WASHINGTON — A major source of credit union revenue could take a hit from a new bill before Congress.

Two Democratic senators are introducing legislation that would ban overdraft fees on debit card transactions and ATM withdrawals.

The bill, sponsored by Sens. Cory Booker, D-N.J., and Sherrod Brown, D-Ohio, would also require financial institutions to post transactions in a manner that minimizes overdraft and insufficient fund fees.

“Overdraft fees are a tax on paychecks already stretched thin,” Brown, the top Democrat on the Senate Banking Committee, said in a press release. “This bill keeps hardworking Americans’ money in their pockets and stops big banks from slapping big fees on customers for small overdraft amounts.”

The senators’ move comes in the wake of a

In 2010, the Federal Reserve required that consumers affirmatively opt in to overdraft services. But the senators cited a Pew Charitable Trusts study that said 52 percent of people who overdrew their checking accounts and paid a fee in the past year could not recall consenting to the service. Along those same lines, Chicago-based Alliant CU was

In addition to prohibiting overdraft fees on debit card and ATM withdrawals, the bill would also stop banks and credit unions from charging more than one overdraft fee per month and no more than six overdraft fees in any single calendar year for check and recurring-bill-payment overdrafts.

The bill would also mandate a three-day waiting period between when an individual opens a new account and when a financial institution may offer overdraft protection.

“These fees generate enormous amounts of revenue for the banks while most customers don’t even know they’ve opted into such charges,” Booker said. “Worse yet, overdraft fees fall on those least likely to be able to afford them — individuals for whom a $35 overdraft charge could push them over the brink into financial ruin.”

But some banking groups say consumers are sufficiently aware of the overdraft fee process.

"Overdraft protection is optional and requires the consumer to proactively opt-in,” said Richard Hunt, chief executive officer of the Consumer Bankers Association, in a statement. “According to research, customers using the service reported a clear understanding of the process.”

Credit union trade groups are also speaking out against the proposed law.

“We are highly skeptical that any legislation on this topic is necessary,” said Ryan Donovan, chief advocacy officer with the Credit Union National Association.” Credit unions offer overdraft protection services as a convenience and accommodation for their members and credit union members appreciate these services. In fact, [Consumer Financial Protection Bureau] data suggests that consumers remain highly satisfied with overdraft products, as indicated by the low number of consumer complaints about overdraft. Further, the [CFPB], under [former] Director [Richard] Cordray’s leadership, placed new overdraft regulations at a very low priority because the current regulatory regime is working. We urge Congress to make it easier – not more difficult – for consumers to enjoy safe and affordable financial services provided by credit unions.”

Carrie Hunt, EVP of government affairs and general counsel at the National Association of Federally-Insured Credit Unions, said CUs "actively seek ways to provide their members with needed products and services, and overdraft protections are one option consumers may choose from to help meet their needs. Before credit unions are able to provide their members with overdraft protections, the consumer must knowingly and willingly request the service on their own accord as required by law.”

Mike Moebs, an economist, credit union expert and principal of Lake Bluff, Ill.-based Moebs $ervices, said Booker and Brown's bill will likely hurt the very consumers it is intended to protect, driving more consumers to predatory payday lenders.

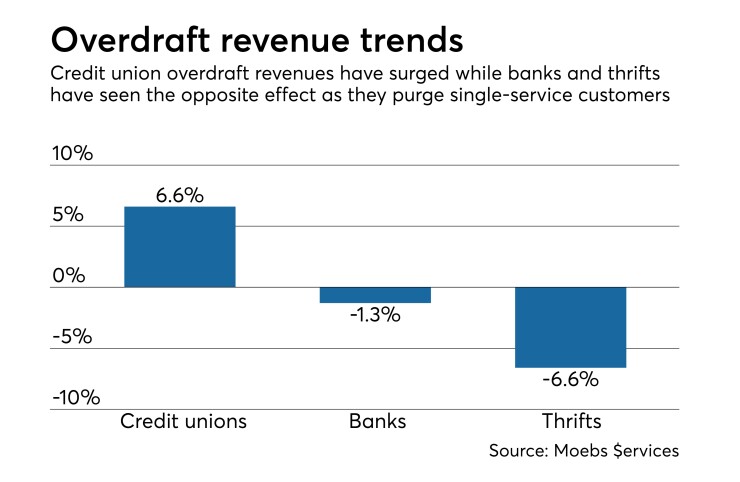

Citing internal data and information from the Federal Reserve, Moebs pointed out that 3,700 financial institutions saw $33. billion in overdraft revenue for the 12 months that ended March 31, 2018, including more than 1.1 billion overdraft transactions.

“Overdrafts, especially for the middle class in the past 10 years, has become an important financial tool to help through difficult economic times,” Moebs told Credit Union Journal via email.

“This legislation will put thousands of depository people out of work, and force millions of consumers to seek financial assistance from outfits which will charge more than banks, thrifts and credit unions,” he added. “If legislation is needed, a bill making information to the consumer users and depositories themselves simpler and much more available is all that is necessary."