-

The information you need to start your day, from PaymentsSource and around the Web. Today: Domino's tests no-cash stores; Fold adds crypto pay; Revolut adds office in Germany; Fintechs get licenses to anticipate Brexit.

July 11 -

Beginning next year, banks will have to dramatically change the way they account for future credit losses, but experts disagree on the new rule's long-term impact.

July 11 -

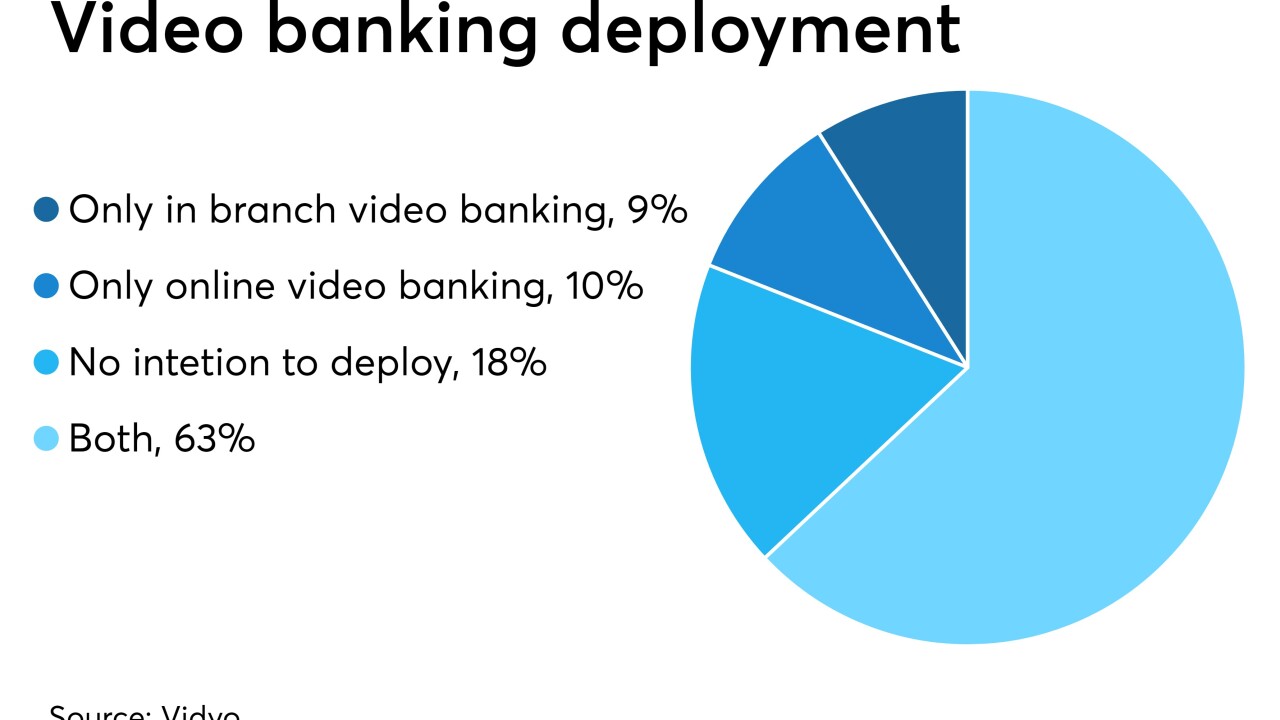

As more credit unions deploy mobile video banking, some observers say if credit unions don’t hop on board now they could be left behind in the next few years.

July 11 -

Finding a fast and easy way to receive payments remains a top priority for these businesses. And yet, they are frequently left out of the industry’s faster payments conversation, writes Steve Robert, co-founder and CEO of Autobooks.

July 11 Autobooks

Autobooks -

Beginning next year, banks will have to dramatically change the way they account for future credit losses, but experts disagree on the new rule's long-term impact.

-

A recent investigation found that institutions taken over by the National Credit Union Administration “are often the least willing to work with borrowers struggling to afford their loans.”

July 10 -

Seattle-based digital remittance provider Remitly has raised $220 million in new investments and financing to accelerate its growth in more global markets.

July 10 -

Vehicle payment technology startup Car IQ raised $5 million in a Series A funding round that included Citi Ventures as an investor.

July 10 -

Interchange rates on payments in the fuel and energy sectors can be so complicated that energy marketers can lose thousands of dollars a year because of mistakes they make in coding their authorized credit card transactions.

July 10 -

The chamber passed a bill that would clarify how certain loans backed by the Department of Veterans Affairs are securitized, and legislation encouraging first-time homebuyers to participate in counseling programs.

July 10