-

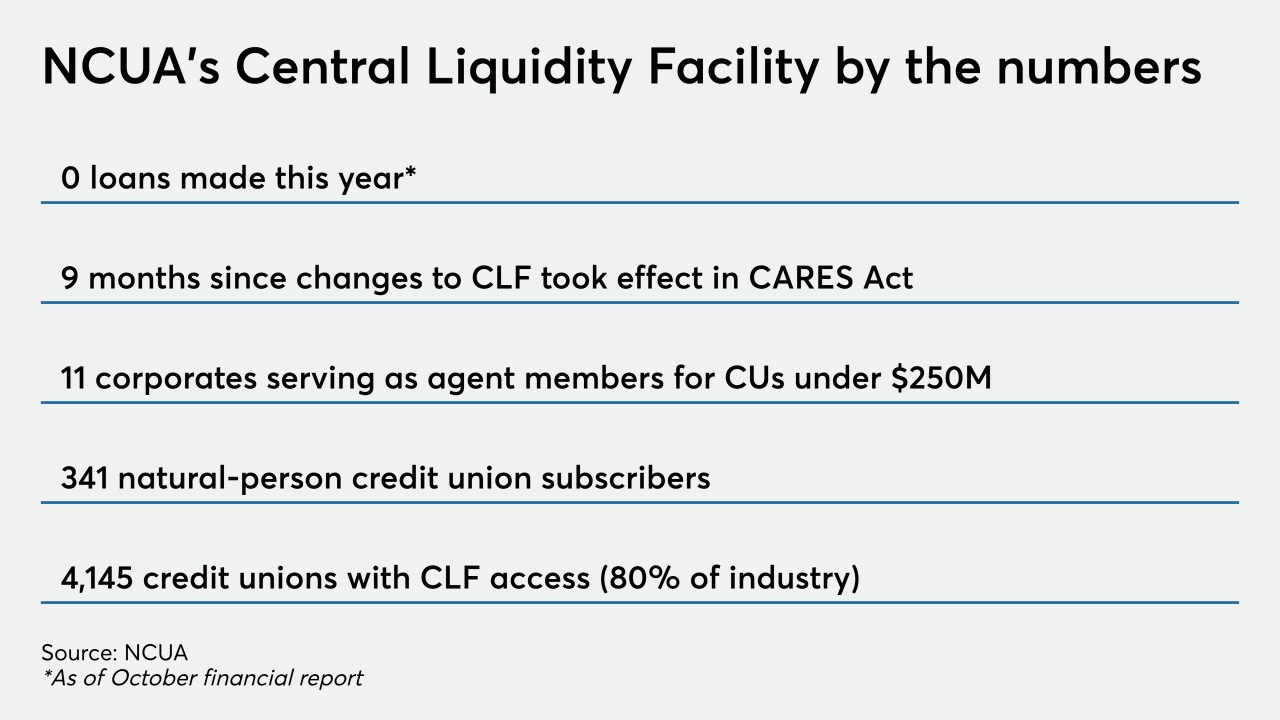

Thousands of institutions could lose a safety net on New Year's Day if Congress fails to act before leaving for the holidays.

December 7 -

Acquirers shelved plans to buy banks this year as the coronavirus became widespread, but a combination of factors could spur the confidence to restart those conversations in the months ahead.

December 4 -

Board member Todd Harper was concerned that the credit union regulator was not adequately preparing for the impact of prolonged economic turmoil and could be caught "flat-footed" as it was heading into the last crisis.

December 2 -

The confirmation ensures Republicans will hold the majority vote at the credit union regulator until at least 2023.

December 2 -

CEO James Schenck says the institution's military focus means it must provide services for a group of consumers who move every few years. That has helped it focus more on mobile services and less on brick and mortar.

December 1 -

Some workers have thrived while working remotely, but others miss the social interaction of an office, and the recent surge in coronavirus diagnoses means employers will be facing these challenges well into next year.

November 30 -

In a potentially good sign for credit unions, last week credit card spending reached its highest point since the start of the coronavirus pandemic, according to data from PSCU.

November 25 -

The biggest questions following the former chairman's resignation aren't about regulation but whether the agency can recapture a spirit of bipartisanship and collaboration.

November 24 -

The annual survey from the National Credit Union Administration shows credit unions making gains in some of their inclusion efforts, but the industry still has much it can do to improve.

November 23 -

The former chairman recently butted heads with colleagues over the agency’s budget plans, and the Senate is expected to vote to confirm a successor early next month.

November 20