Fannie Mae, citing capital concerns and the unsettled state of the funding markets, said on Friday it would be taking a more guarded approach to loan purchases in the near term.

Despite attractive investment opportunities right now, "we have to recognize that funding access in the agency debt market is key," Peter Niculescu, Fannie's executive vice president for capital markets, said on a conference call to discuss second-quarter results.

"We will look at this on a day-by-day basis," Mr. Niculescu said. "Given even mild improvements in agency debt [funding costs], we could see modest growth in balances. Our actions are going to be opportunistic."

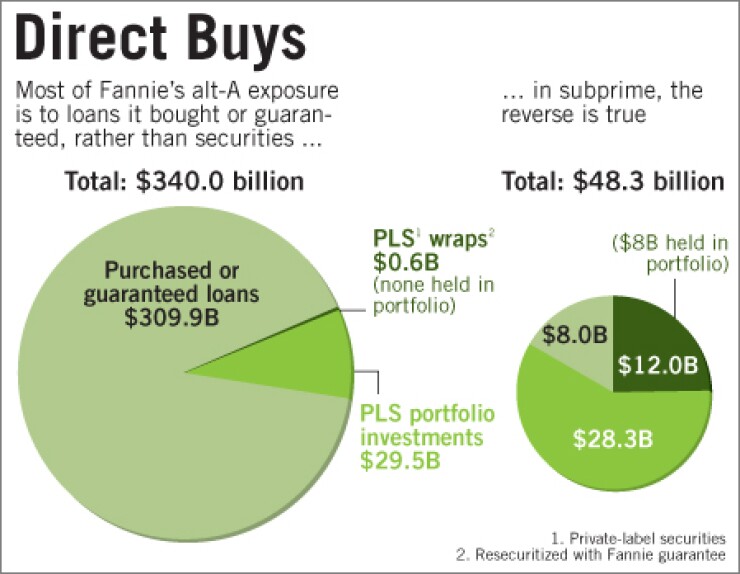

One area where Fannie will not be taking advantage of opportunities is in alternative-A mortgages. The GSE said Friday that it would stop buying such loans — generally defined as those with reduced or nontraditional documentation — entirely by the end of the year. Recent underwriting changes have already reduced its purchases of such loans by 80% from their peak, Fannie said.

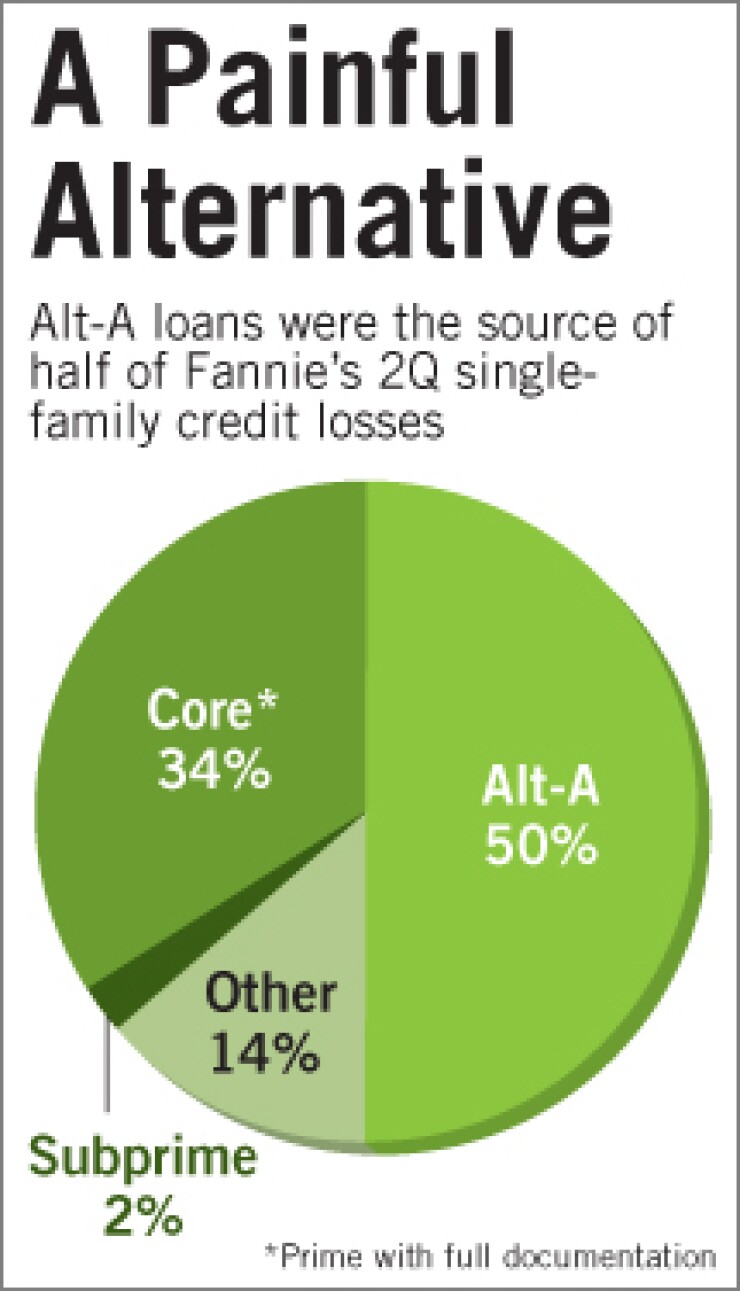

Like Freddie Mac, Fannie said credit costs were disproportionately concentrated in alt-A loans. Fannie reported a 64.9% increase in credit expenses from the previous quarter, to $5.3 billion, though it said it expects credit-related costs to peak this year. The GSE also said it plans to quadruple its review of defaults for "fraud or improper lending practices," to 4,000 a month, by the end of the year, focusing on alt-A.

Fannie's outlook for mortgage purchases was marginally more bullish than the one given two days earlier by Freddie, which said it expects its portfolio to stagnate after growing at an annual rate of 45%, to $792 billion, last quarter.

Over the same period Fannie's portfolio grew at a 12% pace, to $737.5 billion. In March the Office of Federal Housing Enterprise Oversight, the GSEs' former regulator, said a reduction in surplus capital requirements was "expected to provide up to $200 billion of immediate liquidity to the mortgage-backed securities market."

Assuming each would add $100 billion to its portfolio, "Freddie got a lot of the way there but will not get all the way there, and certainly Fannie, which went much more slowly, will not get close to there," Gary Gordon, an analyst at Portales Partners LLC, said in an interview Friday.

"Is it absolutely necessary for policy reasons that they buy that many loans?" he asked. The pullback has "certainly has made a difference. Whether it's made enough of a difference for the government to say, 'We need more, something has to be done' — we haven't seen that but it's possible."

During the call an analyst asked whether the lack of liquidity in the market produces a "feedback loop" where struggling borrowers, unable to refinance because of tight credit, default.

Mr. Niculescu replied: "I think we've seen what you're talking about happen to a degree in the marketplace. In July, you saw a very significant … increase in mortgage rates relative to other interest rates. … There are a number of other investors that have I think removed themselves from mortgages over the last two months and there may be some others that are coming in."

The "larger point that high rates do not help credit is manifestly true," Mr. Niculescu said.

As for Fannie's portfolio activities, Mr. Niculescu said, "We're certainly going to focus our efforts on the areas that are both most illiquid and therefore have some of the highest returns for shareholders." He said "this is a big market" and that the GSEs are "probably not going to play as vibrant a role collectively as we might have in years gone past. A lot of that is going to depend on what happens to the agency debt market."

And that market has been volatile.

"We've seen a lot of different ebbs and flows … over the last several weeks," Mr. Niculescu said. "Mortgages have reacted by seeing some fairly sharp widening in yield spreads through the course of July and into August to levels that in my experience are among the highest historically we've seen really for 20 years or more. So [there has been] really extraordinary change in the makeup of supply and demand in the marketplace."

In a report published last week, Rajiv Setia and Philip Ling, analysts with Barclays PLC's investment bank in New York, wrote that "senior agency debt has also held up relatively well thus far in light of the bleak headlines. However, the longer the uncertainty prevails, the more tentative foreign interest in the sector is likely to become. … Yes, the debt is effectively government guaranteed, but dislocations that make little fundamental sense can persist if there is lack of buy interest."

They recommended against investments in subordinated agency debt because they believe "the primary means for the government to restore confidence to the housing market would be by injecting a copious amount of fresh capital into the GSEs" and the possibility that the government would insist that such an investment would be senior to debt held by private investors.

Daniel Mudd, Fannie's chief executive, said on the call that events in July "heavily weight our outlook."

"Conditions which many of us had described as the worst in a generation took a turn for more worse after the quarter ended," he said. "That week of July 7 was one of the worst Fannie Mae has experienced in the debt and the equity markets."

Though the subsequent announcement of a government backstop plan for the GSEs and passage of the housing bill calmed the markets a bit, Mr. Mudd said, "July was a tough month for our credit performance. We experienced higher defaults and higher loan-loss severities in markets that were experiencing the steepest home price declines, and that gave us higher chargeoffs than we had experienced in any month in the second quarter and higher than we had expected."

Fannie revised its forecast for home price declines to the higher ends of its previous ranges of 7% to 9% for this year and 15% to 19% peak-to-trough. It said its new view on home prices prompted it to increase its projected credit loss ratio this year to a range of 23 basis points to 26 basis points from a previous range of 13 basis points to 17 basis points.

The GSE's net loss increased 5.2% from the previous quarter, to $2.3 billion, in the second quarter. It posted a profit of $1.9 billion in the year-earlier period. Its per-share loss of $2.54 was $1.85 worse than the average analyst estimate.

Fannie shares fell 9% Friday, to $9.05.

The GSE reported that it had a $9.4 billion cushion over its capital surplus requirement, which was lowered to 15% after it raised $7.4 billion in new capital in May.

Stephen Swad, Fannie's chief financial officer, said on the call that it expects to "remain above the surplus capital requirement for the remainder of 2008, but due to the volatile market conditions … we now have less visibility into our capital position in 2009."

Mr. Mudd said, "There are many, many, many different scenarios out there, and they involve projecting variables which have become significantly less clear as we've worked our way through the summer: What are losses going to be? Where is credit going to go? Where are home prices going to bottom? How long is that going to last?"

Before the backstop was created, Fannie and Freddie each had an emergency line of credit of $2.25 billion with the Treasury. Last month the GSEs gained access to the Federal Reserve Board's discount window should they exhaust those lines.

In addition, the legislation signed by President Bush authorized the Treasury to buy a GSE's debt, equity, or both, as long as it has that GSE's consent, through next year. Though the creation of the government backstop was "helpful … in terms of market confidence," Mr. Mudd said Friday, "none of the plans that we've advanced contemplate access to any Treasury line. We've not asked them and they have not offered."

There is uncertainty over whether any rescue investment by the government would subordinate outstanding interests and leave private holders to absorb losses. On the call, Mr. Mudd said the GSE model requires a "competitive return" for private investors.

James Lockhart, the director of the new Federal Housing Finance Agency, "is a businessman," Mr. Mudd said. "He understands that. [Treasury Secretary] Hank Paulson ran an investment bank. He understands that. It's very important that there be an attractive shareholder proposition so that investment comes into the company so that the company's capital is built, so that we continue to attract that global capital that we can invest and defray the cost of U.S. housing and keep all these markets liquid."