MADISON, Wis. — When it comes to private student loans, the growing success of Internet-driven lending models that can offer lower rates has caught the attention of some credit unions executives.

Entering the market, however, requires more than tossing the proverbial hat in the ring.

"There are specific and unique aspects to student lending such as how to service them and how to underwrite them," said Summit Credit Union Chief Lending Officer Dan Milbrandt. "Rather than reinvent the wheel ourselves, we looked for options."

With higher education costs continuing to rise sharply, many CU members — especially Millennials — are in need of student loans.

"There is a big gap with students and financing," said Milbrandt. "We want to keep them with a trusted partner."

There is good reason $2 billion Summit began looking for options last year. NCUA began collecting Call Report data on personal student loans (PSLs) in 2011. At the time, PSLs within the credit union industry amounted to $1.5 billion. Two years later, NCUA reported that number increased to $2 billion.

And as of September 2014, 666 credit unions, with a median asset size of roughly $144 million, reported offering students loans.

"The NCUA is concerned about credit unions jumping in too fast and not knowing that they are doing, which is why we have been very strategic about our goals and how we go about it," Milbrandt noted.

Searching for a Lending Solution

With the success of peer-to-peer (P2P) lending models like the Lending Club, there has been a growing awareness in the industry that web-driven lending models is the future for credit unions of all asset classes.

"Credit unions have noticed with the Lending Club IPO that they have to turn around and participate in the online market place," said LendKey CEO Vince Passione. "It would be a shame for a consumer not to find a credit union loan is this world of online lending."

LendKey, a cloud-based lending technology company, was formerly known as Fynanz. Initially its direct competitor was the Lending Club. However, last year the company changed its focus to institutional lending.

Currently LendKey has roughly 300 credit unions clients along with a handful of community banks. The total loans administered to date, which include an even split between private/federal and refinanced/ consolidated loans, is more than $700 million.

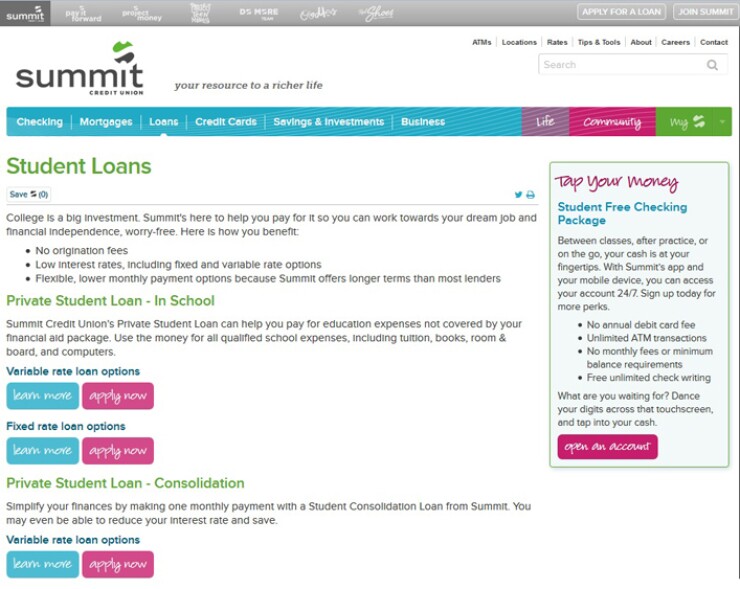

While Summit previously offered online lending solutions such as auto and mortgage loans to its 135,000 members, it didn't offer private student loans. Last May the CU signed with LendKey and now has over $1 million of private student loans on the books.

"We brought LendKey in to fill an existing lending gap we had with our membership," said Milbrandt. "They have given us the technical expertise and the member still gets to work with the local trusted institution."

While Summit conducted a lengthy due diligence process before signing with LendKey, the technical transition of the cloud-based solution was rather effortless, noted Milbrandt. "It's a self-contained web presence."

The Key to Lending

With roughly 380 employees, 80 to 100 of the CU's employees are involved in some form of the overall lending application and approval process. Milbrandt noted that the virtual ease-of-use LendKey solution hasn't required extra hands on deck.

"The applications go through the same application process," he said.

Passione explained that after signing the contract, credit unions should expect six to eight weeks before the solution is live. Both custom solutions (branded to the CU) and off-the-shelf platforms are available. The former is more time consuming.

Approximately 100 CU clients have joined LendKey's network, cuStudentLoans, which provides common underwriting criteria. "The rest are custom programs. Credit unions choose which one they want, typically the small credit unions join the network," Passione noted.

Once operational, the turnaround on loan reviews is comparably faster to traditional paper-based systems. Whereas decisions used to take weeks or longer, members can complete the loan and upload documentation with their smartphone, PC or tablet and potentially have that loan fulfilled in record time.

"Rendering an instant decision is required to compete today in this world of online ending," said Passione. And while rates given are unique to the applicant's credit history, the interest rate savings can be significant.

"The average coupon to the consumer on the in-school product is roughly 5 to 5.5 % and the consolidation loan is tracking closer to 5%," said Passione. "We believe refinance students are receiving a 2 to 2.5% reduction."

Student Loan Portfolios Rising

Summit CU's website now features a LendKey developed link that brings members to an online lending application. Milbrandt said that member applications, once in the queue, can be turned around in 10 to 30 minutes.

"Approval is important but funding is the key element," said Milbrandt. "You can have it approved but you don't necessarily want to fund the student loan until you have confirmation that that student is at school. This is another aspect of LendKey solution and they do it really well."

Milbrandt couldn't provide metrics on loan percentage rates, but said LendKey has allowed the CU to be more competitive and offer better rates to those who qualify.

"We want to set rates that are fair and reasonable to both parties, but we can't give away the store," he said. "It's a balancing act but we have a good, effective and valuable program for our members."

Since rolling out the solution last summer, Summit has not invested in a marketing campaign. Milbrandt said the idea was to take a measured approach to the solution and determine how it integrated with the CU's operating system and how members responded.

"Our goal was to be at $1 million in loans by end of May 2015, but we are already over that number," said Milbrandt. "It's a small number in relation to our asset size but we want to grow slowly and strategically. Once we have experience with the product, over the next year or two, we will push a little harder."