-

A week after President Trump demanded a 10% cap on credit card interest rates, top executives at big banks protested the idea in blunt terms.

January 14 -

The San Francisco-based banking giant reported solid gains in credit card and auto lending as credit remained in check and quarterly operating costs declined from a year ago.

January 14 -

The megabank's net income declined by 13% during the fourth quarter as a result of a $1.2 billion pretax loss on sale related to the divestiture of its remaining operations in Russia.

January 14 -

In the fourth quarter of 2025, America's second-largest bank posted earnings that came in just above Wall Street's forecasts.

January 14 -

The custody bank reported a strong fourth quarter, as it continued to push forward with its new operating model. The momentum contributed to the bank's decision to lay out new financial targets, including a goal to achieve a return on tangible common equity of 28% in the next three to five years.

January 13 -

Top executives at the nation's largest bank spoke Tuesday about shifting dynamics in the credit card business, Federal Reserve independence, the bank's plan to increase spending in 2026 and its large portfolio of loans to nonbank financial institutions.

January 13 -

The largest bank in the country bulked up its reserves by $2.2 billion for potential credit hits from the Apple card portfolio, which JPMorgan is taking over from Goldman Sachs.

January 13 -

Banks will start reporting their fourth-quarter earnings on Tuesday. But it's what bankers say about the next 12 months that will probably attract the most interest from industry observers.

January 12 -

Employers added 50,000 jobs in December, with gains in service industries while broader sectors remained mostly flat, supporting the Fed's cautious stance on further rate cuts.

January 9 -

Investors in alternative assets like private equity, private capital and venture capital often lock their money in for years, but Pluto's founders say its marketplace matches these wealthy investors who need cash with banks and investment firms willing to lend against those illiquid assets.

January 8 -

The company's asset and wealth management business is completely cutting ties with proxy advisors, opting to build its own research and public company voting system. JPMorgan is the first bank to stop using firms such as Glass Lewis and ISS.

January 7 -

A housing official renewed his call for credit bureaus to address lenders' concerns. Low pull-through magnifies a cost that's small relative to others.

January 6 -

New disclosures show the ransomware attack on the marketing vendor affected far more community banks and credit unions than initially estimated.

January 5 -

Minneapolis Federal Reserve President Neel Kashkari said on CNBC that both sides of the central bank's dual mandate show signs of imbalance, with the labor market appearing more vulnerable.

January 5 -

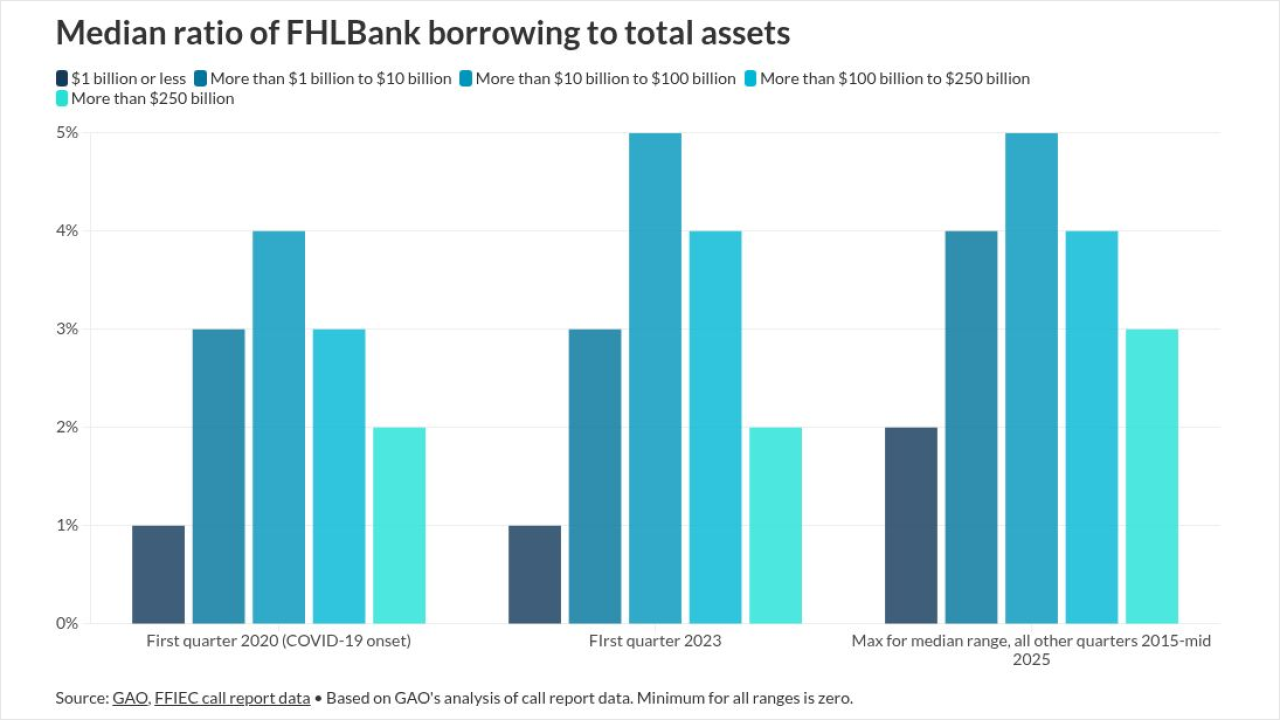

Fewer than 1% of members reported surges relative to total assets outside the normal range, making Silvergate's experience unusual, according to the GAO.

December 26 -

Once artificial intelligence has eliminated all the human-driven volatility from financial markets, will there even be a reason to trade anymore?

December 19

-

The Treasury official renewed a pledge to avoid hurting how mortgages trade in a Fox Business News interview as a new study highlighted one way to do that.

December 17 -

The Nashville community bank is focusing on growing its "digital branches" through fintech partnerships and embedded banking with its latest funding round.

December 16 -

Kansas City Federal Reserve President Jeffrey Schmid and Chicago Fed President Austan Goolsbee said in statements Friday that their dissents from this week's interest rate decision were spurred by inflation concerns and a lack of sufficient economic data.

December 12 -

Treasury Secretary Bessent said FSOC is readjusting its approach to avoid stifling growth in moves with implications for capital, technology and mortgages.

December 11