As credit unions battle for the best employees, the location of their headquarters can make a big difference.

Credit unions have a variety of reasons to move their headquarters, such as accommodating a larger workforce, moving to a more convenient location or revitalizing a depressed area. But when making such a move, selecting the right location can be critical in attracting new talent, experts said.

Corporate headquarter relocations are “on the rise, particularly driven by the focus on workforce and talent attraction,” said Leslie Wagner, director of project management and development at Ginovus, a provider of location modeling, site selection and economic development incentive procurement. “Workers want to be in interesting, communal environments, with easy access and rich with amenities.”

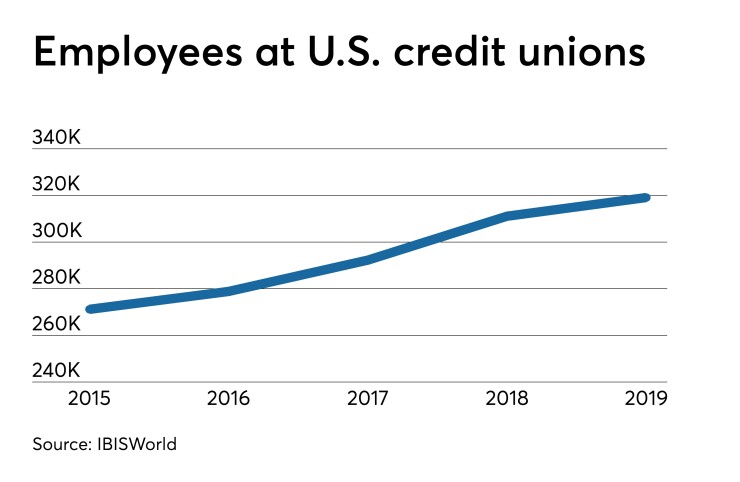

The unemployment rate was 3.7% in June, down from 4% a year earlier, according to the Bureau of Labor Statistics. At the same time, credit unions are hiring more employees. This year the industry employs over 319,000 people, up more than 2% from 2018, according to data from IBISWorld.

Some credit unions, including the $4.2 billion-asset Landmark Credit Union, are moving into a new headquarters because they are growing. But at the same time, management is using the opportunity to update their office to make it more attractive to employees.

The New Berlin, Wis.-based Landmark will likely begin construction on a new 158,000-square-foot building in Brookfield, Wis., later this year. The office will offer a “modern workspace that promotes collaboration and is expandable to meet the credit union’s future needs,” said President and CEO Jay Magulski.

Employees are looking to work for companies that provide office spaces that are more open, promote social interaction and express the culture of the employer, said Paul Seibert, owner of Paul Seibert Consulting, which provides architectural, design and business planning to banks and credit unions. All of this is influencing headquarters spaces that are being built or renovated.

“What kind of office space are you creating for employees?” Seibert asked. “Is it an old office space where no one can see each other because they are stuck behind cubicles? Or is it a space that they can see themselves working there for 10 to 15 years?”

Employees today are looking to work in areas that are easily accessible by different modes of transportation and have amenities, such as restaurants for lunch within walking distance of their offices. Moving a headquarters to such an area can be a big draw in hiring and retaining talent, experts said.

“You need dozens upon dozens of staffers, CPAs, attorneys,” said Steven Reider, president of the consulting firm Bancography. “People want to work in places with amenities where they can walk to lunch nearby and have a gym nearby. They want to avail themselves to all the city has to offer.”

This may mean moving a headquarters to more of a downtown location.

Being in the “heart of the city” and to “become closer to the Memphis community” partly inspired the $868 million-asset Orion Federal Credit Union to move its corporate headquarters in early June from the suburbs into a former Wonder Bread bakery building in the Edge District of the city, said CEO Daniel Weickenand. The Edge District is located between the city’s busy Medical District and Downtown, making it strategically attractive.

However, Orion’s desire to be in this location went beyond that. It selected the building, which had been unoccupied since 2012, in order to revitalize the neighborhood and spur commercial growth, Weickenand said.

Since the credit union announced its move in 2017, a number of other companies – including a greeting cards and stationery design studio, a branding agency and an event planning firm – have set up shop in the area. There are plans for other expansion, including a proposed $950 million mixed-use development.

Weickenand said the Wonder Bread structure was not torn down but was renovated since it was a well-known sight in Memphis. Turning the abandoned factory into its new headquarters in a distressed neighborhood is seen as a way to help end long-term blight and encourage economic development in Memphis.

Numerous downtown areas are currently being redeveloped as more residents forego living in the suburbs and move back into city centers. These areas generally have good access to public transportation, infrastructure already in place and historical elements that add character and are appealing to workers, Seibert said.

But credit unions wanting to move into redeveloping areas need to be aware of some pitfalls. For one, if an institution wants to buy and renovate an older building or factory, it needs to do thorough due diligence to fully understand the cost of the upgrades, Seibert said.

There is also a concern about being considered part of gentrification, which sometimes comes with a negative connotation. Credit unions can avoid that stigma by partnering with local organizations that provide low-cost housing and engaging in other charity work, Seibert added.

The industry’s not-for-profit status can also help mitigate the public's perception of gentrification, Reider said.

“Credit unions are often providing services to those in lower income brackets who have less ability to obtain credit in a traditional environment,” Reider said. “Moving into a redeveloping area aligns perfectly with that.”

While

That should help the $39 million-asset credit union to “concentrate on the neighborhoods and where our members live” and fits with its overall business plan, Mcdad added. It offers programs such as Refi My Ride, where they refinance auto loans from predatory lenders at one half of the rate consumers are currently paying, and MyPayToday, an alternative to payday loans.

“We choose this location specifically because it has high potential for growth,” Mcdad said. “We hope that we can be a force for revitalization in this neighborhood by partnering with other organizations and residents who are already there. We want to give Detroit’s residents more access to services, not push them out.”