-

The company's asset and wealth management business is completely cutting ties with proxy advisors, opting to build its own research and public company voting system. JPMorgan is the first bank to stop using firms such as Glass Lewis and ISS.

January 7 -

A housing official renewed his call for credit bureaus to address lenders' concerns. Low pull-through magnifies a cost that's small relative to others.

January 6 -

New disclosures show the ransomware attack on the marketing vendor affected far more community banks and credit unions than initially estimated.

January 5 -

Minneapolis Federal Reserve President Neel Kashkari said on CNBC that both sides of the central bank's dual mandate show signs of imbalance, with the labor market appearing more vulnerable.

January 5 -

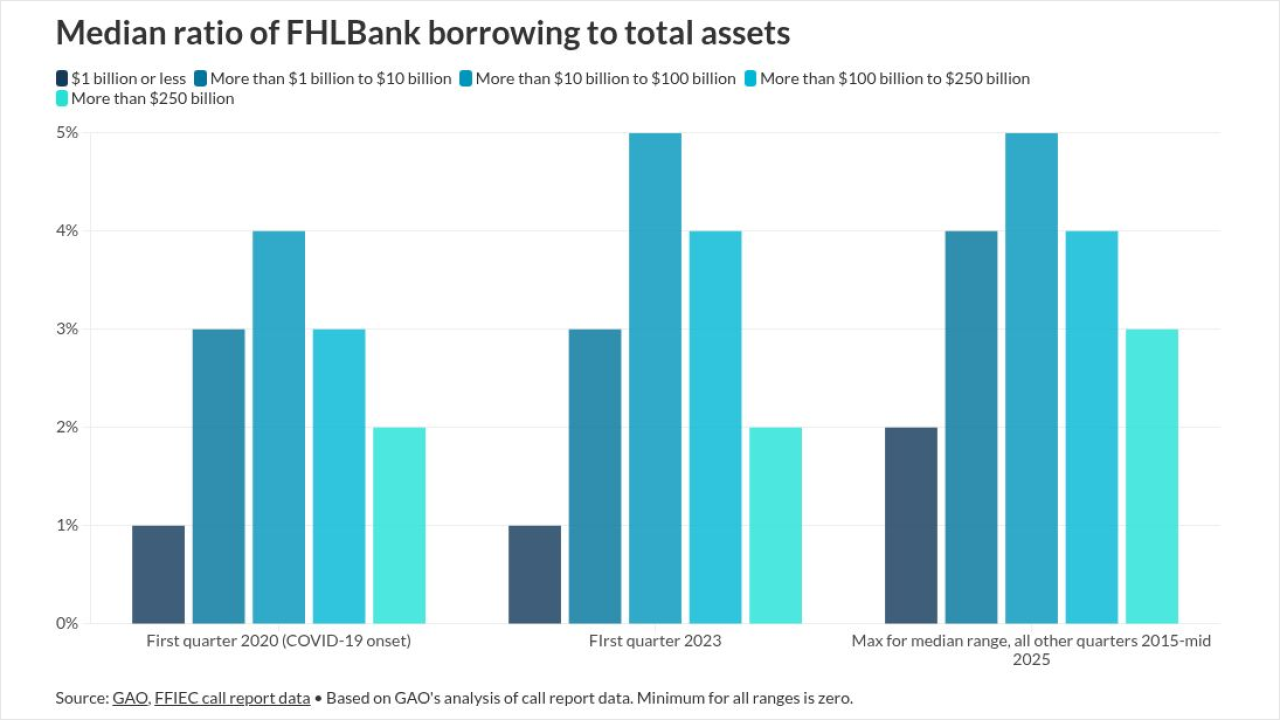

Fewer than 1% of members reported surges relative to total assets outside the normal range, making Silvergate's experience unusual, according to the GAO.

December 26 -

Once artificial intelligence has eliminated all the human-driven volatility from financial markets, will there even be a reason to trade anymore?

December 19

-

The Treasury official renewed a pledge to avoid hurting how mortgages trade in a Fox Business News interview as a new study highlighted one way to do that.

December 17 -

The Nashville community bank is focusing on growing its "digital branches" through fintech partnerships and embedded banking with its latest funding round.

December 16 -

Kansas City Federal Reserve President Jeffrey Schmid and Chicago Fed President Austan Goolsbee said in statements Friday that their dissents from this week's interest rate decision were spurred by inflation concerns and a lack of sufficient economic data.

December 12 -

Treasury Secretary Bessent said FSOC is readjusting its approach to avoid stifling growth in moves with implications for capital, technology and mortgages.

December 11 -

Fed Chair Jerome Powell, speaking at a press conference after the December FOMC meeting, said the central bank is holding interest rates steady until it gets more clarity on the economy.

December 10 -

The Federal Reserve's interest rate-setting committee is widely expected to cut rates by 25 basis points today, but where the central bank goes from here is an open question.

December 10 -

The student lending giant offered forecasts of future earnings that were far below Wall Street's expectations. In recent months, Sallie Mae has been upbeat about the new opportunities it sees under the Trump administration.

December 9 -

Federal Reserve watchers expect a board of governors vote in February to reappoint the 12 regional Fed bank presidents — which is typically treated as a formality — to be the next flashpoint in the White House's effort to bring the central bank to heel.

December 8 -

Midland States Bancorp has completed three major asset sales in the past 12 months, exiting national business lines and shifting focus to its core community banking franchise.

December 4 -

The Canadian bank is determined to grow its U.S. business organically, CEO Darryl White said Thursday. But with so much excess capital, analysts wondered about the bank's appetite for M&A.

December 4 -

The Canadian bank still has more work to do as it rolls out additional processes, technology and training. TD will also have to prove to regulators and the U.S. Department of Justice that its actions are sustainable.

December 4 -

Royal Bank of Canada now expects to achieve an annual return on equity of at least 17% by 2027, executives said Wednesday, up one percentage point from the bank's earlier goal.

December 3 -

The New York Stock Exchange disclosed the news on Monday of the sudden passing of its head of International Capital Markets.

November 25 -

Bank of Marin Bancorp in Novato has sold a big chunk of low-yielding securities, replacing them with investments that should produce significantly more income.

November 25