Ball State Federal Credit Union in Muncie, Ind., is set to merge into Financial Center First Credit Union in Indianapolis.

The deal would be the largest credit union merger in the state’s history if approved by members, according to a press release from the Indiana Credit Union League on Thursday. The combined institution will hold nearly $700 million in assets and be headquartered in Indianapolis under the Financial Center First brand.

“This partnership is a natural fit,” J. Kevin Ryan, Financial Center First’s president and CEO, said in the press release. “The financial literacy expertise that our new organization will deliver to Ball State FCU’s membership and the Muncie community coupled with a 30-year relationship with Ball State Federal Credit Union’s CEO, Randy Glassburn, made it an easy decision for both of our organizations. Financial Center looks forward to delivering its financial literacy approach towards growing membership in combination with Ball State FCU’s well-established brand.”

Glassburn said the merger will increase financial education options for the former Ball State members, along with adding branches, better technology and more. All Ball State FCU employees are expected to be offered positions with Financial Center First

A member vote is expected sometime later this year.

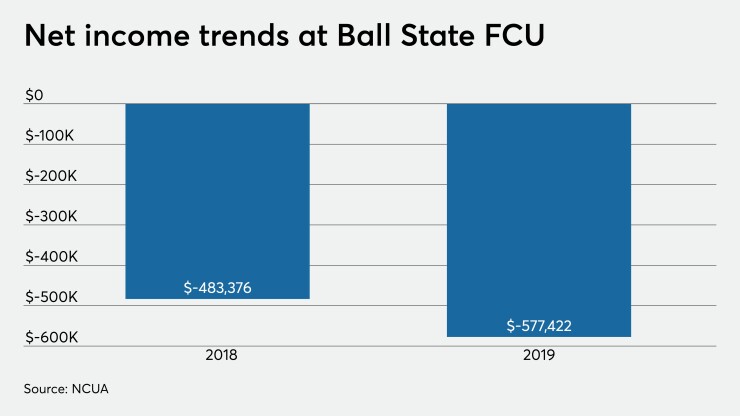

At nearly $90 million in assets, Ball State FCU posted a loss of more than $577,000 last year, according to call report data from the National Credit Union Administration. It lost more than $483,000 in 2018. The credit union had more than $850,000 in charge-offs in 2019, nearly half of which was in used car loans. An emailed statement from the credit union noted that “A concentrated effort has been made over the last four years to address weaknesses in the indirect lending portfolio,” which on aggregate has been reduced by more 40% ($11 million) during that time. Ball State also took steps to improve the credit quality of its indirect portfolio, to the point where more than three quarters of indirect borrowers now have A or B credit.

The combined institution is projected to have a net worth ratio of 11.4% once the merger is completed.

This story was updated at 9:22 P.M. on March 26, 2020.