portfolio.

“This is kind of the litmus test,” he said. “If we see a lot of activity with the referral service, we might say we need to get into this because we didn’t realize [the demand for it]. Sometimes you don’t know what you don’t know.”

With Congress debating additional relief measures as the COVID vaccine slowly roll out, said Arora, new stimulus “is going to crowd out a lot of commercial lending initiatives for at least the first quarter and it may even extend into the second.” If the government continues to dole out stimulus checks, he added, that could be a sign the economy is recovery more slowly than anticipated.

Reider and others advised patience as credit unions wait for pent-up demand to kick in.

“It’s not going to be a light switch, it’s going ot be more of a gradual return,” he said of the economic recovery. “And first there needs to be a little bit of confidence. I don’t think there’s going to be a lot of people who are going to get their [vaccination] and get on an airplane the next day. There’s going to be some lingering uncertainty.”

Clackamas Community’s Rosa is being patient.

“We’re optimistic of a rebound in late Q3 or Q4,” he said, “and we believe that’s when a lot of the opportunity is.”