ORLANDO - (11/15/05) -- Identity Theft 911, which has beenmarketing its identity theft prevention and resolution system tocredit unions, unveiled a new system to allow credit union andother financial institutions to immediately notify customers whentheir database has been compromised. The new system, SBR911, wasintroduced Monday at the annual BAI Retail Delivery Conference. TheSBR911 programs will enable financial institutions to assess adatabase breach and manage a response, including regulatory andconsumer notifications, helping to minimize potential losses andliability. It will also help financial institutions to communicateproactively with their customers to defuse public concerns.Introduction of the new warning system comes as Congress isproposing to require all financial institutions to notify customersof data breaches.

-

Brookfield, Wisconsin-based Landmark Credit Union's planned takeover of American National Bank-Fox Cities is the second credit union-bank acquisition announced in 2026.

5h ago -

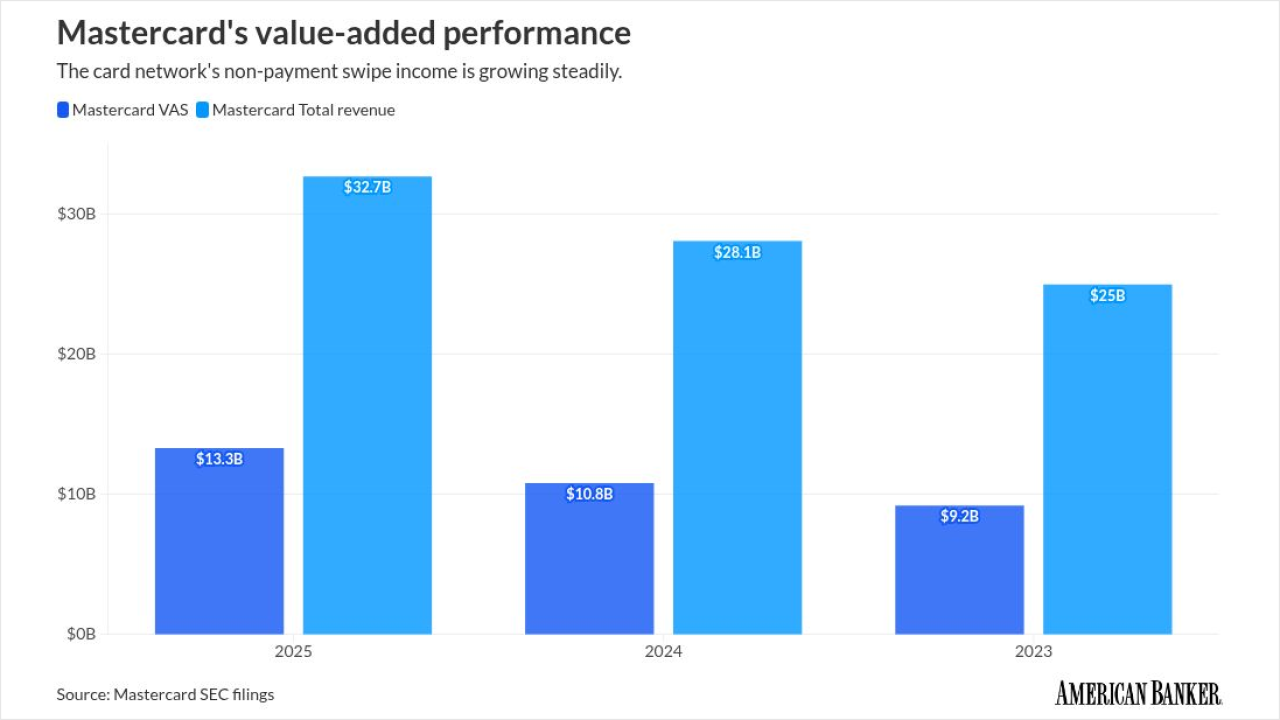

The card network hopes to increase revenue from non-card payments and is tapping two major technology trends.

6h ago -

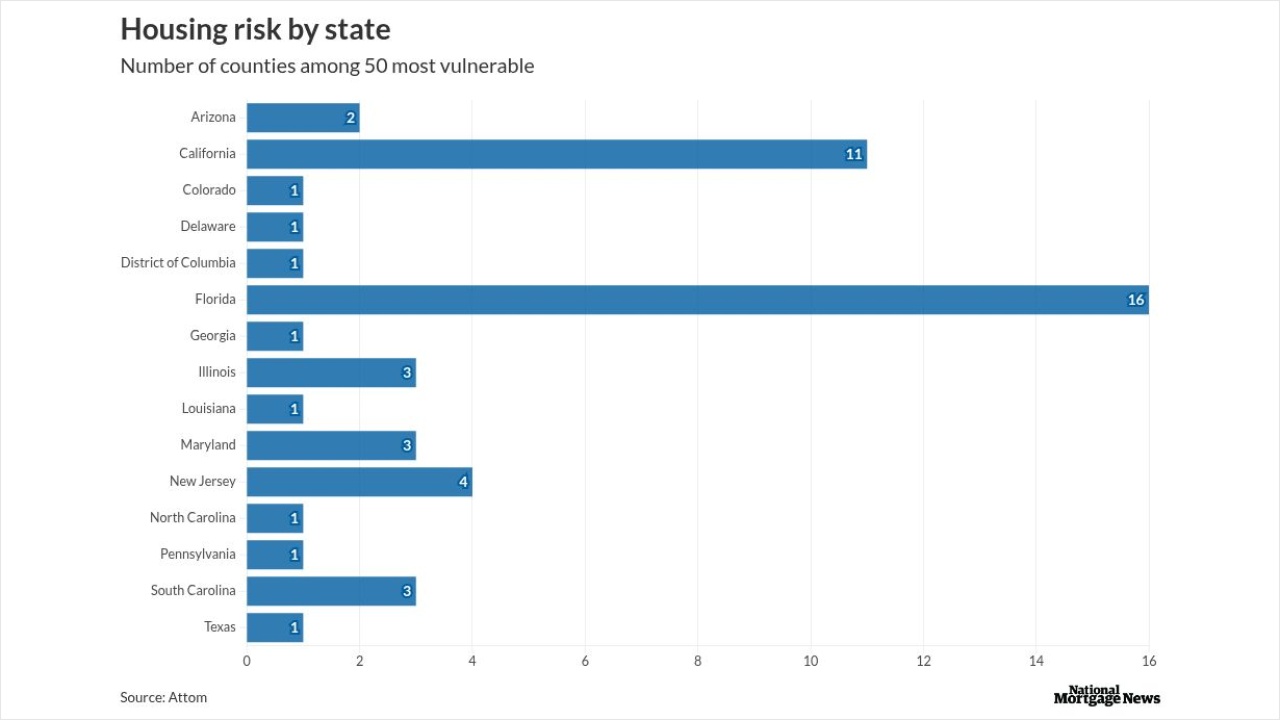

Residents in more than half of U.S. counties need greater than one-third of income to successfully manage major housing costs, according to new Attom research.

7h ago -

Cameron Bready, the firm's CEO, noted the company's clients include 12 large Middle Eastern airlines, and the closed airspace "isn't ideal."

7h ago -

Comptroller of the Currency Jonathan Gould said one of the early messages he is hearing from banks and supervisors revolves around an uneven playing field between small banks and their core providers, but suggested formal rules to address the problem are not imminent.

8h ago -

The Swiss bank turned to a federal judge to mediate its dispute with a Jewish human rights group, but the two sides left the courtroom in deadlock.

8h ago