Want unlimited access to top ideas and insights?

With more than one year under its belt, Zelle’s user rates are skyrocketing, with consumer “trust” noted as a leading indicator. Competitors like PayPal’s Venmo, however, remain formidable opposition.

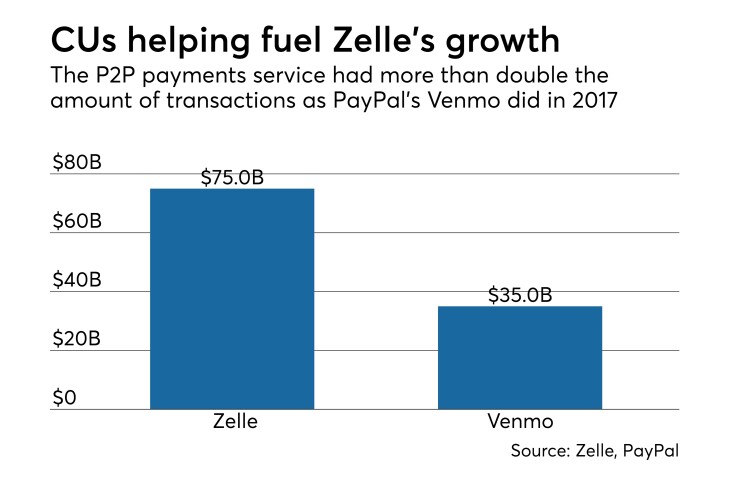

Zelle, operated by Early Warning Services LLC, a real-time payment, authentication and risk-mitigation firm, was conceived as an alternative to popular P2P networks like Venmo, a PayPal subsidiarity. The company reported that in 2017 more than 247 million payments were processed totaling $75 billion. According to PayPal, Venmo reported nearly $35 billion in transactions in 2017.

“There is consistent consumer awareness and excitement from our credit unions to offer Zelle,” said Michelle Lemieux, senior product manager at CO-OP Financial Services, an early adopter of Zelle for credit union clients.

While Lemieux said CO-OP continues to believe “Zelle adoption rates will flourish, and we are working with many clients and mobile banking providers on integration,” she added that CO-OP cannot share clients’ proprietary user statistics.

P2P landscape

In July, Early Warning Services released the results of its first “Digital Payments Adoption Study,” which surveyed more than 9,000 U.S. consumers from the ages of 18 to 65 who were aware of P2P, own smartphones, and access online or mobile banking.

The study found that 68 percent of millennials and 66 percent of Generation X cited “recommendations from friends and family referrals” as the primary reason for trying a P2P payments service.

“Trust is at the heart of the consumer payment relationship,” noted Ravi Logaanathan, head of business intelligence for Early Warning Services. “Our research showed that new segments of consumers engaged in a P2P payment for the first time because it was offered from their known and trusted mobile banking environment or it came recommended by friends, family or peers.”

The top reasons for use in banking apps over a six-month period were rent, meals, splitting utility bills and gifting, the report noted.

With mobile banking and digital payments on the rise, CO-OP’s Lemieux said consumers “need FIs to provide a convenient alternative to cash and checks” that doesn’t compromise safety or the user experience.

“P2P participation will move to a table stake offering and be an important strategy for remaining relevant and retaining and attracting new members,” said Lemieux.

What a difference a year makes

Zelle adoption rates were not stellar out of the gate. In July 2017, for example,

Nine months later LendEDU released another report, with nearly 30 percent of respondents knowing Zelle. The report poll asked users of both Venmo and Zelle which service was more satisfying. Zelle received 22.41 percent and Venmo received 20.69 percent, 50 percent answered “about the same” and 6.9 percent were unsure.

“As more institutions make Zelle available, we believe the Zelle brand will continue to gain ground, especially since Zelle appeals to demographics beyond the millennials,” said Rusiru Gunasena, Jack Henry & Associates’ director of PayCenter. Like CO-OP Financial Services, Jack Henry & Associates partnered with Zelle in 2017.

“We’ve also seen greater levels of interest about Zelle from credit unions, which have seen the growth and are excited to make Zelle’s P2P functionality available to their members,” said Gunasena.

Jack Henry’s Symitar core credit union data processing system serves 680 credit unions, which includes nearly 40 percent of all U.S. credit unions with assets of $1 billion or greater, explained Gunasena.

“We plan to make Zelle available to all our core credit union customers who are NCUA-insured, which is a Zelle participation requirement,” he said. “We are working with multiple partners in the credit union technology space to ensure the availability of Zelle to all our core customers, regardless of their mobile banking platform.”

Zelle’s meteoric rise

George Kelley, CEO of the Atlanta-based Xtensifi (formerly known as Mobile Strategy Partners), said he has heard credit union executives “groan” about P2P platforms over the last few years. The reason is that these services were seen as competition supported by big banks. While Zelle was initially lumped in with that category, he said, differences emerged.

“Zelle has partnered with many leading credit union service providers to offer pre-integrated solutions. This makes it much less expensive and faster to implement,” said Kelley. “The other benefit is they’ve done a great job marketing it. Credit unions can benefit from that marketing spend as many members will recognize what Zelle is and does, thus increase adoption.”

Calling Zelle’s growth “meteoric,” Kelley expects Zelle to surpass Venmo “in terms of users” by the end of 2018.

“It certainly helps that it’s being offered by the largest banks, the top five of which own more than 40 percent of U.S. deposits. That provided it a great head start,” said Kelley. “Payments solutions are only as good as their network, the vast majority of which are closed loop, so the larger the loop the more successful they can be: adoption begets adoption.”

Security remains an issue

All P2P platforms are built on trust. Industry experts implore that P2P users only engage with known entities. Zelle’s recent rise in popularity has attracted scammers with some users becoming victims of significant fraud.

“Scam artists and fraudsters will take advantage of new platforms. Scams are constantly evolving and Early Warning is aware of how con artists are abusing service terms to solicit payment from consumers,” said CO-OP’s Lemieux. “Protections start with consumer education for using Zelle only for transactions between people you know and trust.”

Lemieux further explained that the “Zelle Common Mobile App” has various levels of validation starting with enrollment and throughout the transaction process.

“The Zelle experience in a partner financial institution’s app comes with the security its member’s already know and trust,” said Lemieux. “CO-OP fraud tools and resources will also be utilized for fraud monitoring and transaction processing.”