-

Square is changing an earlier ban on cannabis payments and is conducting a pilot, raising the possibility that cannabis merchants may get greater access to banking and payment processing.

May 23 -

The California-based institution posted growth in loans but saw net income fall from a year earlier.

May 23 -

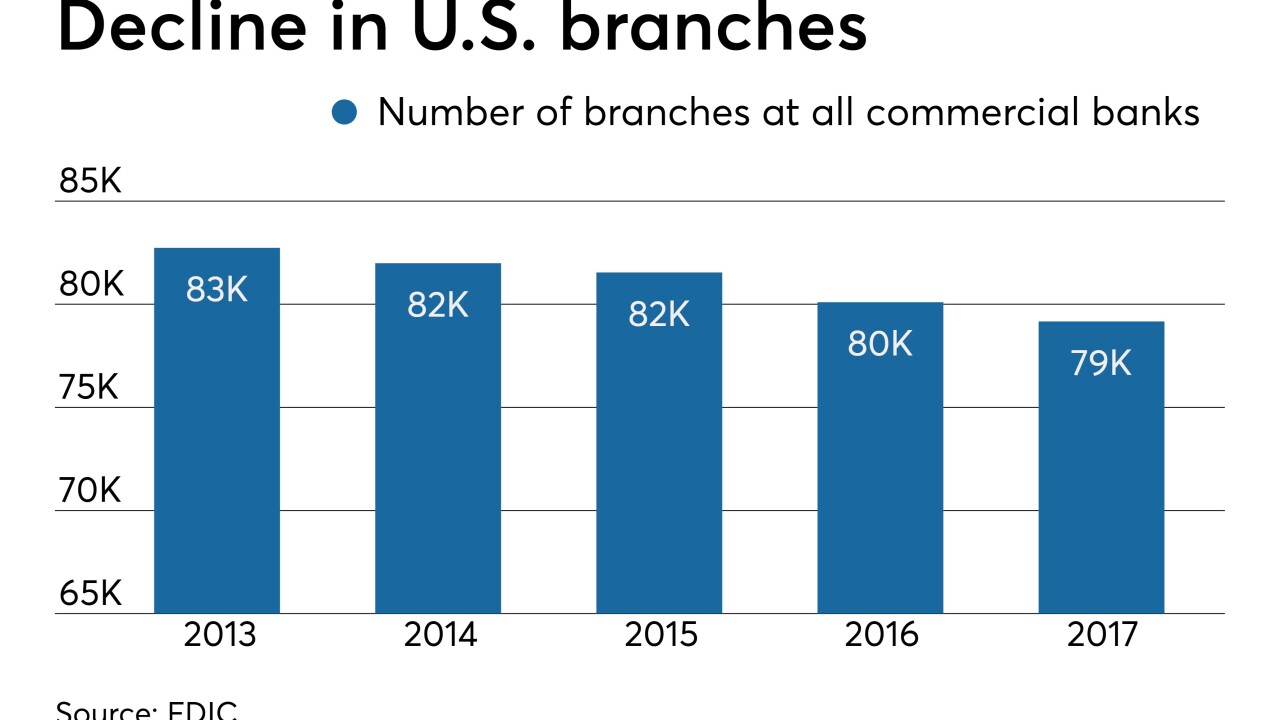

As foot traffic continues to decline, bankers are relying on gimmicks like dramatic lighting and placing buildings closer to highways in an effort to market their institutions.

May 23 -

During its monthly meeting, the National Credit Union Administration board also approved a proposal to increase CU access to non-member deposits, a move bankers are already railing against.

May 23 -

Online lenders now have close to 40% of the unsecured personal loan market, much of which is refinanced credit card debt. Banks' card portfolios are taking a hit.

May 23 -

Cloud-based treasury software provider Kyriba is partnering with JPMorgan Chase to launch a real-time payments API integration for its mutual corporate finance clients.

May 23 -

At first blush, Netflix may seem to have a fairly simple payment process: Collect a card number once, and keep charging it every month until the customer cancels. But even this process can be demanding.

May 23 -

The two lenders are bucking the trend for the overall industry, which saw year-over-year mortgage growth slide to a 17-year low in March, according to the Bank of Canada.

May 23 -

A closer look at a new plan from the Department of Labor still finds room for improvement, but is generally seen as markedly better than Obama-era rule that was rejected at the last minute.

May 23 -

Targeting a 100% gpi ratio for Swift payments among banks will be crucial to enlarging the global reach of payments, writes Marc Recker, global head of institutional market management and cash management for Deutsche Bank.

May 23 Deutsche Bank

Deutsche Bank