-

Bankers have long opposed the idea of the U.S. Postal Service taking deposits and making loans directly, but some in the industry are open to the idea of letting banks and credit unions offer services at post offices.

August 28 -

The Japanese conglomerate first applied for deposit insurance in July 2019 and again in May 2020.

August 18 -

Two trade organizations and a consumer group urged lawmakers to establish a three-year moratorium to block the charter bids of companies that they said were attempting to skirt regulatory requirements.

July 29 -

Seven trade groups said they would fight any effort by the agency to establish a tailored license for payments providers such as PayPal, Stripe and Square.

July 29 -

The Federal Reserve, U.S. Mint and financial industry representatives are strongly considering a public call for Americans to deposit their spare change, among other fixes, to get coins circulating again. Meanwhile, banks of all sizes are getting creative at the local level.

July 21 -

The national conversation around systemic racism has compelled large banks to withdraw support from the “disparate impact” proposal. But community banks maintain that the proposed reforms would reduce frivolous claims.

July 20 -

Worried about a lack of demand and that some of their customers are ineligible, community banks are still on the fence about participating in the effort to back loans for businesses recovering from the pandemic crisis.

June 19 -

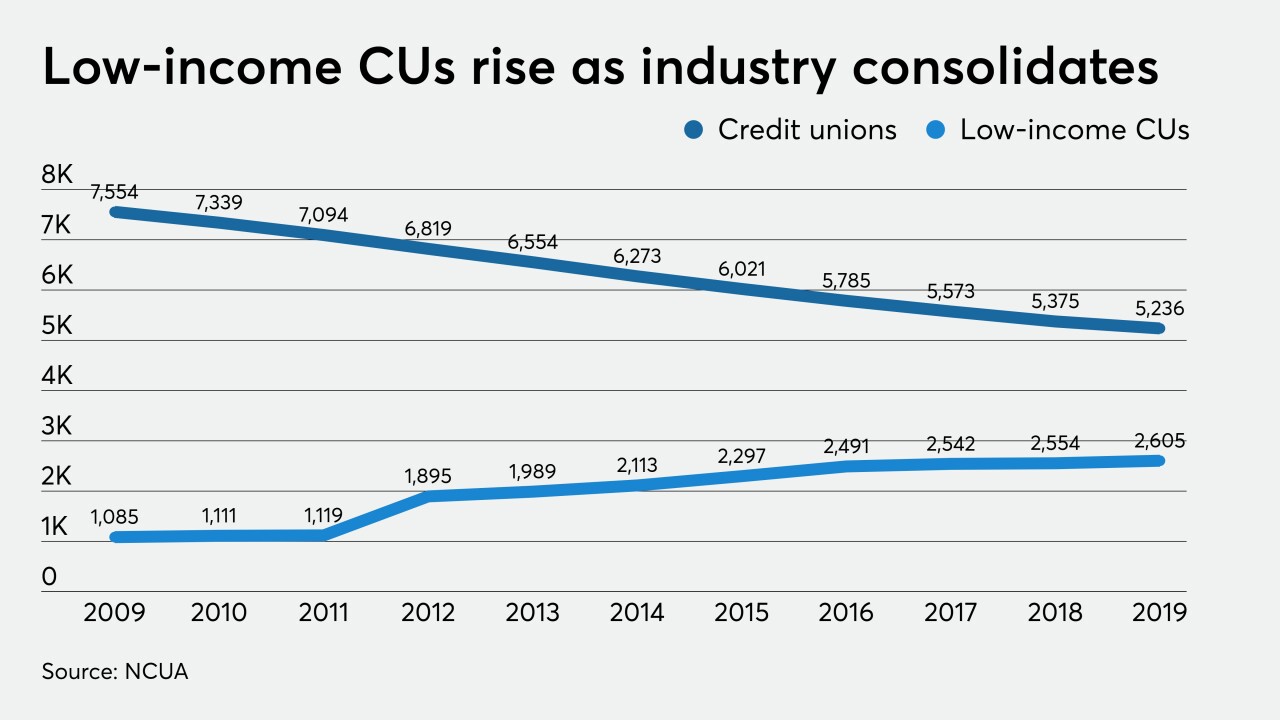

The Independent Community Bankers of America has asked NCUA's inspector general to review the agency's decision to change how low-income credit unions receive that designation.

May 29 -

The Office of the Comptroller of the Currency watered down numeric metrics that some groups blasted and allowed more institutions to opt out of the new regime. But whether the agency has won over any detractors remains to be seen.

May 20 -

The Independent Community Bankers of America would not rule out legal action if Congress doesn't address the National Credit Union Administration's recent decision expanding the low-income designation.

May 13 -

The Independent Community Bankers of America accused the National Credit Union Administration of using the coronavirus to usher in additional changes without the normal amount of scrutiny.

May 7 -

The central bank said customers will be able to make more transfers and withdrawals "at a time when financial events associated with the coronavirus pandemic have made such access more urgent."

April 24 -

A trade group says suspending so-called beneficial owner rules would help financial institutions make more small-business loans through the Paycheck Protection Program.

April 14 -

Sen. Marco Rubio, R-Fla., said that $349 billion will likely not be enough meet loan demand from small businesses seeking a lifeline to help them weather the economic downturn brought on by the coronavirus outbreak.

April 5 -

The regulator formally announced the 60-day delay on Monday after tweeting about it over the weekend.

March 30 -

The OCC and FDIC’s proposal for modernizing the community reinvestment law would give banks below $500 million of assets the option to keep the current regime. But bankers and industry representatives say that threshold should be higher.

March 12 -

Noah Wilcox, a fourth-generation banker, says community banks are well positioned to provide stability and capital in underserved markets during uncertain times.

March 10 -

The outbreak and a free fall of oil and stock prices are rattling bankers at this year's ICBA gathering in Orlando, Fla.

March 9 -

The banking group issued lawmakers a guide on questions to ask as credit union executives visit Capitol Hill for two days.

February 26 -

ICBA outlined a series of questions for lawmakers that would force credit unions to defend the industry's practices during meetings with local representatives.

February 26