M&A

M&A

-

Prosperity Bancshares finalizes the second of three acquisitions it's announced since July; Sumitomo Mitsui Banking Corporation appoints a new chief information security officer for its American operations; Huntington Bancshares, Third Coast Bancshares and Heritage Financial completed acquisitions; and more in this week's banking news roundup.

February 6 -

Unlike some of its expansion-minded regional bank peers, Montana-based First Interstate is reconfiguring its business model to be smaller and more focused on relationship banking. The blueprint is the work of CEO Jim Reuter, who joined the bank 15 months ago.

February 5 -

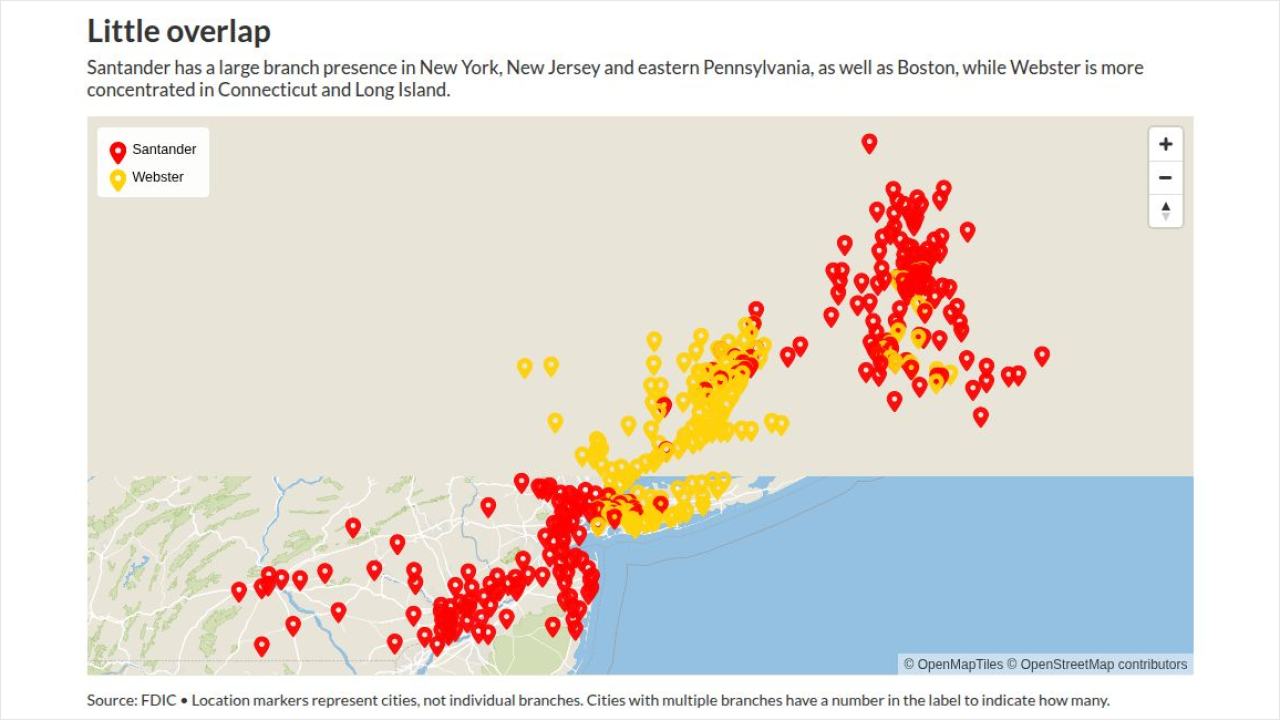

The Spanish banking giant is accelerating its U.S. growth plans with the pending acquisition of Webster Financial in Connecticut. The combined entity will be the second-largest foreign-owned bank operating in the country.

February 4 -

The Spanish banking giant, which has been trying to grow its U.S. business, plans to acquire the Connecticut-based parent company of Webster Bank.

February 3 -

Acquiring the $5.8 billion Northfield Bancorp would give Columbia a presence in both Brooklyn and Staten Island. The deal provides a window into the impact of New York Mayor Zohran Mamdani's plan to freeze rents on the city's multifamily real estate market.

February 3 -

While stablecoins aren't widely used for merchant payments, blockchain tech firms such as BVNK and Polygon Labs are seeking opportunities to add speed to slow-moving international transfers.

February 2 -

The combination of the banks is the latest in a trend of deals closing on speedier timelines, and signals the industry's hunt for scale.

February 2 -

U.S. Bancorp shuffles management as COO Souheil Badran announces his retirement; Stock Yards Bancorp agrees to buy Field & Main Bancorp; Citi's wealth business hires Mercer's Olaolu Aganga for a newly created role; and more in this week's banking news roundup.

January 30 -

Acquiring Stellar Bancorp will create the second-largest Texas-headquartered bank, with a No. 5 deposit share in the massive Houston marketplace.

January 28 -

A Delaware judge denied HoldCo Asset Management's emergency motion for a temporary restraining order to stop the deal from closing. Fifth Third plans to complete its purchase on Feb. 1.

January 27 -

The bank technology seller closed the sale of its payment processor to Global Payments, which sold its card issuing unit to FIS. Helping banks get a handle on artificial intelligence is a big part of FIS' plan to reach banks.

January 26 -

The Boston bank, which has been targeted by an activist investor over its M&A strategy, isn't pursuing deals, CEO Denis Sheahan said Friday. Instead, the company is focused on organic growth and share buybacks.

January 23 -

The McLean, Virginia-based bank plans to close the deal in mid-2026, about a year after it sealed its landmark purchase of Discover Financial Services.

January 22 -

The acquisition will improve how clients can use agentic artificial intelligence to attract and reel in consumers.

January 22 -

Three weeks after completing its "merger of equals" with Synovus Financial, Pinnacle Financial Partners said it plans to hire 225 to 250 revenue-generating bankers in 2026 across its newly expanded Southeast footprint.

January 22 -

Executives surveyed by American Banker said companies vying to wrestle market share from banks are a major threat to operations in the coming year.

January 21 -

The Cleveland-based bank announced changes Tuesday to its board of directors, including the appointment of a new lead independent director. Last month, activist investor HoldCo Asset Management urged the bank's board to not re-nominate its longtime lead independent director.

January 20 -

The Huntsville, Alabama-based regional bank is well positioned to defend its Southeast footprint, according to CEO John Turner. It's hiring more bankers in growth markets, it has strong brand recognition and it has a long history in its core markets, he said.

January 16 -

"We're coming into your market," PNC Chief Executive Bill Demchack said Friday. "If you're not coming into our market to come fight us, we're coming to your market to come fight you, and we're going to get some percentage of your market."

January 16 -

Community Financial in Syracuse has agreed to purchase a small bank that's built its business model around end-of-life planning.

January 16