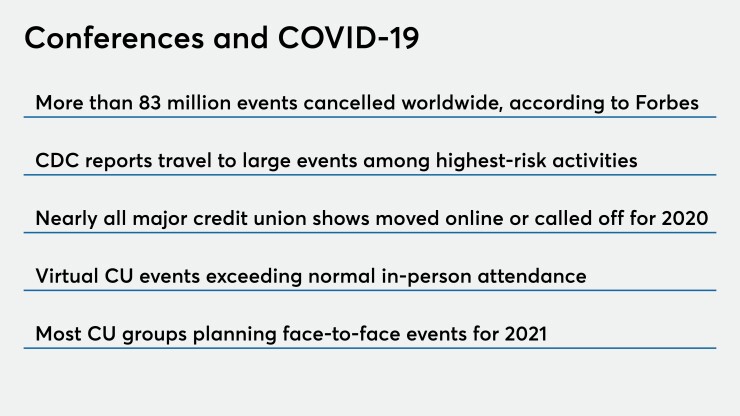

Credit union conferences have a different feel this year as industry events go virtual due to the coronavirus.

The bigger question, however, is whether some of those changes will last beyond 2020.

“I’m not totally convinced the virtual conferences attract enough attention,” said Jason Lindstrom, CEO of Evergreen Credit Union in Portland, Maine, and chair of the CUNA Marketing & Business Development Council. “People look at the opportunity to go somewhere and the opportunity to see friends and people from across the industry. Whereas, virtually, you go online and you don’t have that, you’re just seeing the speaker and it’s just four hours long. I’m not looking to take up my day with four hours, even if it’s free.”

Vendors and trade associations from across the credit union space have already begun rolling out virtual events, with PSCU’s 2020 Member Forum

About 1,300 people have registered for the NAFCU event, which is slightly more than the group would normally see at its annual summer conference, which was scheduled for late July in Vancouver but was

“We understand that for the people who are attending, it’s not a normal situation for them,” said Anthony Demangone, chief operating officer at NAFCU. “They may be working from home and a lot of men and women have other stuff on their plate — it could be child care and looking after their children while trying to lead their credit union. Some of this information is probably going to be consumed on demand later. I don’t think anyone wants to sit in super, super long sessions. I think you’ll find the sessions themselves are a little shorter and punchier.”

Keeping it short and sweet is key to ensuring virtual conferences are a success, said Jennifer Collins, president and CEO of JDC Events, noting that brevity matters more when events move online.

“For every hour of an in-person event, you should cut that by one-third when going online,” she said.

While this is the first time many credit union groups are putting on virtual conferences, the format is old hat for others. CUNA Mutual Group’s Discovery conference shifted to online 10 years ago.

“At that time it was an experiment to see what was palatable and what we could achieve,” said Christy LaMasney, the company’s corporate brand manager. “We were able to affirm that the format worked and it was different than what other events offered; it offered that flexibility. It’s a great way for busy credit union executives to get access to really good content on vital issues.”

Despite the number of active credit unions having shrunk by more than 30% since the conference went online, CUNA Mutual continues to see an uptick in attendance each year. What’s different this year is that the competition among online events has increased — and so have expectations. That means conference planners must not only come up with meaningful content, but it must also be presented in a manner that keeps participants engaged — otherwise attendees may drop out of the event and go back to their day jobs.

For organizers, that means a focus on being interactive, whether that’s through chats, poll questions or virtual break rooms, said Sally Mainprize, owner of Iron Peacock Events.

Toronto-Dominion Bank plans to give most employees the option to return to the office this month and is aiming for workers to officially transition to their new working models by June.

The Biden administration once again extended the pause on student loan payments enacted to help borrowers during the COVID-19 pandemic, this time through the end of August.

Employees will still have some flexibility to work from home, but are strongly encouraged to collaborate with colleagues in person, according to people familiar with the matter.

Many credit union groups that transitioned their conferences to virtual events already have experience hosting webinars, but some suggested the two aren’t comparable.

“A webinar is a one-way engagement,” said Samantha Paxson, chief experience officer at CO-OP Financial Services. CO-OP’s THINK 2020 conference was originally slated for May then

“What has been important as we’ve designed the way we have THINK happen this year in a remote and virtual environment is making that a two-way engagement,” she added.

That means content that reaches a wide audience but also supplemental sessions that drill down into specific subject areas or target certain disciplines within the industry. Some conferences have also set up virtual happy hours for their events, including entertainment or breaking attendees out into smaller groups to facilitate networking.

THINK traditionally attracts about 500 credit union professionals each year, while the company’s webinars can bring in anywhere from 300 to 600 viewers. The virtual event in May garnered 2,700 registrations and 2,000 participants, Paxson said, and live tracking showed attendance never dropped below 1,500. Those kind of numbers back up organizers’ belief that even if online conferences aren’t ideal, there is still an audience for them, particularly since they are likely to attract a wider swath of the industry than just the C-suite, which might typically be the level of staff who travel for in-person events.

One of the biggest questions remaining isn’t how attendance will fare for this year’s events but what the 2021 conference slate will look like. NAFCU, CO-OP and others are all planning to resume in-person meetings next year, but many have noted that post-COVD conferences are likely to be a hybrid mix of in-person and digital content — and there may be some events that don’t come back at all.

Lindstrom said the CUNA Marketing & Business Development Council is still planning to move forward with its annual event next spring, but it’s unclear what registration numbers will look like or how the event might be structured, including if features such as bus trips to off-site locations for experiential learning will still be an option.

“I do think [next year] there will be a group of credit unions and credit union CEOs who say it’s a safety hazard to travel,” he said. “What’s quarantine going to be like when this person comes back? We can save so much money if we do this [virtually] for $99 versus a $799 registration fee plus airfare and hotel…I think there’s going to be a lot of that as well. You have to look in a crystal ball right now to try ot figure out what the future looks like.”