BB&T Corp. gave investors a peek at its Florida strategy last week when chairman John A. Allison said it could be another decade before BB&T becomes one of the state's top five banking companies.

Analysts said Mr. Allison, who is also the Winston-Salem, N.C., company's president and chief executive, was telegraphing to Wall Street that he probably will not pursue a large acquisition in Florida.

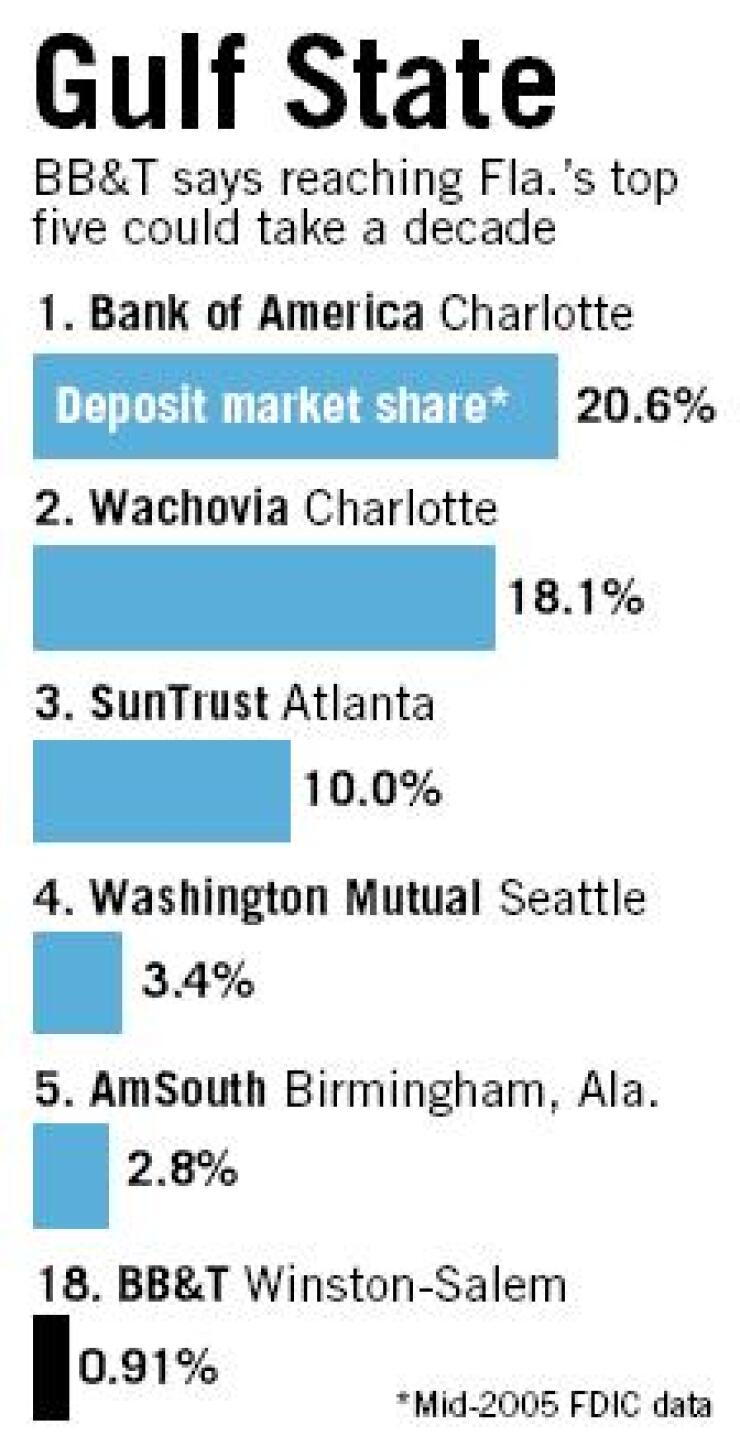

BB&T has assets of $110 billion and is Florida 18th-largest bank by deposits, with a 0.91% share, according to June 2005 Federal Deposit Insurance Corp. data. BB&T says it ranks 11th in Florida, though its data does not include thrifts.

Bank of America and Wachovia, both of Charlotte, and Atlanta's SunTrust Banks Inc. are first, second, and third in deposits in Florida. At his company's annual meeting on April 25, Mr. Allison said that though it "will be a long time" before BB&T is close to that trio, Florida is "a tremendous growth market." BB&T is actively opening branches in the state, and analysts said Mr. Allison is likely to look for smaller acquisitions there.

BB&T has been a serial acquirer in recent years, in keeping with Mr. Allison's long-stated goal that BB&T be among the five largest banks in any state in which it operates. Mr. Allison said that is necessary in order to be part of an eventual "oligopoly" in the U.S. banking industry.

(BB&T is among the top five in five of its nine states: Kentucky, North Carolina, South Carolina, Virginia, and West Virginia. Besides Florida, it lacks such scale in Georgia, Maryland, and Tennessee.)

Mr. Allison used the oligopoly rationale to defend the expensive 2003 purchase of First Virginia Banks Inc., which was slammed by Wall Street. After buying First Virginia, BB&T imposed a bank-acquisition ban on itself.

That ended in December of last year, when BB&T announced it was buying Main Street Banks Inc. of Atlanta, and in January it announced it was buying First Citizens Bancorp of Cleveland, Tenn. Both deals are expected to close this quarter.

Mr. Allison said at last week's meeting that buying Main Street would make BB&T the fifth-largest bank in Georgia and that buying First Citizens would make it the fourth-largest bank in eastern Tennessee. But he added that "we really haven't developed a statewide franchise" in Tennessee, where BB&T ranks seventh with 1.3% market share.

Kevin Fitzsimmons, an analyst at Sandler O'Neill & Partners LP, said Mr. Allison's comments last week were meant to assure investors that a large deal is not looming. "He's just being realistic that he'll have to cobble together a bunch of small banks," Mr. Fitzsimmons said in an interview last week. "It's a wise approach to take."

Richard Bove at Punk, Ziegel & Co. agreed. Mr. Allison "knows that people are really upset with his acquisition strategy," he said. They "want to hear that he's going to build market share internally."

But Mr. Bove added that BB&T will probably emerge as a top-five bank in Florida much sooner than 10 years because a difficult operating environment will create "a lot of community banks" that Mr. Allison "will have no problem acquiring two years from now."

Mr. Allison, however, said: "This is a tough market to do M&A, frankly. The prices … are so high that it's very hard for us to make mergers and acquisitions work. We're still looking to buy community banks … but we'll probably not have a lot of activity until the prices adjust."

In the meantime BB&T is growing in Florida through aggressive branch building; it plans to open 20 new branches a year there. Last year it opened 50 branches across all its markets, and Mr. Allison said during last week's meeting that it was on pace to open 60 this year. Florida's fifth-largest bank, AmSouth Bancorp of Birmingham, Ala., plans to build 54 branches in Florida in 2006.

On April 20, BB&T reported first-quarter net income of $431.5 million, up 9% from a year earlier. It benefited from an effort to boost deposits, which was spurred by a study it commissioned last year that encouraged it to be more aggressive. It added 49,000 net transaction accounts in the first quarter, and average deposits rose 10%, to $74.2 billion.

At the meeting Mr. Allison said his company has a "huge opportunity" to boost deposits further by emphasizing BB&T's "relatively small" trust, wealth management, and private-banking operations. "We're undersold there," he said.

The company's stronger-than-expected earnings won it an upgrade Monday from Jon Balkind, an analyst at Swiss Reinsurance Co.'s Fox-Pitt, Kelton Inc. Mr. Balkind raised his rating on BB&T shares to "in line" from "underperform," with his note to clients citing "relative stability in the margin and solid asset quality." He also said its cost initiatives "are beginning to bear fruit and balance sheet growth looks healthy."