-

At the end of March it will become a lot easier to get a clear view of banks' auto loan holdings. That's when regulators will begin requiring banks to break down the auto loans on their books.

February 8

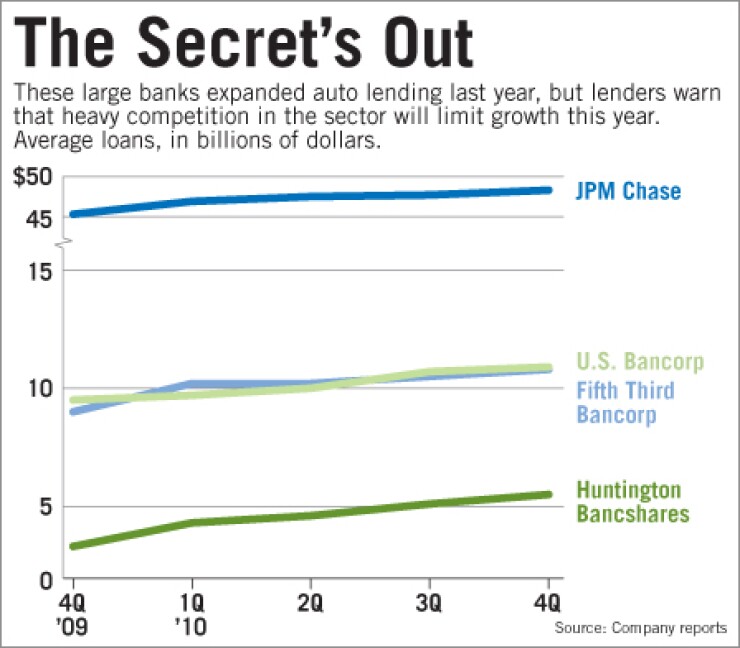

Car sales bounced back in 2010, and as a result auto lending was a bright spot for many banks.

But the steady growth in auto lending that banks have enjoyed over the past year may become less of a sure thing in coming quarters as more companies fight for a piece of the action.

Some bank executives said in fourth-quarter conference calls that increased competition in auto lending had made the pricing less attractive and forced them to ease up.

"We have an appetite for that business because we like it. But at times, the competition gets a little frothy," M&T Bank Corp. Chief Financial Officer Rene Jones said during a January call with analysts. "If we can't generate a return above our cost of capital, then our appetite for the volume actually slows down."

Auto lending also is a big focus at Huntington Bancshares Inc., of Columbus, Ohio, which expanded the business into central and eastern Pennsylvania as well as Massachusetts, Maine, Vermont, New Hampshire and Rhode Island last year. Huntington said that has allowed it to offer financing options to about 500 new dealerships. However, its auto loan originations were down 20% in the fourth quarter from the previous quarter, which CFO Donald R. Kimble attributed to heavier competition.

"We've seen an aggressive return of the captives, as well as several other banks," Kimble told investors at a conference on Feb. 2. However, "we still expect auto to be a growth source for us."

Auto lending may remain an area of focus for lenders for the foreseeable future, simply because growth prospects in other areas of credit are poor to nonexistent.

"Most institutions are looking at … a dearth of real lending opportunities, aside from commercial real estate opportunities," said Brett Rabatin, an analyst with Sterne, Agee & Leach Inc. "But most banks have a lot of CRE and don't want to grow that any further."

So banks are looking for ways to expand their consumer loan portfolios, and "auto is the obvious choice," Rabatin said. "I think people are more comfortable with making auto loans right now than they are with consumer loans like [home equity lines of credit], particularly on a high [loan-to-value] basis."

The reason auto lending is attractive is that, unlike in the housing market, prices remained relatively high throughout the downturn. Consumers have been holding on to their cars longer, putting off upgrading to a newer model to conserve resources, so prices for used cars in particular have skyrocketed. "The value of auto did not fall on its face," said Ken Owensby, president and chief executive of Owens.B Consulting, an auto finance risk management consulting firm. "It's proven to hold up through the storm."

Prices of used cars were up 8.2% in December compared with December 2009, according to Edmunds.com, which tracks industry data. In some cases prices for a used car actually outpaced what it would cost to buy a new model. The higher prices have been a boon to the banks, experts said, as they have a bigger hold on used-car financing, while captives — the financing arms of auto manufacturers — typically control more new-car financing.

Meanwhile, home prices continue to decline. According to figures compiled by Standard & Poor's/Case-Shiller, home prices dipped 1% in November. Prices overall are down about 30% from their peak in June 2006.

Edmunds.com forecasts that new-car sales will outpace used-car sales by a small margin this year, which means prices for used cars should soften. According to Edmunds.com, sales of new cars rose 17% in January compared with a year earlier.

A rejuvenation of subprime auto lending also has spurred growth. According to a report from Experian and Oliver Wyman, the share of new loans to nonprime customers — or those with a credit score of between 620 and 679 — rose to 10.86% during the third quarter from 9.79% a year earlier. The share of loans to consumers with even lower credit scores (550 to 619) increased to 6.61% from 5.66%.

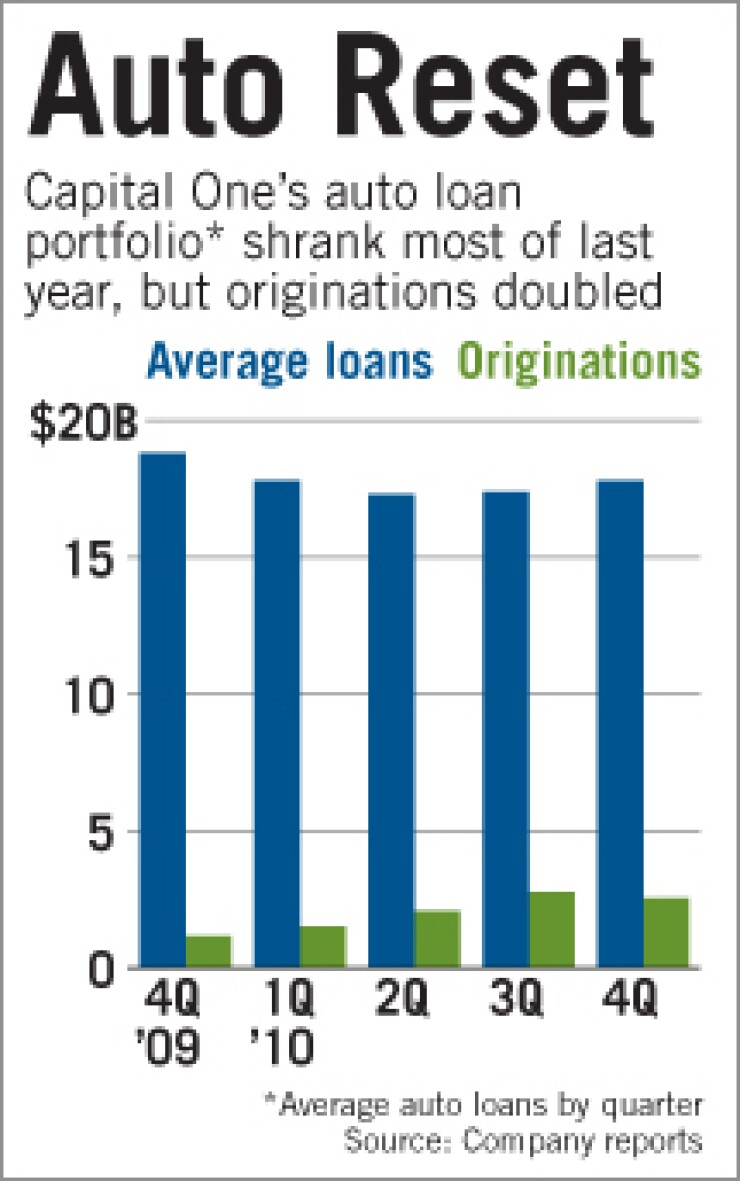

Kevin Borgmann, the head of auto finance at Capital One Financial Corp., said the McLean, Va., company's willingness to lend to consumers with varying levels of credit has helped it to continue to grow its customer base.

"We've taken on more of a relationship strategy with dealers," Borgmann said in a recent interview. "We underwrite across the risk spectrum, and we think dealers find value in that."

Auto lending remains a "real opportunity," said David G. Dietze, chief investment strategist with Point View Financial Services Inc. in Summit, N.J. Not only is there the chance to do more direct lending to dealerships, there are tertiary benefits as well, he said. When people buy more cars, for example, equipment makers make more parts and they often need loans to do that.

"Certainly competition is picking up as you would expect as the economy gets better, but not in the way that it makes us change our core strategy," Borgmann said. "We watch competition very, very carefully and certainly respect competition, but right now we feel the growth in the industry is quite healthy and attractive."