-

-

Incumbents have access to tons of information on consumers, but developing the means to analyze and act on it requires a strategic change, says Icon Solutions' Simon Wilson.

April 30 Icon Solutions

Icon Solutions -

After digging deep into member data, Randolph-Brooks FCU in Texas developed a marketing campaign aimed at persuading JPMorgan Chase clients to switch to the credit union's own card. It's an effort its peers could imitate.

March 15 -

Technology is helping some institutions find new growth opportunities as lending contracts, but many CUs also were able to use data to assist members during the early days of the pandemic.

March 4 -

By gathering pools of customer data ahead of the shopping surge, retailers can capitalize on the increase in shoppers by identifying the right customers and making every engagement count, says Tealium's Sav Khetan.

November 24 Tealium

Tealium -

Consumers are right to worry about data mismanagement. But there are ways to benefit from analytics while respecting privacy, says Cape Privacy's Ché Wijesinghe.

August 18Cape Privacy -

Big data graph analytics allow you to “drill down” into complex interrelationships among organizations, people and transactions, says TigerGraph's Todd Blaschka.

March 18 TigerGraph

TigerGraph -

The payments company is working with nonprofit organizations, law enforcement authorities, victims and others to make it harder for the criminals behind the modern slave trade to move money.

February 6 -

The payments company is working with nonprofit organizations, law enforcement authorities, victims and others to make it harder for the criminals behind the modern slave trade to move money.

February 5 -

As lending slows, new tools could help credit unions expand opportunities to make loans to would-be borrowers they might not otherwise consider.

January 21Experian -

Most banks already have the means to communicate directly with customers, in the form of a mobile banking app or email. It’s just a matter of putting those channels to good use. Targeted discounts and perks reduce shopping costs, and therefore customers’ stress, says Flybits' Justine Melman.

January 7 Flybits

Flybits -

The payments company has loaned $5.5 billion to 275,000 small businesses, thanks to a data-driven process free from human interaction.

November 22 -

Credit unions are slowly embracing the impact data analytics can have on the bottom line, but experts say goal-setting and measurable achievements must also be a part of the process.

July 17 -

Credit unions have not invested enough in analytics. But changing that would help the industry compete with big banks and improve efficiencies.

June 20 Superior Data Strategies

Superior Data Strategies -

The payments space is expected to see continued consolidation, new fraud patterns and more contactless cards for the second half of 2019.

June 10 -

OnApproach was launched in 2005, while Trellance was launched just two years ago as a division of CSCU

February 11 -

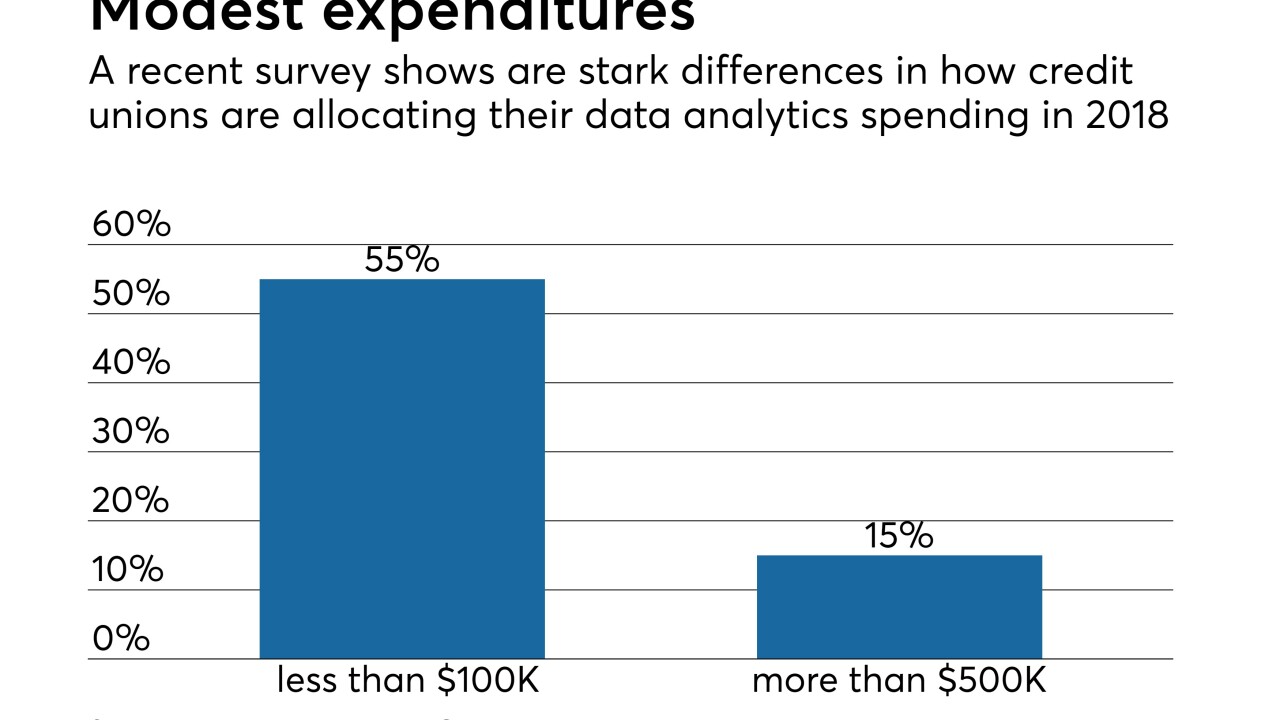

A recent report from Best Innovation Group reveals a significant number of credit unions don't have a data analytics plan, and many that do are putting off spending money on it.

November 8 -

Trellance has acquired IronSafe, which provides data analytics to more than 2,300 credit unions.

October 2 -

Two of the credit union movement's biggest names are teaming up to help CUs better tackle big data.

September 13 -

Rather than ban screen scraping, financial institutions should improve secure account connectivity so that consumers can share data with the apps they want to use.

July 24 Quovo

Quovo