-

Most banks already have the means to communicate directly with customers, in the form of a mobile banking app or email. It’s just a matter of putting those channels to good use. Targeted discounts and perks reduce shopping costs, and therefore customers’ stress, says Flybits' Justine Melman.

January 7 Flybits

Flybits -

The payments company has loaned $5.5 billion to 275,000 small businesses, thanks to a data-driven process free from human interaction.

November 22 -

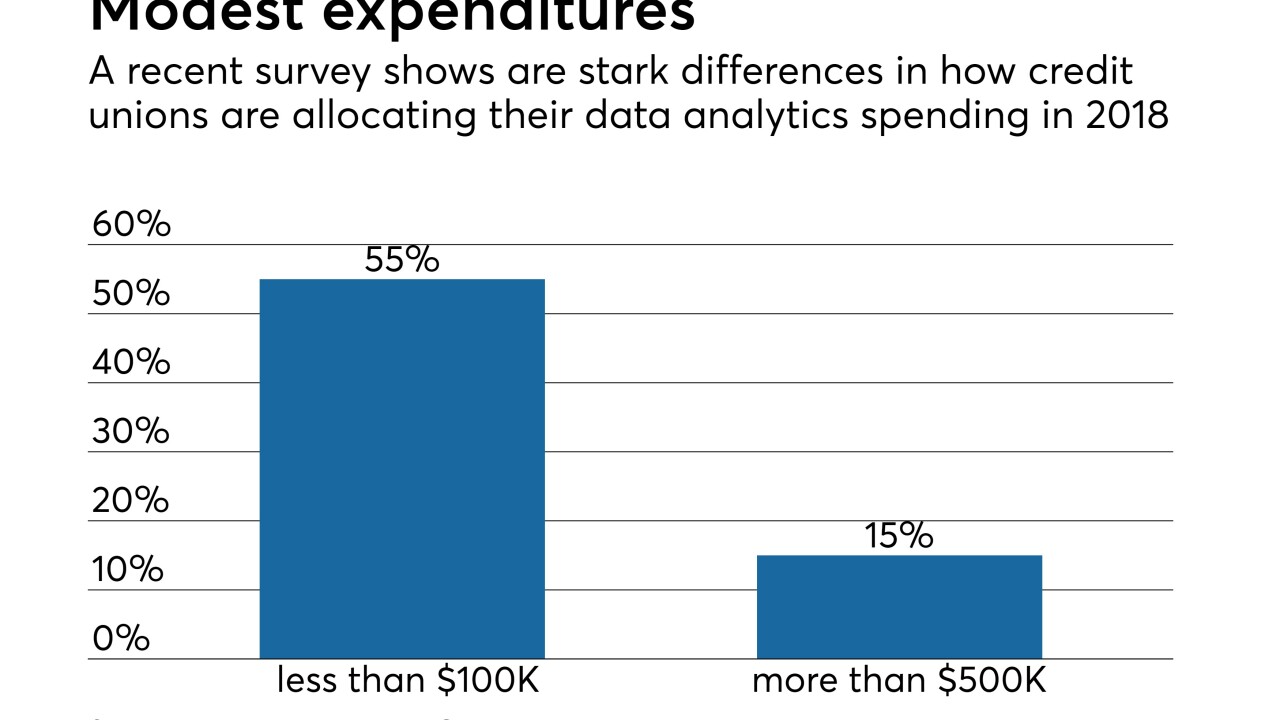

Credit unions are slowly embracing the impact data analytics can have on the bottom line, but experts say goal-setting and measurable achievements must also be a part of the process.

July 17 -

Credit unions have not invested enough in analytics. But changing that would help the industry compete with big banks and improve efficiencies.

June 20 Superior Data Strategies

Superior Data Strategies -

The payments space is expected to see continued consolidation, new fraud patterns and more contactless cards for the second half of 2019.

June 10 -

OnApproach was launched in 2005, while Trellance was launched just two years ago as a division of CSCU

February 11 -

A recent report from Best Innovation Group reveals a significant number of credit unions don't have a data analytics plan, and many that do are putting off spending money on it.

November 8 -

Trellance has acquired IronSafe, which provides data analytics to more than 2,300 credit unions.

October 2 -

Two of the credit union movement's biggest names are teaming up to help CUs better tackle big data.

September 13 -

Rather than ban screen scraping, financial institutions should improve secure account connectivity so that consumers can share data with the apps they want to use.

July 24 Quovo

Quovo -

Rather than ban screen scraping, financial institutions should improve secure account connectivity so that consumers can share data with the apps they want to use.

July 16 Quovo

Quovo -

Credit unions know they need big data, but many aren't sure what to do with it.

June 26 -

Payment data can also reveal insights for companies to foster better relationships with customers and vendors or suppliers, writes Matt Clark, president and COO of Corcentric.

March 21 Corcentric

Corcentric -

In a move rare for the industry, the bank bought a team of data scientists to bolster its artificial intelligence efforts in areas including product recommendations and fraud prevention.

January 16 -

TD Bank's new lab seeks to divine the future of banking.

December 27 -

The financial services industry must change how it attracts, hires and develops data science talent.

December 11 Ayasdi

Ayasdi