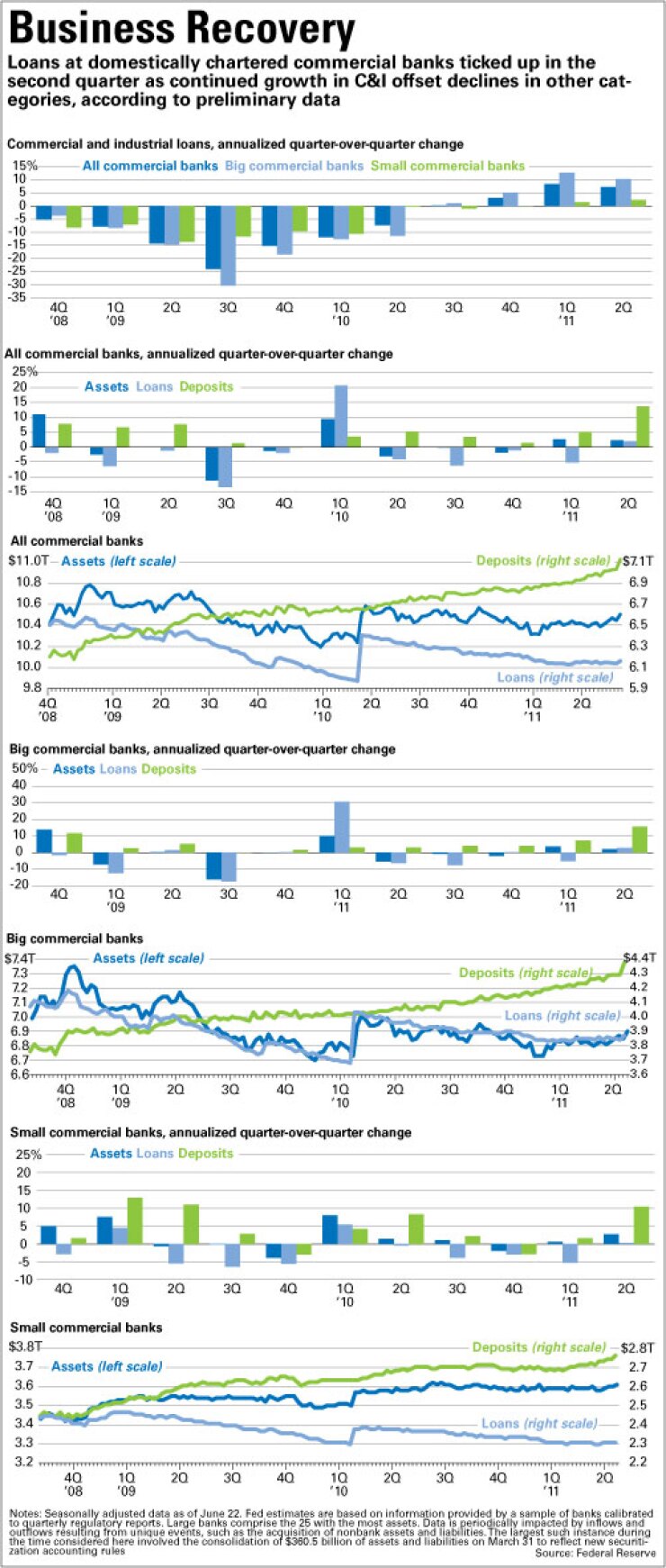

Loans grew at an annual rate of about 2% in the second quarter, according to preliminary data from the Federal Reserve, as the expansion in business lending continued and declines in other categories moderated.

With the release published on July 1, the Fed has posted weekly surveys of bank assets and liabilities covering all but the final eight days of the period.

If the data holds, domestically chartered commercial banks would post their first quarterly increase in loan volume since the financial crisis, excluding the first quarter of 2010, when about $350 billion of assets and liabilities were consolidated on balance sheets to reflect new securitization accounting rules.

Commercial and industrial loan growth actually appears to have dipped a bit, to an annual rate of about 7% in the second quarter, but residential mortgages were about flat and the contraction in commercial mortgages roughly halved to an annual rate of decline of 4.3%.

Loan growth appears to have been stronger at the 25 largest banks by assets, where C&I increased at a 10% pace and overall lending at a 3% pace, than within the rest of the industry, where C&I portfolios grew at a 2% pace and overall lending was about flat.

Deposits continued to surge for both size categories, growing at a 14% annual rate industrywide. Despite tepid lending, assets grew at a 3% pace among small banks as they added heavily to holdings of agency mortgage bonds and other securities. Large banks, meanwhile, wound down securities portfolios at an 8% annual rate.

Executives at major banking companies gave divergent outlooks on loan volume trends during presentations in June.

Wells Fargo & Co. Chief Financial Officer Timothy Sloan said his company was "more optimistic about" commercial and wholesale loan growth "today than we were a month ago, two months ago, three months ago."

JPMorgan Chase & Co. Chief Executive Jamie Dimon said that growth in lending to middle-market businesses had continued to be strong but that corporations with access to capital markets "don't need us right now."

U.S. Bancorp CFO Andrew Cecere said that a slowdown in borrowing activity that set in during February had persisted as the economy continued to be unsettled by factors like the European debt crisis and weak employment and housing prices.

"We are not in the double-dip mode, but we are still not growing at that robust level," he said.

[IMGCAP(1)]