Small lenders are enjoying healthier loan portfolios while at the same time bracing for potential setbacks related to higher interest rates, inflation and more.

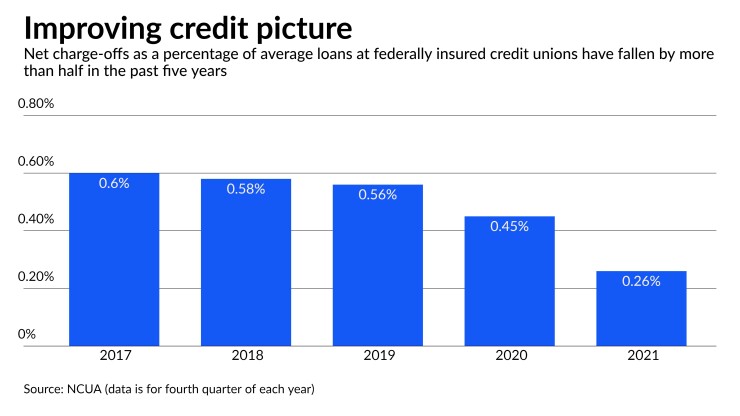

The delinquency rate at federally insured credit unions was 49 basis points in the fourth quarter, down 11 basis points from one year earlier, according to the most recent data available from the National Credit Union Administration. The net charge-off ratio was 26 basis points, down from 45 basis points in the fourth quarter of 2020.

Bankers nearly across the board have also reported low loan losses and expectations for continued strong credit quality for the foreseeable future. What’s more, “U.S. banks maintain solid capital buffers against” any near-term stress, said Rita Sahu, vice president of Moody's Investors Service.

Todd Hall, president and CEO of Truliant Federal Credit Union in Winston-Salem, North Carolina, said that like many credit unions, Truliant was still experiencing below normal delinquency levels. Last year, total charge-offs for the $3.8 billion-asset Truliant fell about 15%, to $14.5 million, from 2020.

However, he is anticipating that could change with the impacts of inflation and the expected dramatic rise in interest rates. Hall said Truliant is well positioned for a rising rate environment and believes its net interest margin will improve with the expected 200 basis points hike in rates.

“But we are not backing away from unsecured loans as we believe, done correctly, it is an essential part of the necessary tools needed by our member base in trying times,” he said. “We expect delinquency and charge-offs to rise, but it is a cost of doing business.”

Many credit unions are experiencing improved health in real estate lending. The NCUA’s most recent data showed a 0.12% year-over-year improvement in fixed-rate real estate portfolios. That’s because real estate markets have been strong with property values rising, said Tim Scholten, president of the credit union and the community bank consultancy Visible Progress.

“This opens up added opportunities with HELOCs as well as a shortage of supply helps people focus on upgrading their existing home,” he added. “Most credit unions I have been working with are doing very well in these spaces.”

Fixed-rate real estate loans at credit unions have seen a low delinquency rate in part because of the actions of Congress and regulators in response to the pandemic, said Michael Christians, principal of Michael Christians Consulting.

That includes the CARES Act, which allowed a borrower with a federally backed mortgage loan to request a 180-day forbearance if they were experiencing a financial hardship related to COVID-19. The forbearance period could be extended an additional 180 days if requested by the borrower during the original forbearance period, Christians said.

The overall health of the fixed-rate real estate loan book at credit unions continues to be strong and will likely remain that way until all COVID-19-related relief provisions have expired or been exhausted.

“What overall economic conditions look like when we reach that point will help determine in what direction delinquency rates move,” he said.

Still, Scholten said that the inflation pressures may start to have an impact on people as the cost of basics like food, gas and clothing has been increasing rapidly. Many credit unions are starting to take a more conservative approach to credit as rates rise and inflation is taking a real hold.

“I am seeing a desire by some to back away from unsecured lending, and other nonessential businesses as they anticipate more delinquency going forward,” Scholten said.

However, most lenders also have emphasized substantial uncertainty from the war in Ukraine, the pandemic and soaring inflation that hit a 40-year high in March. For instance, Bernie Winne, president and CEO of Boston Firefighters Credit Union in Dorchester, Massachusetts, said the rapid increase in mortgage rates has virtually stopped any refinancing activity.

The $398 million-asset credit union has responded with an aggressive home equity campaign. Winne expects that members will still need money for major purchases, home repairs, tuition and other reasons.

“Home values are at all time highs and even when you consider potential increases in the interest rate on the home equities, they are better than unsecured loans and credit cards,” he said.

Executives at CrossFirst Bankshares in Leawood, Kansas, expect they will maintain strong credit quality at the $5.5 billion-asset institution despite these headwinds. First-quarter net charge-offs totaled just $1.1 million. That was well below the $8.2 million it reported a year earlier, even as its average loans swelled by 12% on an annualized basis in the first quarter.

Still, President and CEO Michael Maddox did warn about the potential for growth to slow.

“We continue to watch the geopolitical disruption, growing inflation, continued supply chain challenges and the likelihood of additional rate hikes,” he said. “These factors could dampen growth and slow the economy. We have ambitious objectives. But when we talk about growth, we know we must do so responsibly.”

Another case in point: The $18.6 billion-asset Home Bancshares in Conway, Arkansas, had no credit costs in the first quarter, even as it grew its loan portfolio about 8% on an annualized basis.

Despite this, John Allison, Home’s chairman, told analysts after posting first-quarter results that credit discipline remains a top priority, given the potential threats. He noted that, in an effort to curb inflation, the Federal Reserve

Additionally, the effects of the pandemic linger. While cases have held at low levels in the U.S. most of this year, outbreaks have hindered economic activity in parts of Western Europe and large swaths of Asia.

“The first quarter brought about record-high wholesale prices,