-

The company will top $1 billion in assets after it buys the parent of F&M Bank in Tomah, Wis.

January 22 -

Many government employees are turning to alternative lenders to bridge the gap between paychecks; the average pay at the biggest U.S. banks rose by just 3% last year, well below the CEO rate.

January 22 -

Fintechs are developing data-crunching, automated products that seek to help banks precisely calibrate capital levels. The banks' goal is to pass stress tests while maximizing returns to investors.

January 20 -

CFPB to scrap key underwriting portion of payday rule; Fiserv-First Data — why small banks fear big fintech; banks, credit unions help federal workers hurt by shutdown; and more from this week's most-read stories.

January 18 -

The Tennessee company is pleased with loan growth. It has also been able to reduce its dependence on brokered deposits as it brings in new customers following its purchase of Capital Bank.

January 18 -

The company has filed a request with a federal judge in Pennsylvania for a summary judgment in two counts against it, accusing the bureau of failing to provide evidence.

January 18 -

Strong demand for commercial loans helped offset weaker growth in consumer lending and a decline in fee income.

January 18 -

Even though American Express received pre-approval to provide transaction settlement services in China more than a year ago, it is playing the waiting game to get those wheels in motion amid a fiery political climate.

January 18 -

A spike in charge-offs in the third quarter stoked concerns about commercial real estate exposure. Shares in the Arkansas company rose after it reported its fourth-quarter results.

January 18 -

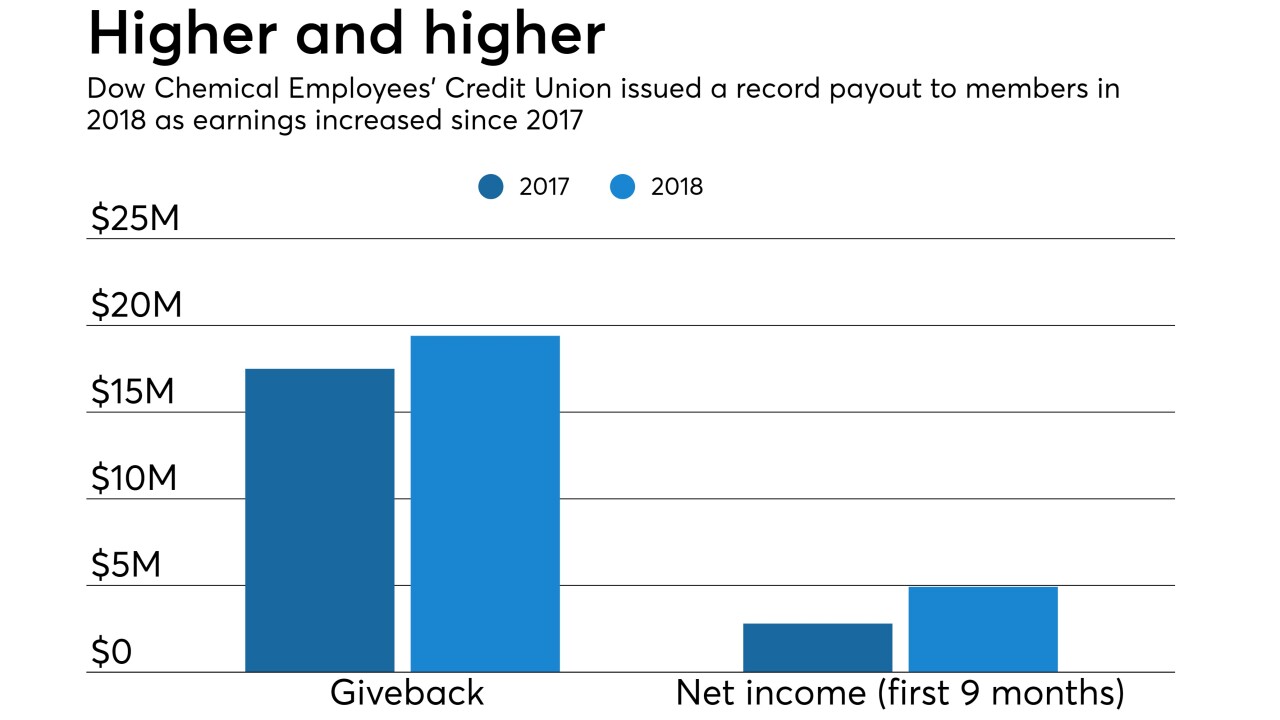

The Midland, Mich.-based institution returned $19.4 million to members for 2018 through rewards and dividends.

January 18 -

The units that handle small business payments and the one for larger firms will be combined; survey shows U.K. consumers may shun loans.

January 18 -

The acquisition of VAR Technology Finance bolsters the bank's efforts to expand into new areas of lending.

January 18 -

Executives at Key pushed back against doubts over a deal for Laurel Road Bank’s digital lending platform so late in the credit cycle, arguing that its customers are prime borrowers with high incomes.

January 17 -

American Express Co. is pulling out the big bucks to keep its stronghold on premium credit-card users.

January 17 -

Demand for commercial loans surged in the fourth quarter and executives at the Buffalo company see the momentum continuing in the new year.

January 17 -

The North Carolina regional closed dozens of branches and cut jobs across the company, directing a chunk of the savings to digital banking initiatives.

January 17 -

Calvin Broadus, better known as the rapper Snoop Dogg, will acquire shares in the Swedish-based alternative finance company Klarna from an existing investor as he becomes the face of Klarna’s new advertising campaign.

January 17 -

The New York company added eight new client teams in 2018 and established a new division that caters to private equity firms on both coasts.

January 17 -

The Indiana-based institution's distribution for 2018 was up more than 60 percent from the previous year.

January 17 -

Goldman Sachs CEO David Solomon sticks to rogue banker defense in scandal; bank misses earnings, revenue estimates.

January 17