‘Tis the season for office holiday parties, where the mixture of alcohol and interacting with colleagues in much different environs can lead to problems. Add in the current media focus on sexual harassment, and now is a good time for credit unions to review their policies and procedures.

Because one of the problems is the older and staler such policies and procedures are, the greater the danger that no one is really paying attention to them.

Robert Farmer, senior vice president of human resources at Missoula Federal Credit Union, a $499 million institution based in Missoula, Mont., said that his credit union has had a policy on sexual harassment “for decades” and that he has seen all kinds of situations during his tenure.

However, Farmer noted that no matter how firmly in place a company’s sexual harassment policies are, if they are not enforced, they mean nothing. Look no further than the Matt Lauer case at NBC, he said.

“I find it hard to believe that a corporation like NBC did not have a pretty solid policy on sexual harassment in place,” Farmer suggested. “But if Lauer was able to behave so badly for so long, what good are these policies?”

Indeed, according to media reports, Lauer’s predatory behavior at NBC was widely known by his colleagues and bosses, but nothing was done until now that the media spotlight is shining so brightly on this issue.

To avoid this from happening at your credit union, Farmer noted, “regardless of the status of the alleged offender and the alleged victim, you need to look at all parties as equals,” he said. “Everyone should be able to go to work without the fear of being harassed. And everyone should believe that their claim will be taken seriously and investigated properly.”

John Bagyi, a management-side labor and employment attorney at Bond, Schoeneck & King of Albany, N.Y., trains executives on sexual harassment issues and has frequently spoken at seminars held by the New York Credit Union Association. While his experience has been that sexual harassment is less prevalent at credit unions for a variety of reasons, they are not immune to this problem.

The key, he said, is creating a culture that not only holds top executives to high standards of personal behavior but also where employees feel empowered to report any incidents of inappropriate behavior. Where it is sometimes trickier, Bagyi said, is smaller credit unions that don’t have a human resources department.

Molly Schmidt, manager of human resources at Veridian Credit Union, a $3.4 billion institution based in Waterloo, Iowa, said that recent reports in the media have “provided a good opportunity” to remind employees of Veridian’s zero-tolerance sexual harassment policy and mandatory annual training. Beyond those reminders, however, she added that there “haven’t been any major shifts” in procedures or policies at the credit union.

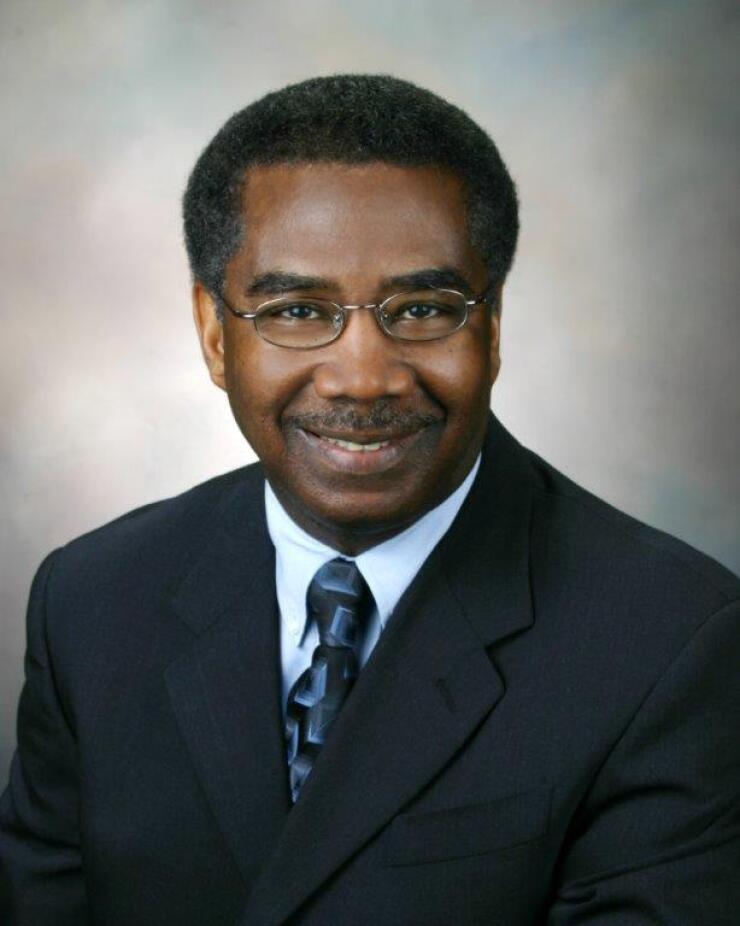

Robert L. Davis, chief human resources officer at Vystar Credit Union, a $6.9 billion institution based in Jacksonville, Fla., said sexual harassment is not a big problem at credit unions because they already abide by strict EEOC and federal guidelines, and they also must comply with NCUA and State Auditors’ directives governing both harassment and discrimination.

“Sexual harassment policies are fairly boilerplate at most credit unions, but most add their own ‘good business practices’ to these existing guidelines,” he said.

But even with the best policies in place, and even when there is a culture of enforcing those policies, there is still another challenge facing credit unions: defining “inappropriate.”

It’s easy when the behavior is so egregious as to be criminal, such as sexual assault and rape — but not so easy when it’s a joke that shouldn’t have been told, for example.

“Inappropriate behavior does not necessarily mean sexual assault or even physical contact,” Farmer said. “Harassment can be something as seemingly mundane as compliments or asking someone out on a date. It depends on the context. People can get in trouble for things far less in scale than what Weinstein and Lauer have allegedly done. If the behavior is unwanted, it should stop. Even if it’s an inappropriate comment or joke.”

Sometimes the bigger issue isn’t the nature of the jokes or comments—but the frequency of them. It is these types of cases, rather than those involving actual assault, that are more likely to plague a credit union, Bagyi said.

"I would say that the vast majority of sexual harassment cases I have seen at credit unions involve workers or even members who engage in bad behavior that is pervasive -- not necessarily severe," he said. "However, we have also noticed that most harassers are serial harassers. Thus, these are usually not isolated incidents -- and, as they accumulate, they can create a very hostile and unpleasant workspace environment."

With holiday party season already in swing, some credit unions may want to rethink what will be on tap — literally.

“Many credit unions are like VyStar and have had longstanding policies where they do not allow alcohol to be served at company events,” Davis noted. “They value their employees and would not want to contribute to anything that would lead to unsafe or uncomfortable conditions.”