-

Metro Bank, the lender founded by U.S. entrepreneur Vernon Hill, plunged to a record low after it disclosed that British regulators are probing how it misclassified assets, an incident that prompted a share sale.

February 27 -

The Seattle company has a letter of intent to sell its home loan centers to Homebridge Financial Services.

February 27 -

With U.S. sanctions in place against Venezuela, banks fear compliance violations; exclusion and cyber attacks the biggest concerns of cash-free society.

February 27 -

The information you need to start your day, from PaymentsSource and around the Web. Today: IBM Watson moves toward in-car payments; Jamie Dimon discusses crypto and Square; Bahrain issues rules for cryptocurrency; Visa advances transit technology; Facebook's takes a cut of crowdsourced artist content.

February 27 -

The deal marks the first time that the retail giant will enable its customers to use fixed-rate loans, rather than credit cards, for big-ticket purchases in its stores and online.

February 27 -

The root of the credit reporting sector’s problems may be its dominance by a handful of big firms, lawmakers from both parties said at a hearing.

February 27 -

The U.K.’s major banks are urging regulators to allow for greater flexibility in processing high-risk transactions, in a bid to tackle ever-rising levels of financial crime.

February 27 -

It creates an auditable, distributed ledger of transactions that cannot be altered or removed, enabling transactions that are valid, authentic, trustworthy and immutable, according to David Uhryniak, a blockchain services leader at Crowe LLP, and Brian T. Zygmunt, a partner with Crowe LLP.

February 27 Crowe LLP

Crowe LLP -

Ronald Rubin, who was a CFPB enforcement attorney, will head an office overseeing nearly 200 state-chartered banks.

February 26 -

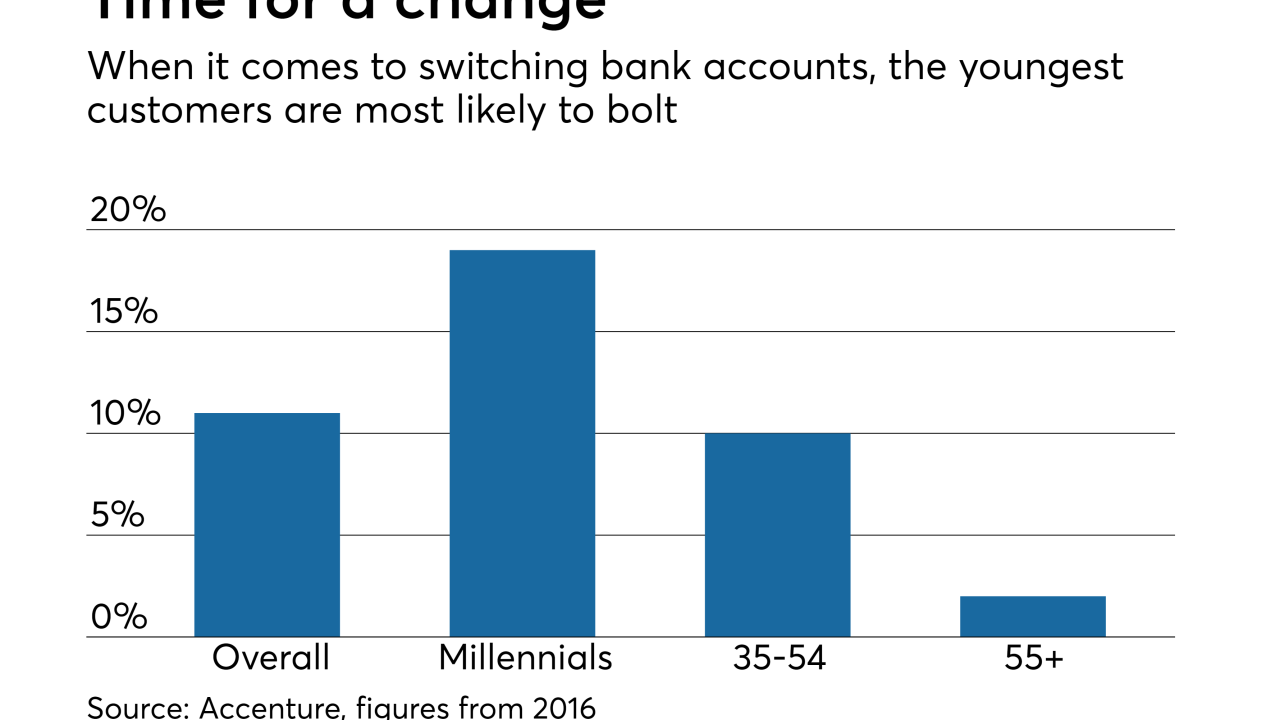

The drudgery of filling out forms and changing bills prevents many customers from swapping banks. One fintech has simplified that exchange, and banks are willing to pay it to deliver them new customers.

February 26