White Christmas? It’s shaping up to be a green Christmas for credit unions, with recent data indicating increased spending among members this holiday season.

Despite an abbreviated shopping timeline thanks to a late Thanksgiving, a recent report from the credit union service organization PSCU suggests sales volumes – based on credit and debit card spending – was up 15% this year on Thanksgiving, Black Friday and Cyber Monday. Mobile wallet usage has also surged a whopping 155% as more consumers turn to the likes of PayPal, Apple Pay and Samsung Pay for both online and in-store shopping.

Credit unions closely track member spending not just because of the interchange income earned through credit and debit card usage and interest on credit card balances, but because the more a member uses the CU's card offerings, the more likely that member is to consider the credit union as their primary financial institution. PFI status indicates a "sticky," long-term relationship with the potential for lending and other products and services.

The CUSO also reports average spend per transaction is on the rise. While credit cards saw only a 2% year-over-year increase, debit transactions were up by 11%, in line with recent PSCU data indicating

“Although this year’s shopping season is shorter, in looking at November volumes, we see that consumers are taking advantage of holiday deals,” Ivana Spadijer, program manager for data science and insights at PSCU, said in a press release. “Sales volumes have increased and… this holiday shopping season is expected to surpass last year’s volumes.”

A report

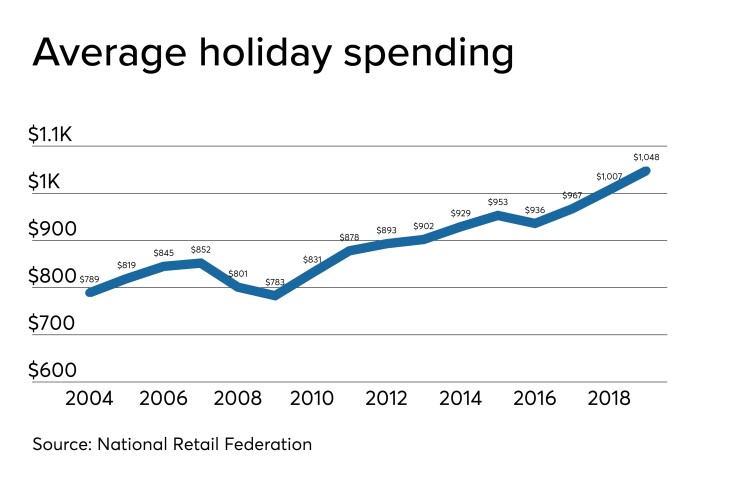

An October study from the National Retail Federation suggested consumer spending was likely to rise by 4% this holiday season for an average of just under $1,050. Shoppers in the 35 – 44 age range – in other words, the demographic most likely to be raising children – had the highest average at more than $1,150.

This year’s average is 32% higher than 15 years ago and nearly 12% higher than just three years ago.