-

It may be hard for banks like Toronto-Dominion and New York Community to resist trying to outbid M&T for Hudson City, which agree to sell itself for a relatively low-priced offer.

August 29 -

Unprecedented regulatory demands and competition require banks to continue innovating and diversifying, says Aubrey Patterson, the Tupelo, Miss.-based company's longtime CEO, in a wide-ranging interview.

August 20 -

A combination of a lower loan-loss provision and higher noninterest income contributed to improved profits at Texas Capital Bancshares (TCBI) in Dallas.

July 25

M&T Bank's (MTB) $3.7 billion deal to buy Hudson City (HCBK) has reenergized speculation about bank mergers and acquisitions.

Their agreement, the largest whole-bank deal of the year, has raised expectations that more dominoes will fall, especially among large community banks.

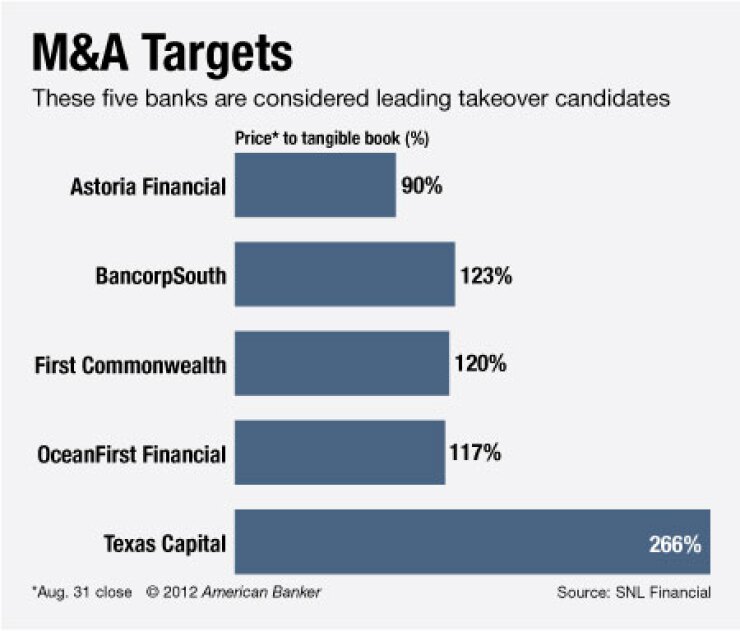

Here are five banks that could be next, according to analysts and investment bankers.

Astoria Financial (AF), $17.8 billion of assets, Lake Success, N.Y.

The M&T/Hudson City deal shined the takeover spotlight on

Astoria is in a bind similar to Hudson City's:They are both very large thrifts struggling to make money in the face of dismally low interest rates and weak housing demand. Astoria — like Hudson — has hoped diversification would solve its financial woes, which include shares that trade at just 90% of tangible book and a 0.30% return on assets in the most recent quarter.

The 82-branch Astoria is surrounded by a stable of able acquirers that are eager to expand. It is hoping to fend them off by taking a bigger slice of the New York area commercial real estate market, one of the most brutally competitive CRE markets in the country.

Hudson City decided it was better off doing a stock-based deal than it would be spending years investing in the new products and people necessary to evolve into a different kind of bank.

Calls to an Astoria official Tuesday were not returned.

Texas Capital Bancshares (TCBI), $9.14 billion of assets, Dallas

Three factors put a target on Texas Capital's back.

It is one of the few big, independent banks in one of the strongest economic areas — and hottest M&A market — in the country. It has an aging management team in Chief Executive George Jones Jr. and Chairman James Holland Jr., who are both over 65. And it reportedly explored selling about two years ago but found the bids wanting.

Texas Capital is the kind of bank that M&A experts often say will be sold, not bought. It has a quirky but lucrative model that is focused on business banking. It has surprisingly few branches for an institution its size, with just a dozen banking locations in the states' five big cities. So its people are its moneymaker, which makes it a somewhat risky takeover target. If its culture did not mesh with the buyer's and its people opted to leave, they could take their clients with them — and the acquirer ends up overpaying for a dozen branches in Dallas, Houston, Austin and elsewhere.

Comerica (CMA), BB&T (BBT), Prosperity Bancshares (PB), Cadence Bancorp and other institutions that might be natural buyers for Texas Capital are either busy with recent acquisitions or pointedly opposed to striking pricey deals.

A spokeswoman for Texas Capital declined to comment.

BancorpSouth (BXS), $13.8 billion of assets, Tupelo, Miss.

Count this 260-branch lender as another member of the club of attractive, sizable banks with aging management.

It, too, is surrounded by several healthy community and regional bank

Its return on average assets was a respectable 0.64% in the most recent quarter, and it currently trades at a reasonable 123% of its tangible book value. Its tangible book value was $1.13 billion at the end of the second quarter.

A buyer could pay a small premium for its shares should the acquirer be able to handle paying a fair market price of around 150%, which healthy banks in good markets have been fetching lately.

BancorpSouth does not comment on M&A speculation, a spokesman said.

First Commonwealth Financial (FCF) $5.9 billion of assets in Indiana, Pa.

First Commonwealth has several attributes that could make it vulnerable to an investor-activist squeeze to seek a buyer, experts say.

It operates in a burgeoning M&A market. The 162% of tangible book that

First Commonwealth has a bigger presence, higher profits and fewer problem loans than Fidelity. It is one of the last sizable, independent institutions in the region, operating 112 branches.

Its shares trade at an inviting price of 120% of tangible book, and the company has had a management changeover. When

Pennsylvania is thick with potential buyers. Among them are S&T Bancorp (STBA), National Penn Bancshares (NPBC), F.N.B. (FNB) and Huntington Bancshares (HBAN).

First Commonwealth did not comment.

OceanFirst Financial (OCFC), $2.3 billion assets, Toms River, N.J.

Recent management issues have drawn attention to OceanFirst, a profitable bank with 24 branches along the coast of central New Jersey. In August, the company announced

OceanFirst has never successfully closed a whole-bank deal, which raises questions about its ability to be an acquirer should the M&A market catch fire.

Uncertainty about future leadership coupled with some attractive financial and strategic attributes makes OceanFirst an interesting takeover prospect for a number of banks in the New York region, experts say. It had a return on assets of 0.94% and a nonperforming asset ratio of 2.09% in the most recent quarter. Its shares trade at roughly 117% of tangible book.

OceanFirst does not comment on M&A speculation, a spokeswoman said.