There is a movement afoot with credit unions flipping the script and becoming technology companies that offer financial services.

“We adopted a new strategic plan. We are now a technology company that offers bank products and services,” said John Holt, CEO of Nutmeg State Financial Credit Union. “We are changing our internal infrastructure so it can handle new technologies, which includes moving to a new core.”

The $420 million Rocky Hill, Conn.-based Nutmeg State has also found a new approach to operating its nine branches, which has similarities to the Amazon retail store model. To achieve this initiative, Holt hired a third-party technology design team.

“We want the ability for our members to walk in and have the branch interact with the member via our mobile app,” said Holt. Tellers, he added, are referred to as “consultants” who are instrumental in educating members on new technologies, such as ITM machines.

“We are not scrapping the branch idea,” said Holt. “It’s just going to be a very different experience.” The 42,000-member credit union, he added, has a 44 percent e-banking membership usage (total desktop and mobile) rate and a 23 percent mobile banking usage rate.

Chrome Federal Credit Union’s CEO Christopher George is also looking at the credit union construct differently. He calls members “customers” and branches “stores.”

“We view ourselves differently as a technology company that offers financial products and services with a credit union charter,” said George. “It’s a mindset.”

In 2010, George joined the $167 million credit union, which he refers to as simply “Chrome.” At the time, the status quo wasn’t appealing to his vision. He told the board the credit union could die a slow death, die a quick death (merge with another CU) or it could differentiate itself by taking a whole other path. The latter approach won out.

“We rebranded ourselves. We are changing our core because we tried to ‘lipstick’ changes to our existing core with 35 different vendors and it didn’t work,” said George.

Washington, Pa.-based Chrome is nearing the end of the core conversion process and will soon have an open-API integration platform that allows George to plug in any service offering that makes sense to his overall strategy.

“Our end game is to be like an Amazon experience, where you can open up your account, you can fund it, fund any payment with any source you want — simply banking,” said George. “We really flipped our model upside down and went mobile and online.”

Tech-driven service

While Nutmeg State FCU has a forward-looking approach to banking, Holt said he is not “giving up on the older generation.” Rather, Holt wants to “show” the baby boom generation new banking options.

“We are making our app and delivery channels as easy as we can,” said Holt. “It is like shopping online at Amazon—a few clicks of the button. This is a fool-proof approach.”

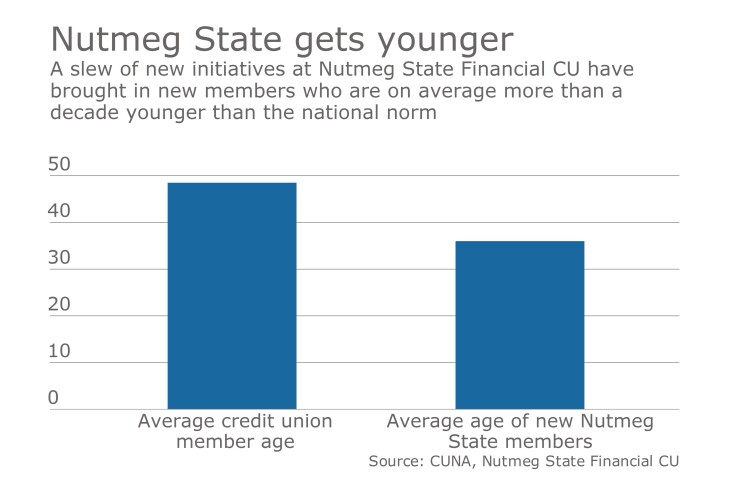

Baby boomers aside, 31 percent of Nutmeg State FCU’s members are Gen Y (age 21-40), with Millennials representing roughly 15% of membership. Holt also concentrates on the 21 to 30 age demographic that currently represents 16 percent of overall membership. While the credit union’s overall average member is 49 years old, hewing close to traditional averages for the movement (48.2 years old in 2016, according to CUNA), Nutmeg State's new members are decidedly younger — the average new member is just 36 years old, and the credit union has a long-term goal to bring that down to 25 years old.

“When I got here in 2010, the age breakdown was significantly different,” said Holt. “The credit union was strong and stable, but it was very vanilla and didn’t have a lot of technology and services. The board has been extremely excited by this change and direction.”

To better understand what “customers” to attract, George hired a marketing firm to survey the seven different counties Chrome serves. Results pointed to “soccer moms” as the target demographic, which at present isn’t the leading group.

“These women like to bank on their phone or predominantly online and don’t want to come into a store [branch], but want to know one is there,” said George.

Armed with this information, George is in the process of transforming three existing branches into stores modeled after the Apple Store. The $170 million Chrome has 45 employees, 15 of which are “universal” and are trained to work at Chrome stores.

“Our goal is to have five or six stores sprinkled throughout six or seven counties, so they are in a 45-minute drive of each other,” said George, adding that Chrome supports 18,000 members.

With some of the new “store” designs now over a year old, George said it is still common for customers to comment on the “new” design daily. This is because trips to the bank or credit union are rarely done anymore.

“There is a huge disruption in our industry where there is this misnomer that people want to come into a bank — it’s like a utility now,” George. “Banking used to be a destination and now it is something you do on the fly.”