-

After vowing for months to crack down on ransomware, the Biden administration and allied countries unleashed a string of actions Monday against one of the most prolific hacking groups and also issued sanctions against cryptocurrency entities that allegedly enable such attacks.

November 8 -

-

If law enforcement concludes that the company's devices were used in a cyberattack on U.S. companies, banks may need to change the way they choose, test and monitor point-of-sale equipment.

October 29 -

The decision came prior to news of a federal investigation of PAX Technology and a raid of its Florida locations that has prompted inquiries from customers about the security of devices that they have relied on for making and receiving payments.

October 27 -

The DeFi protocol Cream Finance suffered yet another 2021 hack in an exploit that stole at least $130 million and could be one of the largest thefts in decentralized finance.

October 27 -

The credit bureau's $638 million deal to buy the ID verification firm is its second M&A agreement in a little over a month to broaden its line of products and services that help customers combat fraudsters and identity thieves.

October 27 -

Cybersecurity teams are using scoring systems, standard formats and other tactics to prioritize the deluge of alerts they're receiving about commonly used programs.

October 13 -

The Justice Department is creating a new team to investigate and prevent hackers from using cryptocurrency exchanges to remain anonymous while extorting money from victims of their attacks, Deputy Attorney General Lisa Monaco said Wednesday.

October 6 -

Bank of America’s online-banking platform went down for several hours Friday, leaving thousands of customers locked out of their accounts before service was restored.

October 1 -

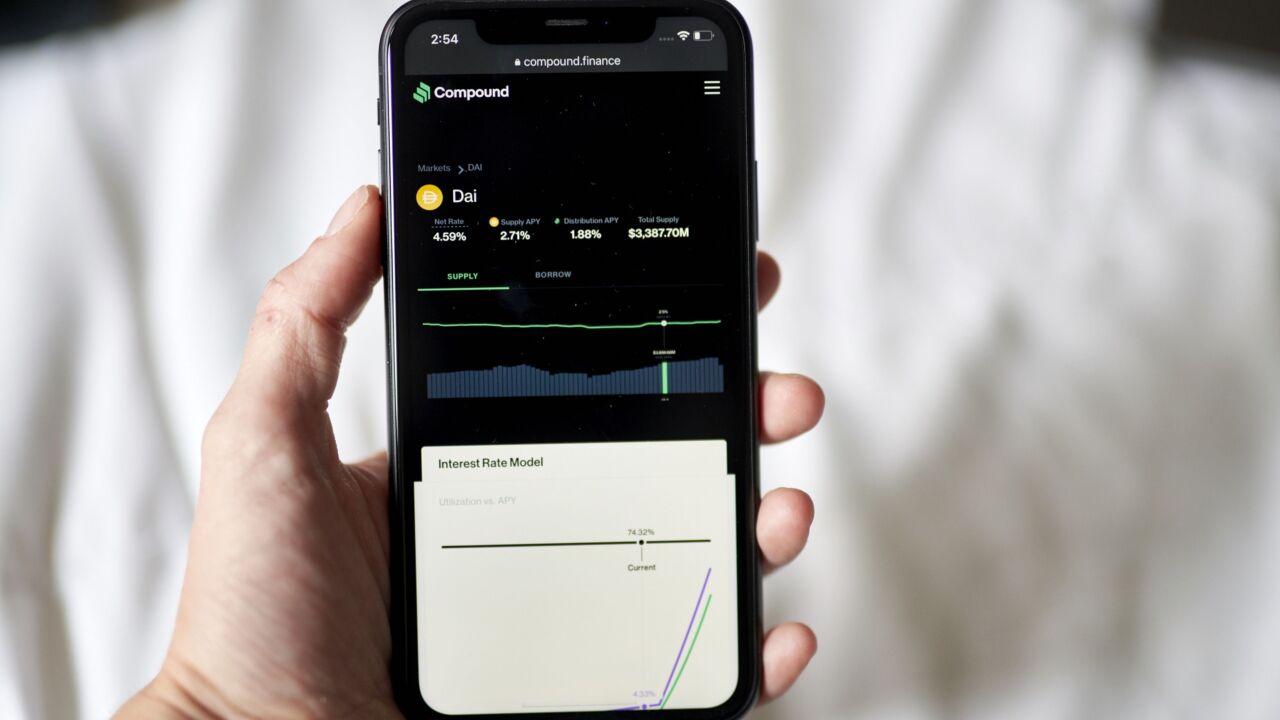

A bug in a recent update of the decentralized finance platform Compound sent users nearly $90 million worth of cryptocurrency in error, leaving its creator’s CEO begging users to voluntarily send it back.

October 1 -

The U.S. subsidiary of Japanese banking giant Mitsubishi UFJ Financial Group has entered into a consent order with the Office of the Comptroller of the Currency that requires it to improve its information security protocols, hire more IT staff and create a board-level committee to monitor its progress.

September 20 -

President Biden urged a group of chief executive officers to help improve cybersecurity across the nation’s critical infrastructure and economy, citing a lack of trained professionals to adequately protect the U.S.

September 17 -

Email scams in which hackers siphon small amounts of money from thousands of accounts at once are on the rise. Here's what banks are doing about it.

September 16 -

As the need for easy-yet-secure mobile banking authentication escalates and consumers become used to logging in by looking into a camera, banks are taking the technology more seriously.

September 13 -

-

Though banks were not directly affected by security flaws discovered in Azure systems last week, they need to be aware of the kinds of misconfigurations that could lead to massive data breaches.

September 1 -

-

For banks that want to replace usernames and passwords with more secure options, there's hope: Consumers are becoming more comfortable with biometrics, the technology is getting easier to use and regulators are starting to require it.

August 26 -

Chief executives from across the business world are set to join President Biden for a discussion Wednesday on how industry and the federal government can partner to improve cybersecurity in the face of debilitating ransomware and cyberattacks.

August 25 -

Infrastructure will command most of lawmakers’ attention, but expect banks to keep pushing for bills that would ease the transition away from a key benchmark rate and help them serve legal cannabis businesses.

August 24