Just in time for Valentine’s Day, credit unions are sounding the alarm about a fraud risk that carries high costs but often flies under the radar.

A growing number of financial institutions and other organizations are warning consumers about romance scams, in which victims are duped by someone they met online who pretends to care for them in order to get money from them. These scams are closely related to catfishing, which is defined as “luring a person into a relationship through a fictional online persona.” That fraud technique widely entered the public consciousness in 2013 after University of Notre Dame linebacker Manti Te’o revealed he’d been the victim of an online hoax involving a fake girlfriend.

“This is about manipulating people’s emotions and feelings to steal their money, and the romance scam is targeting a very specific group of people, and unfortunately it’s not age- or race- or gender-specific,” said Joe Nowland, CEO of Jax Federal Credit Union in Jacksonville, Fla. “It’s targeting folks that are lonely and manipulating their emotions to take as much money from them as possible.”

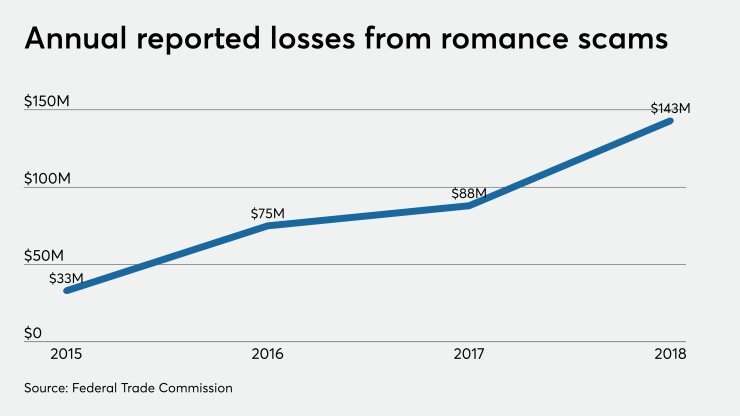

A 2019 study from the Federal Trade Commission shows consumer losses due to romance scams rose by more than 300% between 2015 and 2018, from $33 million to $143 million.

“It’s one of those things people don’t talk about because it’s embarrassing,” added Nowland. “They say it’s $143 million in 2018 [but] that number is substantially higher because it doesn’t account for the folks that aren’t talking about it because they’re embarrassed or scared or don’t know where to go.”

What’s more, the median reported loss for these scams runs about $2,600 – roughly seven times higher than any other type of fraud, according to the FTC. But average losses increase as victims age, with consumers between 40 and 69 years old losing twice as much as those in their twenties, while those 70 and older reported median individual losses of $10,000.

What makes these scams especially onerous, sources said, is that unlike card fraud where unauthorized charges can be returned, romance scammers tend to deal in cash, gift cards, wires or even gaining access to the member’s entire account. So when the money is gone, it’s gone for good.

“We’ve seen losses greater than [the median] and it’s very sad, because it’s very difficult if not impossible to recover any of those funds,” said Janelle Merritt, VP of community partnerships at America 1 Credit Union in Jackson, Mich. “You’re in a situation where by the time you realize what has happened, the money is gone and there’s nothing you can do.”

Credit union sources consulted for this story said they have seen an increase in these scams in recent years that mirrors what the FTC reported, including upticks both in frequency and losses. Jason Swoboda, AVP of fraud, compliance and epayments at A+ FCU in Austin, Texas, said it’s not uncommon to see these types of scams as often as once a week.

Swoboda said the victims A+ sees tend to be educated single women over the age of 50 who are very computer literate. While men are also prey to these scams, Swoboda said his credit union sees a higher percentage targeting females.

“The myth is it’s people who are uneducated, just home all day [and] really lonely, and the truth of the matter is it’s often educated people that are just like you and me, but the scammers are very, very good at what they do,” said Merritt. “We’re trying to get the word out that that’s the case so we can take out the embarrassment for people if this does happen so they know they’re not the only one this is happening to. There are places to turn and ways to protect themselves [and] the sooner you admit it, catch it and shut it down, the better. It’s not just people who don’t know any better falling prey to these scams.”

'We're in a unique role to help'

Online dating has existed for over two decades, but the stigma has decreased in recent years as the number of outlets has risen. Whereas Match.com and Eharmony.com dominated the field in the early days, today’s landscape also includes such as Tinder and more specific services like Jdate, OurTime, Farmers Only and others.

A recent study from the Pew Research Center found

Many credit unions have begun posting information on their websites about red flags to watch for that could indicate a romance scam, and sources said staff training to maximize communication with members is key. That ensures front-line staff can ask questions about abnormal transaction patterns, requests for unusually high amounts of gift cards or wire transfers, and more.

“We’re in a unique role to help,” said Jody Ledgerwood, marketing manager at Hoosier Hills CU in Bedford, Ind. “For those who may have concerns, we are well poised as a partner because … we don’t have that emotional blindspot or the emotional bias. We can take a look at the patterns and situations and help them come to terms with what’s going on.”

While recoveries do occasionally happen, the more likely outcome is helping members understand what’s happening and putting a stop to it before things get any worse.

And when that happens, the scammer is often gone quickly and on to the next target.

“Oftentimes the person is no longer there – there’s no one to recover the money from,” said Ledgerwood.