-

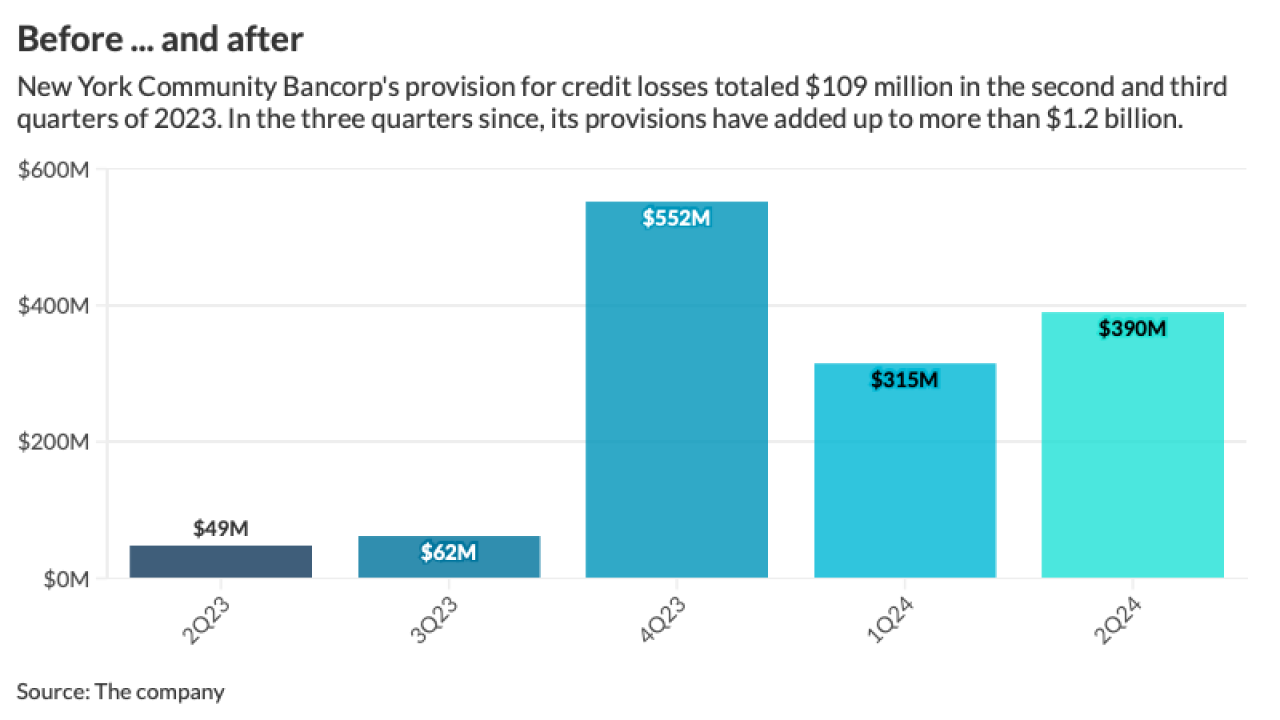

The parent company of Flagstar Bank reported a net loss of $323 million for the second quarter after boosting loan-loss provisions and recording a steep increase in net charge-offs. Still, it says it's making progress on a turnaround plan, including by agreeing to the sale of its mortgage servicing business.

July 25 -

The $72.8 billion-asset bank lowered its guidance for net interest income, explaining that while business prospects on the island are relatively rosy, its stateside opportunities for loan growth look weaker.

July 24 -

The embattled Long Island-based bank announced the hiring of nine new senior executives. Most of them have ties to CEO Joseph Otting, who previously held the top job at the OCC and OneWest Bank.

July 24 -

Federal Deposit Insurance Corp. Vice Chair Travis Hill has called for a full reproposal of the Basel III endgame capital standards, emphasizing the need for joint advancement by all three major federal banking agencies and an additional comment period for industry feedback.

July 24 -

The bank is developing algorithmic models that will be ready to take advantage of quantum computers when they become powerful and reliable enough to use. It's also taking steps to defend itself against the day cybercriminals can harness quantum computing to break the encryption protocols everyone uses.

July 24 -

The $73.5 million all-stock deal, slated to close early in 2025, would create a bank with more than $3 billion of assets.

July 24 -

A rising number of check fraud cases involving counterfeit checks is compounding the already-serious problem of fraud in one of the oldest payment methods widely available.

July 24 -

After 40 years in finance, Harford is now learning to play golf and mahjong, and spending more time with family and friends.

July 24 -

The payments company is pulling Cash out of the U.K. as it tries to expand the peer-to-peer app in the U.S.; firms in Hong Kong and Australia try to make stablecoin transactions global; and more.

July 24 -

The Consumer Financial Protection Bureau reversed itself, declaring that earned wage access programs, which conduct no underwriting and charge no interest, are loans. This is a disservice to the industry and consumers.

July 24