-

Recent hand-wringing over small businesses' access to funding is in no small part because of the turmoil at CIT Group Inc., a major small-business lender that has undergone a swift restructuring in bankruptcy.

December 22

The decline in small-business lending is real, and so is the pressure on bankers to lend to help the economy.

Most bankers insist that they would make a lot more commercial loans except for two key hurdles beyond their control: Most business owners seeking loans carry substantial risk that cannot be overlooked, and approvals will rise only when the most creditworthy borrowers step forward to apply.

That's an unpopular argument, but economists and even some small-business advocates agree that the caricature of the tight-fisted banker is unfair — or at least an incomplete explanation for sluggish volume. Bankers, however, will keep getting pounded unless the economy rebounds or policymakers find more ways to stimulate demand.

"The basic story is that the banks have plenty of money to lend, but just not many bankable applicants," said William Dunkelberg, the chief economist for the National Federation of Independent Business, which represents the interests of small and midsize companies. It has been 35 years since businesses were this reluctant to boost inventories or consider capital expenditures; "the firms that should be borrowing aren't there."

Dunkelberg is in a unique position to weigh both sides of the issue, serving as the chairman of Liberty Bell Bank, a $171 million-asset bank in Cherry Hill, N.J. He acknowledged that banks have reined in credit. "It's natural to do that during a recession," he said. "The banks have learned what happens if you don't have solid underwriting standards."

Dunkelberg and others contend that the government must do more to address unemployment, waning consumer confidence and uncertainty among small-business owners. Doing so might create a need for expansion, which could lure more creditworthy borrowers to lenders.

The headline numbers are stark.

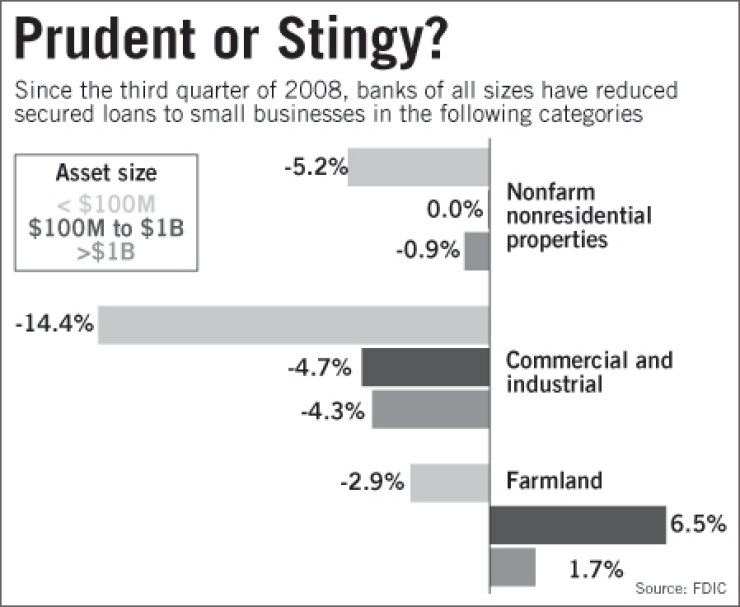

In the third quarter, the volume of small-business loans on banks' balance sheets fell 0.7% from the second quarter and 2% from a year earlier, to $761 billion, according to data collected by the Federal Deposit Insurance Corp.

That's important because the nation's 27 million small businesses employ roughly half of the private-sector work force and account for about $1 trillion in debt, Federal Reserve data says. Those companies rely on banks for 90% of their financing, compared with 30% for midsize companies and corporations.

But NFIB data supports the view that those businesses have more on their minds than getting loans. A November survey of the group's membership found that only 4% of small-business owners viewed financing as their top concern, and roughly 10% reported problems getting a loan. In comparison, a third of the respondents said their greatest worries center around weak sales.

John Asbury, head of business banking at Regions Financial Corp., is witnessing the decline firsthand. The $140 billion-asset Birmingham, Ala., company's pipeline of loan applications is two-thirds what it would be under more normal conditions. "We have seen some pickup from a first-quarter trough, but we are rebounding off a very low base," he said. "Our most sound clients … are unwilling to make investments because they are unsure about demand for their own products."

C. Dowd Ritter, Regions' chairman and CEO, gave an example during a Dec. 8 conference hosted by Goldman Sachs Group Inc., detailing a recent visit he had made to a pipe manufacturer. Though the owner initially expressed confidence, Ritter quickly discovered that the client was reluctant to build inventories. "There was nothing on the yard to deliver," Ritter said. "That is very true from the standpoint of a lot of people."

Dick Evans, the chairman and CEO of Cullen/Frost Bankers Inc., said many borrowers are using excess funds to pay down debt. Even those who are borrowing only want the bare minimum, contrasting with the past when clients would take out credit lines for much more than they needed.

"We're all going through the painful process of deleveraging," Evans said. "Our clients are also adjusting their expenses and that includes credit use."

Bankers said many of the bedrock ways of backing loans have deteriorated during the recession. Cash flows are often negative or unreliable, inventories are negligible and real estate valuations are far below levels of just a few years ago. All this is making it difficult to underwrite secured loans.

The complex and sometimes conflicting role of regulators cannot be overlooked, observers said. Though there may be a push from Washington to have more capital make it into the hands of small businesses, regulators are also intent on making sure banks avoid the same mistakes that contributed to the implosion of housing markets and last year's financial crisis.

"More scrutiny is to be expected," said Dimitri Papadimitriou, the president of the Jerome Levy Economics Institute at Bard College. He said scrutiny could come from stated capital requirements, guidance on underwriting standards or critiques that follow audits. "Depending on each case, those decisions would have an effect on items such as underwriting decisions, adequacy of collateral, interim financial reports."

Even President Obama, who has admonished the industry for a lack of lending, acknowledged the bind last week.

"No one wants banks making the kinds of risky loans that got us into this situation in the first place," he said. "And it's true that regulators are requiring them to hold more of their capital as a hedge against the kind of problems that we saw last year."

Bankers agreed with that assessment. "With the pressure to do more, you don't want to loosen your standards," said Cindy Crotty, who heads the commercial banking segment at KeyCorp. "That's what got us here in the first place."

Because of such impediments, Papadimitriou and others are concerned that efforts to boost lending may fall flat. Several proposals are circulating for recycling money from the Troubled Asset Relief Program. The American Bankers Association has said it would like to see $5 billion distributed to small banks that can find matching private-equity funds and are willing to commit the funds to small-business lending. The White House has said it wants to expand lending through the Small Business Administration.

On Saturday, President Obama signed an appropriations bill that included $125 million to waive borrower fees for certain loans. The SBA estimated that the new funding would support $4.5 billion in small-business lending.

Crotty said she is encouraged by plans to expand SBA programs, though she has concerns about the efficacy of such efforts. The $97 billion-asset Cleveland company is among the nation's 20-biggest SBA lenders. She said the biggest issue is applicants must have positive cash flow to qualify for SBA loans.

A hang-up is that companies with positive cash flow are showing a tendency to stockpile the cash rather than tie it up in loans. Another hitch with SBA loans is the origination fees, which the government reduced earlier in the recession, but were reinstituted in the past month. "Waiving that fee seemed to get us some volume," she said. "That money is an up-front out-of-pocket expense for the borrower."

In the past few weeks several banking companies have agreed to increase small-business lending. JPMorgan Chase & Co. said it would increase small-business lending by $4 billion next year, hiring 325 bankers to carry out the initiative. Bank of America Corp. vowed to boost lending to such companies by $5 billion in 2010.

Richard Davis, the chairman and CEO of U.S. Bancorp, said the company has implemented a program where rejected loan applications will be reconsidered. "At the end of a recession or the beginning of a recovery, the very people who need the loan the most are the ones under the most stressed circumstances," he said during a Dec. 14 interview with Fox Business. "We need to find a way to make loans to qualified people."

Other bankers said they are expanding efforts to serve small businesses.

Asbury said Regions has realigned compensation to reward bankers making small-business loans.

Evans said Cullen/Frost bankers have made 35% more calls to prospects than they did a year earlier, but it is a tough sell. "What we're finding is that people are in a holding pattern."