The Federal Reserve is holding short-term rates near the "zero bound," but some deposit franchises have moved closer to the mark than others.

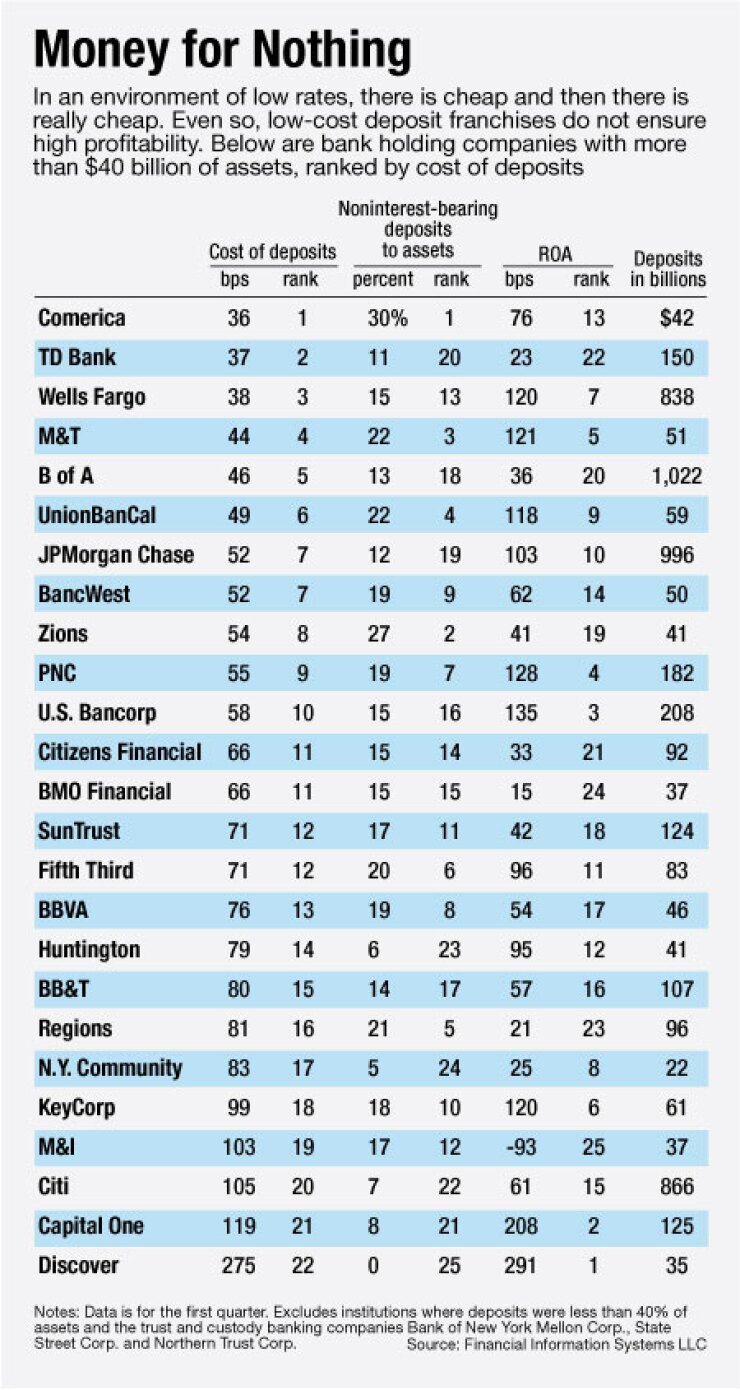

At a rate of just 36 basis points, Comerica Inc. had the lowest cost of deposits among bank holding companies with at least $40 billion of assets for the first quarter, according to data from Financial Information Systems LLC (see table).

Discover Financial Services, which has

(The data excludes institutions where deposits were less than 40% of assets, and trust and custody banking companies.)

The efficiency of Comerica's funding is likely tied to its focus on commercial lending.

Nonfinancial businesses typically hold the biggest share of total demand deposits (41% at March 31, according to the Fed), and Comerica also ranked first among the large holding company group in terms of noninterest-bearing deposits as a portion of assets at 30%.

The nation's retail giants — Bank of America Corp., JPMorgan Chase & Co. and Wells Fargo & Co. — also compared well in terms of deposit costs despite middling rankings in noninterest accounts.

Wells Fargo, which achieved coast-to-coast coverage and the biggest branch network in the country at about 6,500 offices through its acquisition of Wachovia Corp. in 2008, had the lowest cost of deposits among the three at 38 basis points.

Citigroup Inc., the fourth-largest holding company by assets, ranked near the bottom in cost of deposits by contrast.

It has a relatively small domestic franchise at about 1,000 branches, and foreign offices accounted for about 65% of its $866 billion of deposits at the end of the first quarter.

To be sure, cheap deposits are not a sufficient condition for profitability.

Like much of the industry,

Conversely, Discover had the strongest return on assets at 291 basis points.

Credit cards ordinarily generate higher loan losses than traditional banking services and carry greater risk, and therefore such businesses require higher returns.

Moreover, Discover's deposit strategy is relatively new and already represents a major step away from capital markets funding that proved unreliable under stress.

"You can't paint" deposit franchises "with a broad brush," said Jim Eckenrode, research executive for banking at TowerGroup. "Every one of them has a different strategy, a different risk tolerance."

Still, companies like New York Community Bancorp, whose cost of deposits at 83 basis points was near the highest in the group, have moved to improve their funding profiles.

That issue was one of the chief rationales for the

Similarly, Capital One Financial Corp., another credit card specialist with a high cost of deposits and a high return on assets, agreed in June to

Including lower overhead, Capital One reckoned the deal would reduce its deposit costs by 10 basis points, or $200 million, in 2013.