When it comes to loan-loss reserves, it may be time for bankers to show a little more reserve.

That's the sentiment of many industry watchers half way through the third quarter. Big banks stepped up the release of loan-loss reserves last quarter when credit quality improved and economic outlooks were rosier. With the economy seeming to have hit a lull again, banks could be more vulnerable to an unexpected shock in the second half, analysts said.

Some bankers concluded they needed fewer reserves because of sluggish loan growth and shrinking balance sheets. Yet, to some experts, those are also more reasons to be cautious about the future.

"It is a yo-yo out there," said Christopher Marinac, an analyst at FIG Partners LLC. "For some banks it is probably acceptable to release reserves, but at this stage, there is also a question of sustainability."

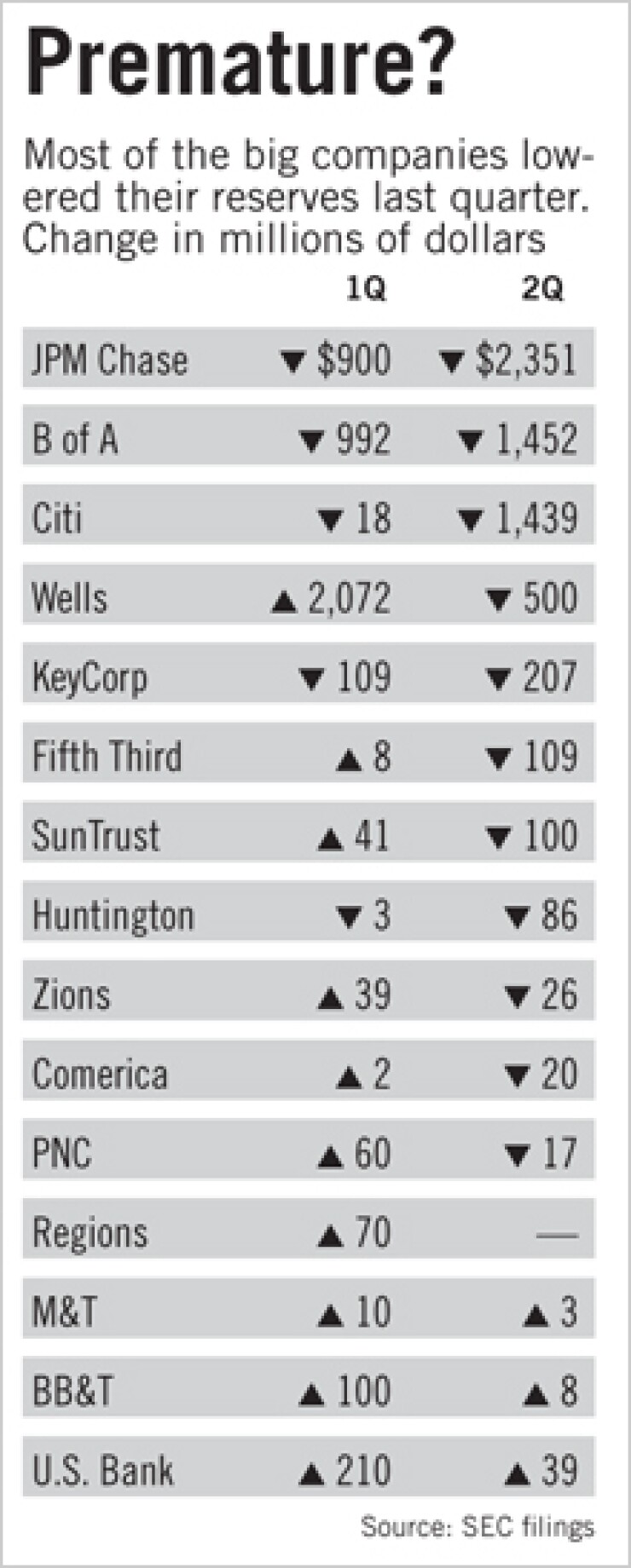

During the second quarter, the nation's 15 biggest banking companies collectively reduced the size of their allowance for loan losses by $6.25 billion, according to company filings. In comparison, those companies added $590 million to the loan-loss reserve in the first quarter.

Though such moves helped several banks return to profitability during the quarter, they create a quandary for the analysts who evaluate earnings and forecast future returns. Releases can add short-lived rocket fuel to the bottom line, but they are not the ideal type of growth for analysts and investors looking for signs of a return to long-term health.

Blake Howells, an analyst at Becker Capital Management, said most earnings projections exclude such gains though they boost capital levels and book values. He estimated that every dollar released can add 65 cents to earnings, taking into account tax rates, compared with 26 cents for revenue-generating activities with corresponding expenses. "The leverage from a release is much greater," he said.

No analysts accused executives of improperly boosting results; most stated that accounting rules and internal policies dictate many of those treatments.

There are reasons to believe, though, that banks might ease back on reserves in the near future, some analysts said. Among them: regulators are likely keeping a watchful eye on reserve levels.

William Fitzpatrick, an analyst at Optique Capital Management, said the recent release activity seems to have most banks "positioned adequately" given continued uncertainty.

"Another sizeable release in the third quarter would likely raise credit-quality concerns," he said.

"I'd be surprised if we seen an acceleration," said Jeff Davis, an analyst at Guggenheim Partners. "There's still so much uncertainty ahead." Davis said the recent jump in reserve releases "came a little bit earlier than I would have guessed a year ago."

Howells said the ratio of reserves to total loans hit 3.69% in the first quarter and will likely represent a peak in this cycle. He said he believes those levels will remain above 3% for the next few quarters, compared with historical levels closer to 1.5%.

"There will be no new baseline until the economy firms up, and that could be 2012," Davis said.

Jeff Weeden, the chief financial officer at KeyCorp, said his company can continue to shrink its allowance throughout the rest of this year, though he was quick to add a caveat.

"We believe we are going to show improvement … unless there is a substantial reduction or turnaround in overall economic activities," Weeden said during the Cleveland company's July 22 quarterly conference call with analysts.

Other companies pointed to sluggish loan demand as the reason for smaller reserves. There is theoretically less need for a hefty allowance if banks are unable to book new loans that need backing.

Doyle Arnold, the chief financial officer at Zions Bancorp., attributed most of the Salt Lake City's $26 million allowance reduction to stymied lending efforts.

Arnold told analysts during the company's July 19 quarterly call that while "modest" shrinkage could continue, a major reserve release would be unlikely until next year "whether or not a double-dip recession is on the table."

Some banks are displaying even more caution. U.S. Bancorp, BB&T Corp. and M&T Bank Corp. added to their reserve, while Regions Financial Corp. kept its level constant.

Executives at those banks were reluctant to say they would be joining the ranks of those reducing the allowance.

"A lot of folks at this time are maybe rushing to release allowances, but we're not doing that," said Kelly King, BB&T's chairman and CEO, during a July 22 quarterly conference call with analysts.

"We just want to be very conservative as we move through the next couple of quarters to be sure we're on solid footing as we look forward."

Richard Davis, the chairman and CEO of U.S. Bancorp, took an academic view. "It's math for us," he said during the Minneapolis company's July 21 quarterly call.

Davis then pointed to a struggling economy, high unemployment and lingering concerns over housing.

"Our math says that we still need to be at or right above our current loss experience," he said.