-

Katz Investment agreed to buy Camp Grove Bancorp in March 2019. The Federal Reserve approved the buyer's application to form a bank holding company earlier this year.

April 12 -

Bank of Montreal agreed to sell its Europe, Middle East and Africa asset management unit to Ameriprise Financial for 615 million pounds ($847 million), marking CEO Darryl White’s biggest move yet to trim the bank’s portfolio of noncore businesses.

April 12 -

BancorpSouth would have $44 billion of assets after it buys Houston-based Cadence. The company will be rebranded, while the bank will retain the Cadence name.

April 12 -

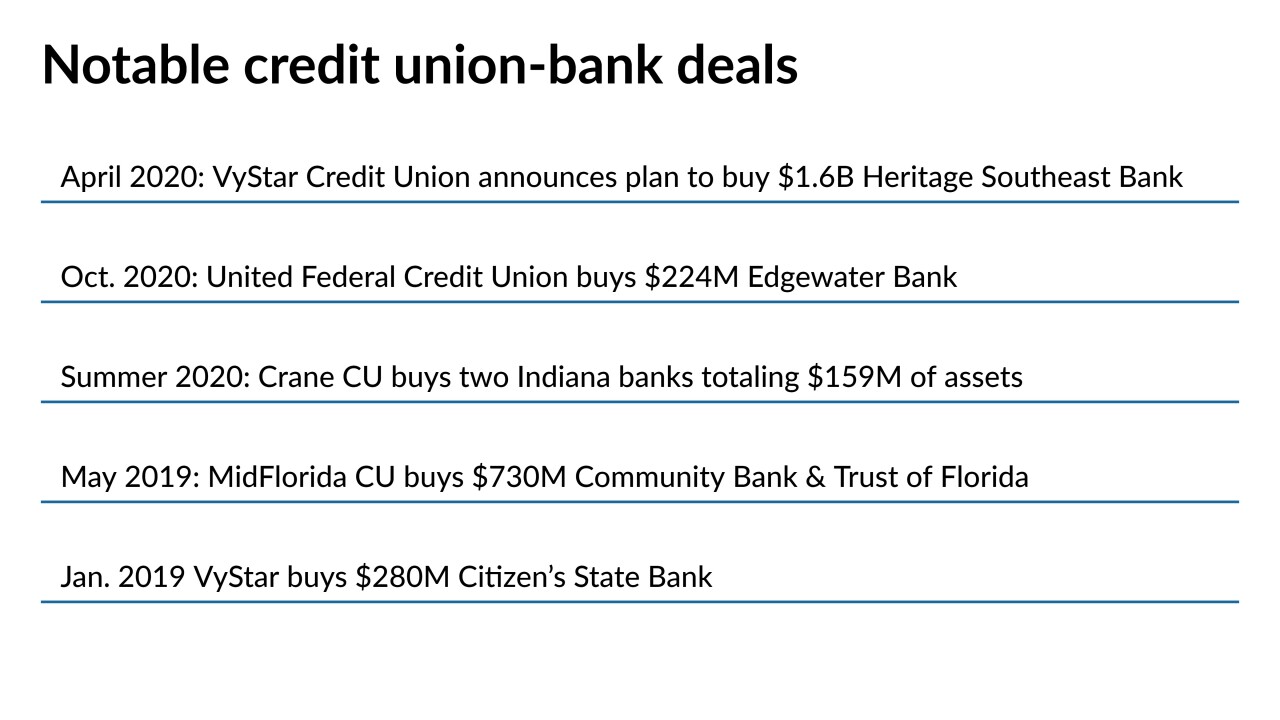

Banking trade groups have called for congressional hearings following the Jacksonville, Fla.-based credit union's agreement to purchase the $1.6 billion-asset Heritage Southeast Bank, the largest deal of its kind to date.

April 12 -

The California company has not established a time or pricing for the IPO.

April 9 -

The deal will see the $16 million-asset Georgetown FCU join the $258 million-asset PAHO/WHO. The combined institution will serve more than 7,500 members.

April 9 -

With its deal for Century Bancorp, Eastern will significantly boost its deposit share in greater Boston while gaining an entrée into several new business lines, including cannabis banking.

April 8 -

Regulators have approved the credit union's request to add 477 underserved census tracts to its field of membership, allowing it to reach roughly 2.5 million consumers.

April 8 -

The announcement comes about six months after Boston-based Eastern raised $1.7 billion through an initial public offering.

April 7 -

Longstanding familiarity with each other and years of informal talks helped the companies negotiate their $7.6 billion merger in just two months.

April 6