Making progress

The future of auto lending

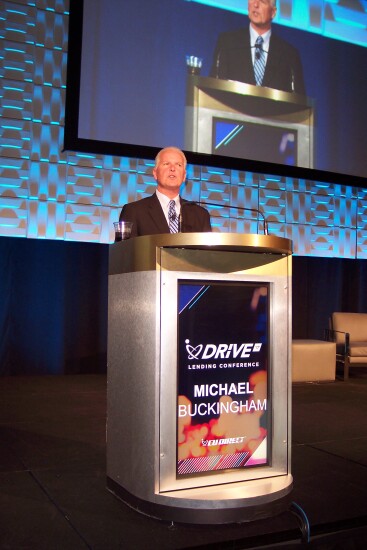

No subprime crisis

Buckingham noted new loan terms now run 72 months and more, the highest levels ever, and a glut of used cars is hurting new car sales. On the subprime front, he said at JD Power, “We do not see the subprime market as a bubble or in crisis. Many dealers have reduced mix as delinquency and credit risk are increasing.”

The agency foresees continued strong sales, although limited growth is forecasted for 2017. The month of May might see a “small” year-over-year reduction, but 2017 could result in another record for new auto sales. He cautioned these records are powered by tactics necessary to maintain sales in a hyper-competitive market, and said there is a question as to whether those tactics pose a risk to the long-term health of the industry.

“Credit unions should see their share in both new and used vehicle financing grow as banks take a more cautious view of auto financing and captives pricing gaps widen,” he said. “Growth in non-prime and subprime lending may have peaked as lenders have become more cautious.”

NADA vs. CFPB

NADA’s economists expect sales between 16 million and 18 million cars for the next five years. “It is a cyclical business,” Welch said. “People use the term ‘plateauing’ but you have to admit 16 million or 17 million is a very nice plateau.”

Welch criticized the Consumer Financial Protection Bureau on several fronts, but saved his harshest assessments for the CFPB’s fair lending enforcements. He termed them “Backwards-looking statistical reviews” of lending numbers, adding, “If you are off by 10 basis points the CFPB calls you a discriminator. This is a blow to your reputation.” Welch said he met several times with CFPB Director Richard Cordray and explained the “ecosystem” and the methods dealers use to discount credit for the benefit of customers. As a result, he said, credit markets are “as robust as they have ever been.”

He noted there had been 13 fair lending investigations, but the Justice Department is no longer enforcing them. “NADA has made available a voluntary fair credit compliance program. There is no room for discrimination in our business or in any business, in my opinion.”