(Image: Fotolia)

Stuart Gulliver, CEO, HSBC

Related article:

(Image: Bloomberg News)

Vikram Pandit, former CEO, Citigroup

(Image: Bloomberg News)

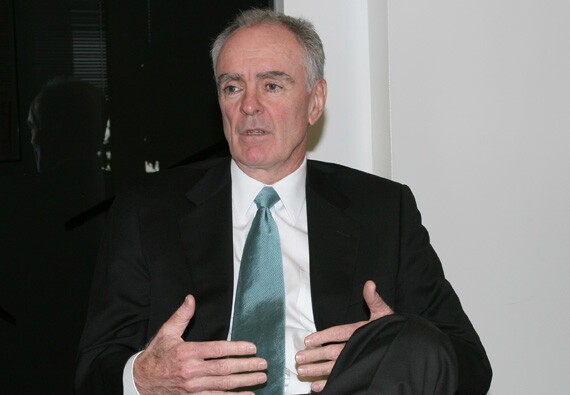

John Koelmel, Chairman, CEO, First Niagara Financial Group

Related article:

(Image: Bloomberg News)

Scott Thompson, former CEO, Yahoo

Related article:

(Image: Bloomberg News)

Douglas Bergeron, CEO, VeriFone

Related article:

Ina Drew, former Chief Investment Officer, JPMorgan Chase

Bob Diamond, former CEO, Barclays

Related article:

(Image: Bloomberg News)

Bank organizers

Related article:

(Image: Fotolia)

Joe Reid, Chairman, CEO, Capitol Bancorp

Related article:

(Image: Michael Chu)

Victor Karpiak, CEO, First Financial Northwest

Related article: