-

New authentication methods make it harder to fake biometrics, Eric Setterberg of Fingerprints argues.

May 26Fingerprints -

Credit unions need a clear strategy if they hope to break through to consumers already overwhelmed by the coronavirus.

May 26 PenFed Credit Union

PenFed Credit Union -

The bank is trying to recover millions of dollars in returned deposits. It also has a $14 million loan to the company that allegedly conducted the scheme.

May 26 -

Despite record low mortgage rates, borrowers are having trouble getting loans from wary lenders; the underperforming American unit may be ditched in U.K. bank restructuring.

May 26 -

Texas Capital also said that Keith Cargill has stepped down as president and CEO.

May 26 -

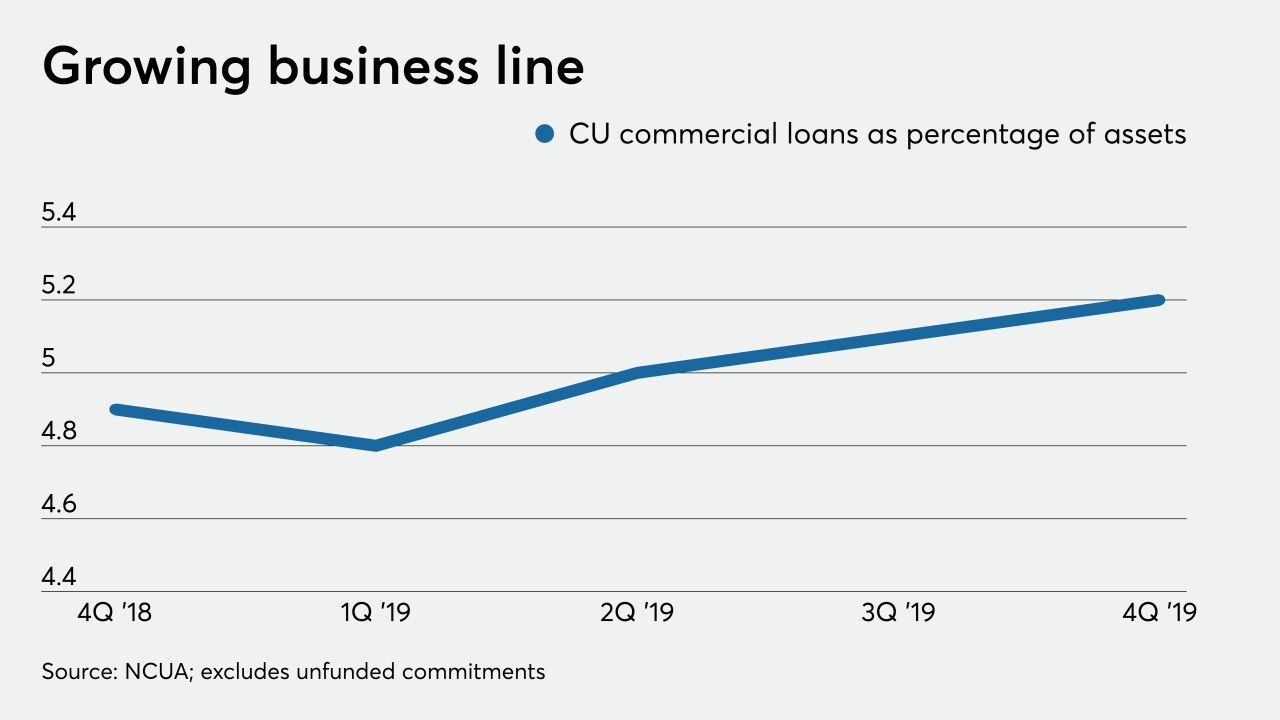

The industry is well positioned to gain market share, but institutions may not see the same levels of growth as after the last recession.

May 26 -

Companies like Amazon, Apple, PayPal Netflix, Uber and others have made it so easy to transact that consumers are left wondering why their bank or credit union cannot provide them with the same kind of seamless and tailored experiences, says Payrailz's Mickey Goldwasser.

May 26 Payrailz

Payrailz -

The coronavirus lockdown could provide the opportunity for parent-controlled payment cards or mobile apps for children to gain traction after a wobbly past in terms of consumer adoption.

May 26 -

Some observers wonder if proposed regulatory targets for Fannie Mae and Freddie Mac will stoke concerns about low shareholder returns. But others suggest those fears are unfounded.

May 25 -

Demand has soared for mental health services as bank employees put in long hours, supervise kids while working at home and endure personal crises. Citi, BofA, Fifth Third and others are getting creative to help them decompress during the pandemic.

May 24