The Consumer Financial Protection Bureau's complex payday lending proposal is sparking concerns that state legislatures will try to repeal existing usury laws and allow a parade of pro-payday-lending bills to move forward.

The bureau's proposal, released last week, includes what consumer advocates are calling "loopholes" that would still allow lenders to charge triple-digit annual percentage rates for some long-term loans. As a result, many see payday lenders as likely to shift their policies from short to longer-term credit, while still charging high rates.

At the same time, however, consumer advocates fear that the payday lending industry will use the CFPB's proposal as cover to rollback protections in states that ban or restrict such loans, arguing the agency has given the business its stamp of approval.

"The payday lenders are using the CFPB's proposal as a Trojan Horse to bring payday loans into states like Pennsylvania by saying the CFPB has approved this kind of product," Kerry Smith, a staff attorney at Community Legal Services of Philadelphia, said during a public hearing on the plan in Kansas City last week.

There are 36 states that allow payday lending, with the 14 others, such as Pennsylvania and New York, either banning the product or setting such low interest rate caps that it's difficult for lenders to operate profitably.

"Every year, states like Pennsylvania have to fight back against payday lenders that draft bills claiming they are bringing 'a responsible product in,'" Smith said, "when what they're trying to do is legalize high-cost payday loans."

Michael Wishnow, senior vice president of marketing and communications at the Pennsylvania Credit Union Association (PCUA) mentioned the difficulty in reviewing more than 1,000 pages of regulations, especially for smaller credit unions without a dedicated staff.

"Our legal team and compliance team are looking at [the proposal] pretty closely," Wishnow said. "At first blush it looks like it will accommodate our credit unions' Better Choice program, which was our concern."

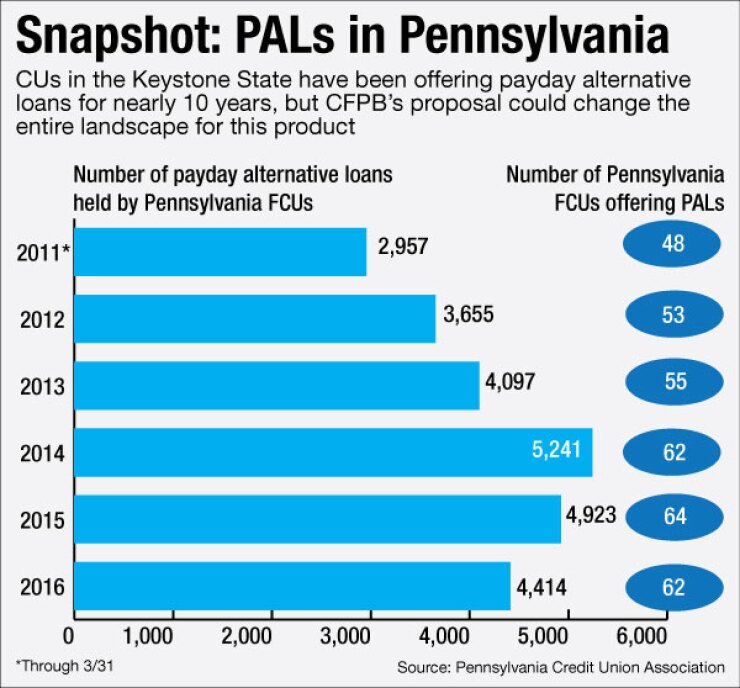

Pennsylvania credit unions have been offering small-dollar loans to help members in need for nearly a decade, according to Wishnow. Around 70 CUs in the state offer a form of the state's Better Choice program. The program was created by the state Treasury Department and the PCUA to help Pennsylvanians avoid payday lenders.

Better Choice "is unique because it is designed to wean people off of payday lending products," Wishnow said, adding that the program also requires a savings and financial counseling component. "When you get to payday lenders, check cashers, pawn brokers – they are pretty much enriching themselves without improving the financial lot of their customer."

Consumer Advocates Weigh In

Consumer advocates fear the CFPB plan effectively legitimizes the product, while not doing enough to make it more affordable. They point to a recent memo circulated by Pennsylvania State Sen. John Yudichak, which cited the bureau's proposal as a model for new legislation.

"Under my legislation, we will follow the proposals set forth by the CFPB and implement strong guidelines for the lending industry in Pennsylvania," Yudichak wrote.

The memo outlined a loan with a minimum term of one year, no rollovers or balloon payments and an annual interest rate cap of 36%.

But Mike Roles, a field organizer for the Pennsylvania Public Interest Research Group, said that a 36% interest rate cap would roll back the state's current 24% APR cap.

"By putting in a cap of 36% interest, but no cap on fees, it would be the equivalent of a loan with 300% or 400% APR," Roles said.

Andy Morrison, a campaign coordinator at the New Economy Project, said New York's check-cashing industry is making a push to offer payday loans. The CFPB's proposal "allows for high-cost predatory loans without underwriting, so we're being vigilant about protecting our usury cap," he said.

Like the PCUA, the New York Credit Union Association is also in the process of evaluating and assessing the impact of the CFPB's proposal in the Empire State, Ron Mclean, NYCUA's chief engagement officer, said in an email.

The CFPB is prohibited by law from setting a rate cap on short-term, small-dollar loans, and some of proposal's complexity appears to be an effort to work around that restriction while still protecting consumers from abusive practices. The proposal is the first the agency has brought under its authority to define unfair, deceptive or abusive acts or practices.

Still, some said the proposal would have far-reaching consequences, including making it difficult for payday or auto title lenders to originate short-term products.

Most payday lenders "will be driven into installment lending," said Andy Arculin, of counsel at the law firm Venable and a former senior counsel in the CFPB's Office of Regulations.

The agency was not trying to kill the product overall, however, he said.

"They've identified several harms, one of which is direct account access … and another is the automatic rollovers for these short-term loans and they want the market to go toward different types of installment loans," Arculin said.

CFPB Director Richard Cordray said that payday and single-payment auto title loans depend heavily on repeat borrowing by consumers.

"The business model depends primarily on access to a borrower's account or auto title, which provides the lender with the necessary leverage to extract payments even when the borrower cannot afford them," Cordray said during the hearing. "Based on our research and what we hear around the country, we believe the harm done to consumers by these business models needs to be addressed."

Many in the industry expect a payday lender will sue the agency over the plan. There is 90-day comment period for the proposal with a final rule expected next year.

- Eric Guldenstern contributed reporting to this article.