This story is part of an ongoing series about the outlook for the second half of the year. Look for more coverage throughout the month of June.

Credit unions need to keep an eye on the numerous changes happening in the payments space in the second half of 2019.

More contactless cards are expected to be issued while the consolidation of payments companies is likely to continue. Payments companies are also fighting a different type of fraud and looking to revamp rewards programs to ensure more member loyalty.

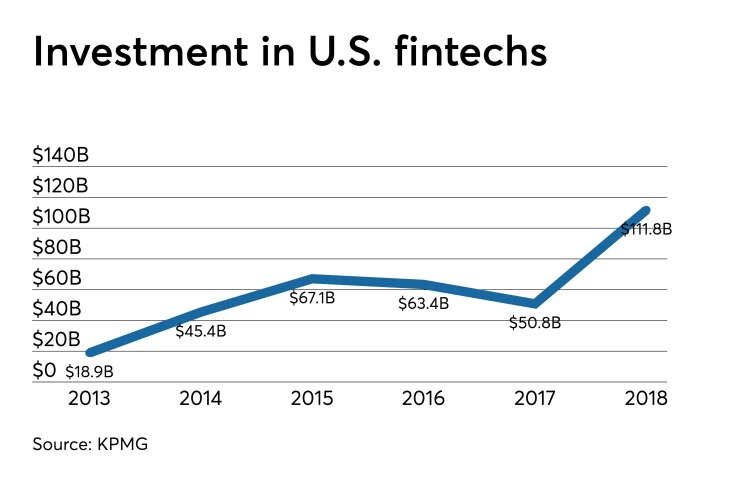

“Debit cards and credit cards do not stand alone. They are part of an ecosystem. … There is a ton of money coming into the payments space,” said Todd Clark, president and CEO of CO-OP in Rancho Cucamonga, Calif. “The amount of money invested in fintechs doubled from 2017 to 2018, which makes us feel good about being in this business.”

Credit cards remain the “most important device” in payments, said Chuck Fagan, president and CEO of PSCU in St. Petersburg, Fla. Because of that, loyalty programs are still an “important tool” that drive utilization of cards by members, he added.

Reward programs have been around for 30 years, but are due for changes, said Lou Grilli, AVP product development and thought leadership at Trellance, a Tampa-based CUSO offering card portfolio solutions.

Card rewards typically offer points based on purchases, sometimes varying by merchant category code.

“But points for purchases do not drive loyalty to the credit union. It drives top-of-wallet, temporarily, until the next better rewards card comes along,” Grilli asserted.

Rather than focusing on spending, Grilli argued that credit unions should reward their most valuable members, or MVMs. He said a loyalty program should identify and reward existing MVMs and encourage others to use the credit unions’ card more.

“An MVM program is based on the premise that MVMs are your most profitable members, so reward them, and convert more members to become MVMs,” Grilli said. “You have to look at the total relationship the credit union has with the member, all accounts, loans and products, and then reward the MVM.”

However, structuring a program this way can be difficult. Grilli said loan origination systems often do not integrate with the core processor, and the credit card processor does not touch a CU’s core.

“Unless you have everything with one vendor, such as Jack Henry, which integrates, it is difficult to identify the MVMs,” he said. “You need a data analytics platform that is sitting in the middle, allowing it to collect data from multiple places.”

Will economic downturn affect spending?

In December, CO-OP’s Clark predicted mid- to high-single-digit growth for both credit and debit card usage in the year ahead. He said June data shows his forecast will be in the low end of that range.

“Part of that is the government shutdown and bad weather earlier this year, but we are not really sure why card usage was lighter than expected,” he said. “We are expecting lower gas prices to spur some summer travel, but it would take quite a bit of change to reach the top end of the range.”

There are concerns that the economy could be headed toward a recession. The Labor Department released its latest jobs report on Friday, which showed the economy added 75,000 jobs in May, far below the 224,000 jobs added in April. The unemployment rate remained the same at 3.6%.

But Clark and Fagan haven’t seen any big pullback in consumer spending. Consumers may eventually spend less in areas such as experiences or trips, Fagan added. There has also been a “modest uptick” in delinquencies in PSCU’s collections business, Fagan said.

“I have heard talk of reaching the end of the credit expansion cycle, but I also have heard the possibility of rate reduction from the Fed, which could extend the cycle,” Clark said. “Once you see an expansion last for so many years you expect a pullback at some point.”

Contactless cards continue to gain in popularity

“The lower price for plastic is making contactless cards more attractive for credit unions to get into the market,” Clark assessed. “For the first time, we are seeing feedback that contactless is generating net new transactions.”

The New York City transit system now allows riders to “tap” in the turnstiles, which opens a major new market, Fagan said. Originally, PSCU’s Fagan projected that 65% of U.S. terminals would be enabled for contactless payment by the end of 2019 but he now predicts that number to be a bit higher.

“Some merchants had pushed back, including Target, but now they are coming along to the realization that tap and go is what consumers want,” he added.

Fraud and consolidation

Fagan said a focus on security is “always out in front” in the payments space, and criminals have shifted from card not present fraud from counterfeit cards. As such, there are different approval rates for in-store usage versus card not present.

PSCU is investing in robotics, artificial intelligence and machine learning to combat these issues.

“We are learning how to use data to improve card not present approval rates,” Fagan said. “As the intelligence comes in, the ability to respond is critical. We need to see that a particular credit union is being attacked, or that a particular transaction is being attacked, and then we need to respond.”

Consolidation of payments companies is another big trend to watch. Recent deals include

“Consolidation shows the need for scale, and that payments are going to be a very important component of financial institutions going forward,” Fagan declared.