In most financial industry discussions, credit unions receive little attention. It is not hard to see why. In a ranking of financial institutions based on asset size, the largest credit union, Navy Federal, comes in number 38 and is less than half the size of the 24th largest bank, Keycorp. Altogether, based on asset size, credit unions represent just 6% of the U.S. financial market. But our studies reveal that credit unions consistently distinguish themselves in an important way: they are superior in real estate loss experience to date.

Loss experience is a measurement of total losses with respect to a portfolio of loans. Total losses include all expenses associated with the sale of a home that a lender has acquired after foreclosing on a delinquent borrower. The delinquency status of these homes is also known as real estate owned (REO). In addition to the costs of maintaining and selling the REO home, financial institutions may suffer additional loss when the sale price of the home is exceeded by the loan's current balance.

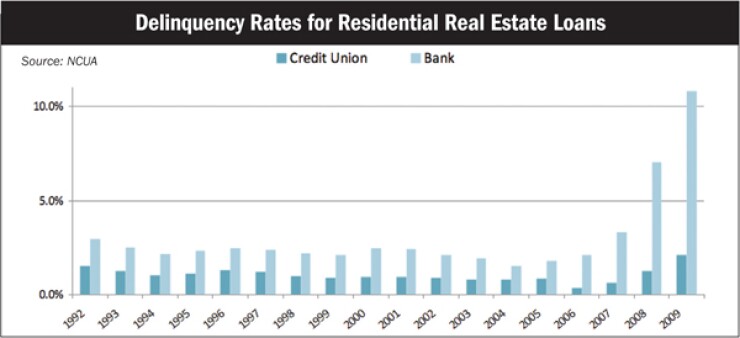

Figure 1 shows a comparison of real estate delinquency rates, a leading indicator of losses, between banks and credit unions. These delinquency rates are determined as the total number of delinquent loans at the end of the calendar year divided by the total number of outstanding loans at year-end.

Asset Size Isn't Only Way Banks Dwarf CUs

The delinquency rate of credit union loans is dwarfed by that of bank loans. In order to protect themselves from the potential losses associated with borrowers defaulting on their loans, both credit unions and banks generally require mortgage insurance from most homebuyers who obtain a loan for more than 80% of the value of the home.

When assessing the loss potential of mortgage insurers, loan characteristics such as FICO score, loan-to-value ratio, loan amortization, and occupancy type are analyzed. Based on these underwriting characteristics, credit unions have historically underwritten loans with a more favorable profile than banks have. Not only have credit unions underwritten higher-quality loans, but they have also experienced more favorable loss experience compared to that of banks on loans with similar underwriting characteristics.

As an example, when doing a comparison of the state of Florida's premium rates for United Guaranty Residential Insurance Company's (UGRIC) credit union loans versus its bank loans, the average premium rate is significantly lower than its non-credit union average premium rate. The comparison holds when looking at premium rates from comparable risk characteristics.

Do Superior Member Relations Reduce Risk?

Credit unions by their very nature are focused on their members and their communities. In general, credit unions have been less apt to securitize loans and more likely to hold them in portfolio. As a result, there is an incentive for greater underwriting scrutiny, given that most loans are held in portfolio. Risk retention has historically been and continues to be an important feature in underwriting practices for credit unions. The industry participants and regulators have recognized the value of risk retention as evidenced by the risk retention requirements found in the Dodd-Frank Act.

It may be precisely because CUs are community-based that they are able to achieve superior loss performance. CU officers typically live and work in their communities, giving them ample opportunity to understand their markets and local economies. It may also be that, because credit unions are cooperative-based, the members demand higher standards of lending to ensure that their own interests in the CU are met.

However these factors are considered for individual CUs, the forecasting implications for the industry are clear: CUs demonstrate a clear, consistent advantage in real estate loan loss experience. Both CUs and banks have adopted stricter underwriting policies because of the stresses of the current environment.

It remains to be seen whether the historical superiority of credit unions will hold up in the current environment. Early indications suggest it may persist, but the jury is still out.

Leighton Hunley is a financial consultant with the Milwaukee office of Milliman and may be reached at 262-784-2250 or