ARLINGTON, Va.-It used to be that interest rates drove mortgage volume, yet volume is flat despite very attractive rates.

So what's driving mortgage loans to credit unions right now? Not much-unless you're asking what's driving volume down.

NAFCU's Tun Wai and CUNA Mutual Group's Dave Colby agreed that mortgage volume is being stymied by a number of factors:

• The end of the First-Time Homebuyer Tax Credit.

• Rates have been attractively low for such a long time at this point that most of the people who were in a position to refinance already have done so.

• Refis, long the bread-and-butter of CU real estate lending, have been hung up by depressed housing prices, pushing a lot of people out of the refi market, because the equity just isn't there (ditto for home equity loans and for "move-up" loans).

• A lot of excess inventory from short sales and foreclosures-with still more on the way-is likely to keep housing prices down.

• A big chunk of housing/mortgage demand during the go-go mortgage years came from people with less income or creditworthiness compared with the price of the house they wanted to buy-much stricter secondary market underwriting requirements, as well as more stringent unconventional/non-conforming mortgage underwriting-has been lopped off.

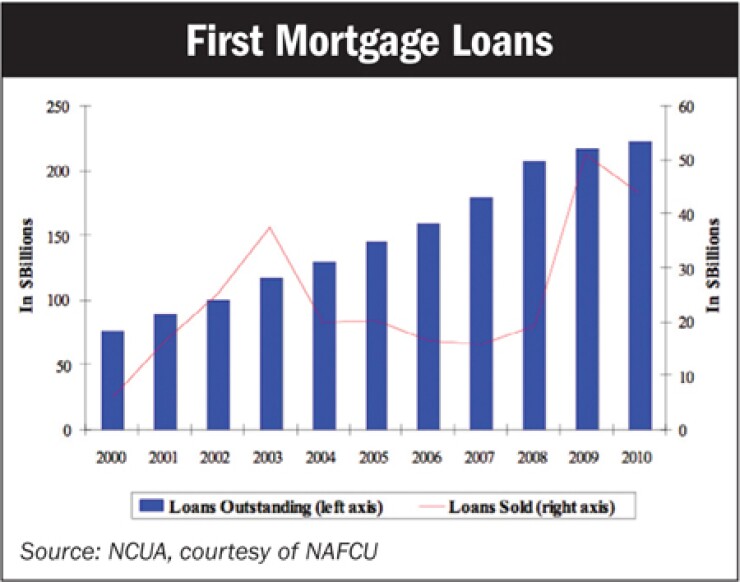

"Credit unions are doing their part, that's what you'll see if you look at some of the numbers," Wai said (see accompanying chart), but obviously it's not that dramatic, as mortgages [overall] were outright flat last year. It's difficult when you have a real estate sector that's just bumping along, at best. Last year we had $1.6 trillion in mortgages [overall]. This year, I'm saying we'll have $1 trillion."

Given the stalemate between banks holding onto short sales and foreclosures in hope of prices rebounding, homeowners being "stuck" in existing homes when they might otherwise upgrade to bigger homes if they had more equity, and would-be homeowners not having the cash and/or stability to qualify under the stricter underwriting, the questions become: what is finally going to make one of these things move, and when will it finally happen?

"Right now, I think the income side, the jobs side, is more important than the price side," said Tun Wai of NAFCU. "People have to rebuild their net worth. For that to happen, we need jobs creation and an expansion of income. It's going to take 10 years (from the bust in 2007) for housing to come back."

CUNA Mutual Group's Dave Colby agreed this isn't going to happen overnight, despite some of the really good recovery indicators in other aspects of the economy. "Assuming there are no other shocks in the meantime, I anticipate we won't see housing prices hit bottom until the fourth quarter of this year, and while that's not that far away, I think they're going to languish there for a while," he said. "It's going to take a long time to clear the market."