-

About 35 million Americans are considered underbanked. According to a Javelin study, this group has higher income and potential interest in traditional banking than you might think.

June 14 -

New channels and data analysis are making it easier for financial institutions to reach people with thin credit histories.

June 1 -

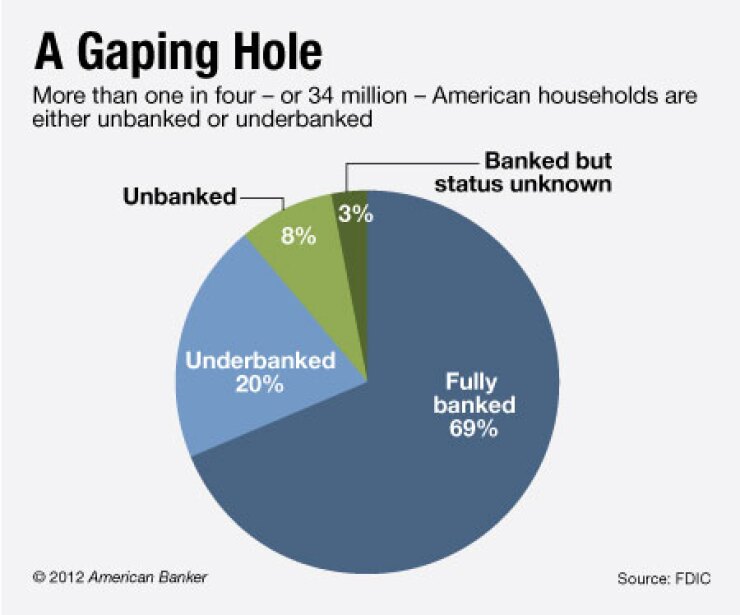

The FDIC provided new insight Wednesday on the vast segment of the country that lacks a meaningful relationship with a bank, releasing a study that showed one in four families go elsewhere for financial services.

December 2

WASHINGTON — The proportion of U.S. households with limited access to a bank inched up between 2009 and 2011, with most unbanked and underbanked still turning to alternative products to manage their finances, the Federal Deposit Insurance Corp. said Wednesday.

The FDIC's second biennial

Similar to the

The report also showed that transactional use by unbanked customers of nonbank financial companies such as check-cashers continues to be prevalent. Overall, more people appear to be using such providers than what was reported in the 2009 survey.

"Unbanked and underbanked households value the convenience of transaction … [alternative financial services] and perceive AFS credit to be easier to obtain than bank credit," the report said. "The most common reason households use transaction AFS is convenience, while the main reason households use AFS credit products is because they are easier or faster to obtain than bank credit."

The nation's amount of unbanked households increased only slightly in the two-year period — by 821,000 or 0.6% — to nearly 10 million households, totaling about 17 million adults. That amounted to about one in 12 households being unbanked. Over 29% of U.S. households lack a savings account, while about 10% lack a checking account.

The rise in the "underbanked" — meaning those that have a bank account but also utilize alternative products — was more pronounced, although the increase was due in part to changes in the category's definition between the two periods. Underbanked households increased by 14% — or about 3 million — to 24 million households, totaling about 51 million adults. Over 20% of U.S. households are considered underbanked.

The results of the survey "indicate that insured financial institutions have an important chance to grow their customer base by expanding opportunities that bring unbanked and underbanked individuals into mainstream banking," Martin Gruenberg, the FDIC's acting chairman, said in a press release.

Meanwhile, lower-income families and minorities were more likely than the rest of the nation to have little or no contact with a traditional bank. Nearly half of the households in several demographic groups — including non-Asian minorities, lower-income, younger households and the unemployed — were either unbanked or underbanked, compared to just over a quarter of all households. (The FDIC noted that unbanked rates among specific demographic groups were "essentially unchanged" from the previous survey.)

The FDIC said about a quarter of all households had used some kind of alternative financial product in the year leading up to when the survey was conducted. "The use of both transaction and credit AFS became more widespread between 2009 and 2011, with higher proportions of households reporting having used either product," the report said.

Over 23% of households had used an alternative transaction product — which include money orders and remittances — compared to 6% using a credit product from an alternative provider, such as payday lenders and pawn shops.

The survey also provided data on the growing use of prepaid cards by the unbanked. Although not formally considered an "alternative" product for the purposes of the report, the FDIC said "prepaid debit cards continue to be more widely used among the unbanked and underbanked than among fully banked households."

Nearly 18% of unbanked households used a prepaid card in 2011, compared to just over 12% two years earlier.