Credit unions in Minnesota have banded together to launch a clean energy lending platform, CU Green.

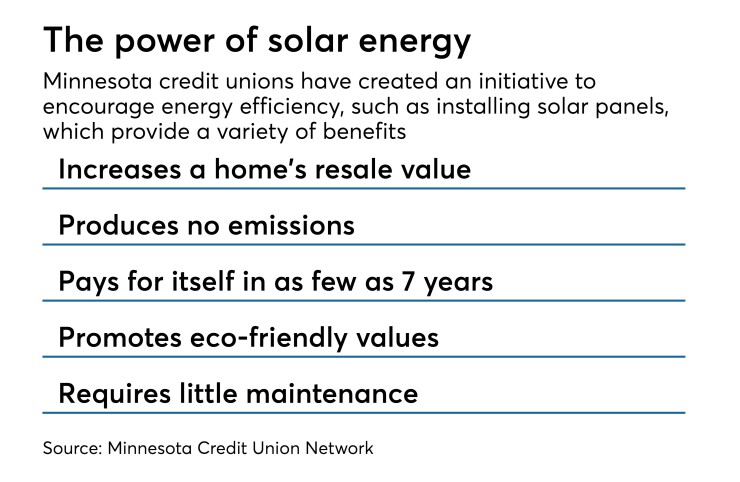

The program was developed to give consumers greater access to clean energy through loans, investment options and educational resources, the Minnesota Credit Union Network said on Tuesday. CU Green provides consumers with information about qualified contractors, utility incentives and below-market rate financing for solar electric generator system installation.

The state’s credit unions are working with the University of Minnesota Institute on the Environment Climate Smart Municipalities program to increase energy efficiency.

The Minnesota Credit Union Network, and Hiway Federal Credit Union and Affinity Plus Federal Credit Union, both based in St. Paul, Minn., created the website, cu-green.org.

“By connecting Minnesotans with trusted installers, personalized energy savings estimates and competitive loans, credit unions are helping families and communities go green,” Mark Cummins, Minnesota Credit Union Network’s president and CEO, said in a statement.

Jeremy Kalin, a former state legislator and clean energy financing expert, is joining the credit unions as they work on implementing energy efficiency improvements to branches.

With over $20 billion in assets, the Minnesota Credit Union Network serves more than 1.7 million members across 400 branches statewide. Affinity serves over 192,000 members across 28 branches while Hiway serves over 73,000 members.

Many credit unions have implemented eco-friendly policies, such as building