-

ECB Bancorp Inc. will no longer buy the deposits and certain assets of seven North Carolina branches from Hampton Roads Bankshares Inc. in Norfolk, Va., after funding for the deal fell through.

March 14 -

FNB United Corp. in Asheboro, N.C., said it completed a one-for-100 reverse stock split.

November 1 -

ECB Bancorp is set to receive nearly $80 million in capital by mid-November. The $942 million-asset company is laying out a three-pronged strategy of acquisitions, de novo branch expansion and organic growth to get to $3 billion to $5 billion in the next few years.

September 28

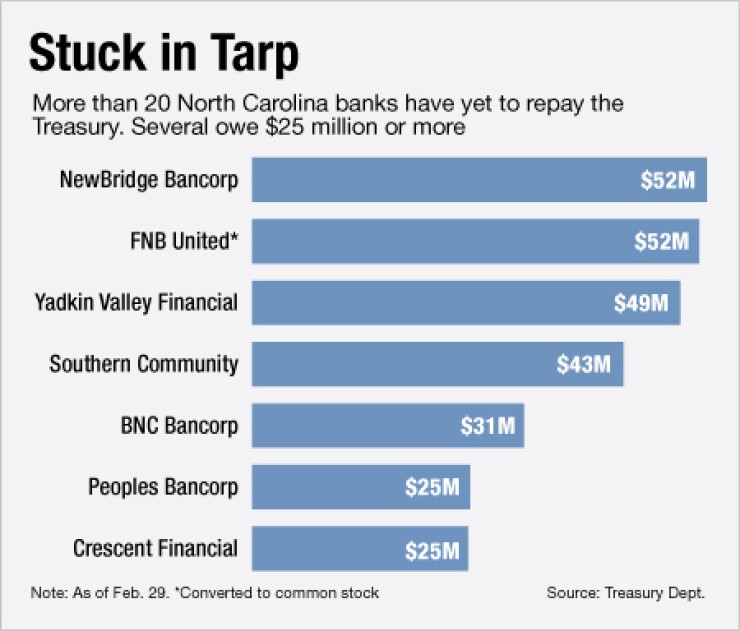

North Carolina could become a key area for consolidation as nearly two dozen banks there remain stuck in the Troubled Asset Relief Program.

The state shares many traits with is Southeast neighbors, most notably ongoing real estate woes and credit deterioration, but it has more banks in Tarp than any other state the region.

With fewer failures expected in the state, compared to Georgia and Florida, industry observers say acquirers will need to consider buying out those banks. "For the banks that do still have Treasury capital, it is a factor for them as they assess their future," says Scott Custer, the chief executive of Piedmont Community Bank Holdings,

Only four states have more than 20 Tarp participants left: California, Illinois, Missouri and North Carolina, based on Feb. 29 data from the Treasury Department. Typically, banks would raise capital and exit the program, but tepid capital markets and dilution concerns have made that a tough go. Some North Carolina banks have instead opted to sell.

"It would have taken us a year or two to get enough profitability and a [stock] price back to the point where we could do a capital raise in a way where it wasn't excessively diluted," says F. Scott Bauer, the president and chief executive of Southern Community Financial (SCMF) in Winston-Salem, N.C. "We definitely could have made it on our own but the road would have been longer."

The seller has $43 million in capital from Tarp. Southern Community had returned to profitability, but Bauer says raising capital may have been more dilutive than selling to Capital, which has ample capital to put the $1.5 billion-asset company back on the "offensive."

Analysts say Southern Community's sale could convince other banks in the state to follow suit. "The problem is the community banks we all knew and loved are really, really changing …and the tip of the iceberg are banks like Southern Community," says Tony Plath, a professor at the University of North Carolina at Charlotte. "Look at what [they have] been through and all the work they've done. …They were just a sitting duck because they couldn't grow without more capital."

Since early 2010, nine of the 14 banks bought in North Carolina had Tarp funds, according to Sandler O'Neill & Partners. Only two of the banks, including Capital Bank when it

Jeffrey Adams, a managing director of Monroe Securities, says some North Carolina banks became too reliant on Tarp. While common equity was "reasonably healthy," the banks' tangible common equity was not.

Southern Community's common equity ratio was 6.5% at Dec. 31, but its tangible common equity was 3.7% when it should have been at least 6%, Adams says. "Banks like that are probably doing a really wise thing by selling," he says. Making matters worse, capital raising has slowed, particularly in the last nine months.

A lot of banks "see the headlights coming and recognize that maybe earnings haven't bounced back as much as they would have liked," Adams says. "They see that raising capital would be at a pretty big discount to tangible book." At Feb. 29, 21 banks in North Carolina held Tarp funds.

The biggest are NewBridge Bancorp (NBBC) in Greensboro and FNB United (FNBN) in Asheboro, with $52 million each.

Analysts agree that Tarp banks are likely acquisition targets, though they were wary of a spike in deals in coming months. "Tarp is a catalyst for these companies to determine what course of action should be taken," says Chris Marinac, an analyst at FIG Partners.

"We know many banks are staying the course." Pricing disparities between buyers and sellers, along with dilution and regulatory concerns continue to stymie deals. Earlier this month, ECB Bancorp (ECBE) in Engelhard, N.C.,

In some cases, it really is like trying to catch a falling knife and wondering, 'has it hit the floor yet?' " Custer says. "I believe more consolidation is inevitable but I don't know whether that's near term, intermediate term or long term."

Bauer says he's seeing "what appears to be definite turn" in the state's economy, which could spur deals. "We're at that point where most community banks …have overcome the last four years. If you're going to do something, now's the time to do it."